Retirement Guide for Healthcare Employees

2024 Tax Changes and Inflation

It is imperative for individuals to be aware of new changes made by the IRS. The primary elements that are most likely to have an impact on corporate workers are:

The standard deduction will rise to $21,900 for heads of household, $29,200 for joint filers, and $14,600 for single taxpayers and married couples filing separately in 2023.

Taxpayers may increase their standard deduction by an additional $1,5500 if they are blind or over 65. If you are not a surviving spouse or are not married, that amount increases to $1,950.

As in 2023, the personal exemption for the tax year 2024 is zero. A provision of the Tax Cuts and Jobs Act was the removal of the personal exemption.

Employees working remotely for a business entity may be subject to double taxation on state taxes. Many workers returned home as a result of the pandemic, sometimes even leaving the state in which they were working. Many of the temporary relief provisions that several states had in place last year to prevent double taxation of income have since expired. Currently, a "special convenience of employer" regulation is only in place in six states: Delaware, Connecticut, Nebraska, New Jersey, New York, and Pennsylvania. Ask your tax advisor if there are any other alternatives to reduce the double taxation if you work remotely for a business entity and do not now reside in those states.

Contributions to retirement accounts: You can lower your tax liability by making contributions to your employer's 401(k) plan, and the maximum amount you can save has been raised for 2024. In 2024, the maximum contribution amount that people can make to their 401(k) plans will rise to $23,000, from $22,500 in 2023. For 2024, there will be an increase in the income thresholds that determine who is eligible to make deductible contributions to traditional IRAs, roll over contributions to Roth IRAs, and claim the Saver's Credit. For workers who are 50 years of age or older, the maximum catch-up contribution will rise to $8,000.

You should be aware of the following significant changes to the Earned Income Tax Credit (EITC) if you are a taxpayer who works for a corporation:

For qualifying taxpayers with three or more qualifying children, the maximum Earned Income Tax Credit amount for tax year 2024 is $7,830, up from $7,430 for tax year 2023.

Those who are married and file separately may be eligible: If you satisfy certain requirements, you may be eligible to claim the EITC as a married filing separately. In past years, this wasn't offered.

Cash charitable contribution deduction: The special deduction that let individuals who are not itemizers to claim a deduction of up to $300 (or $600 for married couples filing jointly) for cash gifts to approved charities has ended.

Changes to the Child Tax Credit

For each eligible child, the maximum tax credit is $2,000. Furthermore, unlike in 2023, you are not eligible to get a portion of the credit in advance.

If your adjusted gross income is less than $200,000 if you're filing singly or less than $400,000 if you're filing a joint return with a spouse, you qualify for the Child Tax Credit as a parent or guardian.

A partial refundability of 80% that applies to people whose tax bill is less than the credit amount.

2024 Tax Brackets

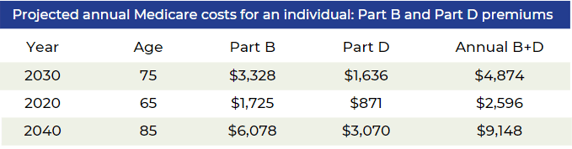

Over time, inflation diminishes buying power because rising prices result in a basket of products becoming more expensive. You will need to account for increasing costs in your plan if you want to keep your retirement quality of living the same when you leave your business. The Federal Reserve aims to maintain an annual inflation rate of 2%, but in 2023 it skyrocketed to 4.9%, a sharp rise from 1.4% in 2020. Even though costs have increased significantly overall, there are certain areas, like healthcare, to be mindful of if you are close to or already retired from your employer. Medicare serves as the primary health insurance for many business retirees, and in 2023, the out-of-pocket cost of such coverage is expected to rise by 5% to 14%. The cost of over-the-counter drugs is expected to rise by at least 7% in addition to Medicare increases. In their 2022 research, the Employee Benefit Research Institute (ERBI) discovered that, in order to pay for their average prescription expenses in retirement, a couple would need to save $296,000. All of these elements must be taken into account when creating a comprehensive retirement plan from your employer.

*Source: Forbes, Bankrate, Yahoo, IRS.gov

Planning Your Kaiser Permanente Retirement

Retirement planning is a verb. And consistent action must be taken whether you’re 20 or 60.

The truth is that most Americans don’t know how much to save or the amount of income they’ll need. No matter where you stand in the planning process, or your current age, we hope this guide gives you a good overview of the steps to take, and provides some resources that can help you simplify your transition into retirement and get the most from your benefits.

You know you need to be saving and investing, but you don’t have the time or expertise to know if you’re building retirement savings that can last.

"A separate study by Russell Investments, a large money management firm, came to a similar conclusion . Russell estimates a good financial advisor can increase investor returns by 3.75 percent."

Source: Is it Worth the Money to Hire a Financial Advisor?, the balance, 202

Starting to save as early as possible matters. Time on your side means compounding can have significant impacts on your future savings. And, once you’ve started, continuing to increase and maximize your 401(k) contributions is key, and can lead to huge windfalls later on in your life.

As decades go by, you’re likely full swing into your career, and your income probably reflects that. However, the challenges to saving for retirement start adding up: a mortgage, raising children and saving for their college.

One of the classic planning conflicts is saving for retirement, versus saving for college. Most financial planners will tell you that retirement should be your top priority, because your child can usually find support from financial aid while you’ll be on your own to fund your retirement.

Your particular financial circumstances and aspirations will always determine how much we advise you to invest for your retirement. Nonetheless, during your 30s and 40s, think about setting aside at least 10% of your income for retirement funds. Maximizing your company's contribution match should be a goal, provided that your unique situation permits.

Over the age of 50? You may contribute a maximum of $22,500 to your employer's 401(k) plan.

You're ideally in your prime earning years as you approach your 50s and 60s, with some of your biggest expenses—like a mortgage or raising children—either behind you or about to go. Now could be a good time to see whether you can increase your retirement savings target to 20% or higher of your income. This may be the last chance that many individuals have to put money down.

Employees 50 years of age or older may contribute up to $22,500 to their 401(k) or retirement plan in 2023. They can add an extra $7,500 in catch-up contributions once they reach this cap. Every year, these caps are revised to account for inflation.

If you work for a corporation and are over 50, you might be able to use an IRA catch-up contribution.

*Source: Forbes, Bankrate, Yahoo, IRS.gov

What makes matching contributions to 401(k)s so popular?

These retirement savings vehicles give you the chance to take advantage of three main benefits:

-

Compound growth opportunities (as seen above)

-

Tax saving opportunities

-

Matching contributions

Simply put, matching contributions are when your employer, in this case Kaiser Permanente, contributes funds from the company to match the amount you contribute to your 401(k). If Kaiser Permanente matches, the company money typically matches up to a certain percent of the amount you put in.

Unfortunately, many people don’t take full advantage of the employer match because they’re not putting in enough themselves.

$1,336 - Employees who do not take full advantage of the company match often leave $1,336 of possible additional retirement funds on the table annually, according to a 2020 Financial Engines study titled "Missing Out: How Much Employer 401(k) Matching Contributions Do Employees Leave on the Table?"

- If you contribute 2% of your salary to your plan and Kaiser Permanente matches up to 3% of it, you will not receive the full amount of Kaiser Permanente's potential match.

- By bumping up your contribution by just 1%, Kaiser Permanente is now matching 3% (the max) of your contributions for a total contribution of 6% of your salary. You aren’t leaving money on the table.

Whether you live in the U.S. or Puerto Rico, you'll receive quite a bit of useful information from this article! Speak with a Kaiser Permanente-focused advisor by clicking the button below.

Whether you’re changing jobs or retiring, knowing what to do with your hard-earned retirement savings can be difficult. A plan sponsored by Kaiser Permanente, such as a pension and 401(k), may make up the majority of your retirement savings, but how much do you really know about that plan and how it works?

There are seemingly endless rules that vary from one retirement plan to the next, early out offers, interest rate impacts, age penalties, and complex tax impacts.

Increasing your investment balance and reducing taxes is the key to a successful retirement plan spending strategy. At The Retirement Group, we can help you understand how your Kaiser Permanente retirement scheme fits into your overall financial picture, and how to make that plan work for you.

Workers are far more likely to rely on their workplace defined contribution (DC) retirement plans as a source of income.

Getting help and leveraging the financial planning tools and resources Kaiser Permanente makes available can help you understand whether you are on track, or need to make adjustments to meet your long-term retirement goals...

Source: Schwab 401(k) Survey Finds Savings Goals and Stress Levels on the Rise

Companies freeze or off-load DB pension plans in order to cut down on their current pension obligations. By making the switch from a DB plan to a DC plan corporations can also shift risk from the company to the workers. The trend is good for investors because companies who relieve themselves of pension debt become less risky investments.

KPEPP Eligibility

- Retirement Age: 55+

- Term of Employment: 15+ years

Age Penalty for Early Retirement Withdrawing before age 65

Union Calculation - KPEPP

1.45 % of Final Average Monthly Compensation (Last 10 years) X Years and partial years of Credited Service = Monthly Pension - Age Penalty

In 1990, Joe is hired by AT&T and participates in the Hourly Pension Plan:

TPMG Pension Eligibility

- Retirement Age: 55+

- Term of Employment: 15+ years

- OR Age and Years of Service total 75+

Highest Average Compensation (Highest 5 year compensation of last 10 years) X 1.5% X Years and Months of Credited Service = Monthly Pension – Age Penalty

For Physicians: Highest Average Compensation (Highest 3 average) X 2% of HAC for 20 YOS + 1% of HAC for 20+ YOS - Any other MCO payout

*Note: TPGM Physicians only have lump sum if disabled

Benefits:

- - Tax free payment benefit

- - Flexible legacy strategies

- - Maximum cash flow

Single Life Pension - Joint Life Pension = Spread

Use the "Spread" to buy low cost life insurance. In the event of an early death, your potential beneficiary will receive your life insurance payout instead of receiving continued benefits from Joint Life Pension.

The following table shows the percentage of your normal retirement benefit payable between ages 55 and 65:

Early Retirement: 55 years of age + 15 years of service (but no medical)

Thinking about what to do with your pension is an important part of planning for your retirement at KP. What is best for you and your family?

You should routinely use the tools and resources found on The Retirement Group's e-book gallery, such as the Retirekit, to model your pension benefit in retirement and the pension payment options that will be available to you.

You can also contact a KP-focused at The Retirement Group at (800)-900-5867. We will get you in front of a KP-focused advisor to help you start the retirement process and tell you about your payment.

Note: We recommend you read the KP Summary Plan Description. The Retirement Group is not affiliated with nor endorsed by KP.

Next Step:

- Determine if you should take your pension from KP as a lump sum or annuity.

- How do interest rates affect your decision?

- Use the "Retirekit" to understand cash flow, interest rates, and explore which pension option might be the best fit for you during retirement.

- As you get closer to your retirement date, contact a retirement-focused advisor at The Retirement Group and also read KP's SPD Summary to start your retirement process.

- KP needs you to provide documents that show proof of birth, marriage, divorce, Social Security number, etc., for you and your spouse/legally recognized partner.

- Your company may have a Beneficiary Designation online to make updates to your beneficiary designations, if applicable to your pension program. Please read KP's SPD for more detail.

Lump-Sum vs. Annuity

Retirees who are eligible for a pension are often offered the choice of whether to actually take the pension payments for life, or receive a lump-sum dollar amount for the “equivalent” value of the pension – with the idea that you could then take the money (rolling it over to an IRA), invest it, and generate your own cash flows by taking systematic withdrawals throughout retirement from your company.

The upside of keeping the pension itself is that the payments are guaranteed to continue for life (at least to the extent that the pension plan itself remains in place and solvent and doesn’t default). Thus, whether you live 10, 20, or 30 (or more!) years after leaving your company, you don’t have to worry about the risk of outliving the money.

In contrast, selecting the lump-sum gives you the potential to invest, earn more growth, and potentially generate even greater retirement cash flow. Additionally, if something happens to you, any unused account balance will be available to a surviving spouse or heirs. However, if you fail to invest the funds for sufficient growth, there’s a danger that the money could run out altogether and you may regret not having held onto the pension’s “income for life” guarantee.

What kind of return must be generated on that lump-sum in order to replicate the annuity payments ultimately determines the "risk" assessment that should be done to decide whether or not to take the lump sum or the guaranteed lifetime payments that your company pension offers. After all, even if you withdraw from your lump sum for the rest of your life, there is minimal chance that you will outlive it if it would only take a return of 1% to 2% to generate the same pension cash flows for a lifetime(10). However, if the pension payments can only be replaced with a higher and much riskier rate of return, there is, in turn, a greater risk those returns won’t manifest and you could run out of money.

Interest Rates and Life Expectancy

In many defined benefit plans, like the KP, current and future retirees are offered a lump-sum payout or a monthly pension benefit. Sometimes these plans have billions of dollars worth of unfunded pension liabilities, and in order to get the liability off the books, your company may offer a lump-sum.

Depending on life expectancy, the initial lump-sum is typically less money than regular pension payments over a normal retirement time frame. However, most individuals that opt for the lump-sum plan to invest the majority of the proceeds, as most of the funds aren't needed immediately after retirement from your company.

Something else to keep in mind is that current interest rates, as well as your life expectancy at retirement, have an impact on lump-sum payout options of your company's defined benefit pension plans. Lump-sum payouts are typically higher in a low interest rate environment, but be careful because lump-sums decrease in a rising interest rate environment.

Additionally, projected pension lump-sum benefits for active corporate employees will often decrease as an employee ages and their life expectancy decreases. This can potentially be a detriment of continuing to work, so it is important that you run your pension numbers often and thoroughly understand the impact that timing has on your benefit. Other factors such as income needs, need for survivor benefits, and tax liabilities often dictate the decision to take the lump-sum over the annuity option on the pension.

Pension Maximization

As retirement is approached, couples may find themselves questioning whether they should select a pension lump sum or an annuity. The choice made will largely impact their retirement planning and even dictate which strategies they can or can’t implement in their finances. Meeting with a financial advisor is elemental in considering one’s retirement expenses & desired lifestyle, and ultimately, tailoring financial strategies to fit your needs & wants.

A strong option for retirees who wish to maximize their pension’s return is referred to as “Pension Maximization”, a strategy able to facilitate the pension-claiming process. This strategy states that a pension holder should select a single life annuity and invest the difference between this payout and that of a joint and survivor annuity to purchase a life insurance policy. Given that single life annuities have a higher payout than joint & survivor annuities, choosing a single life annuity will provide a higher monthly return while the pension holder lives, and purchasing a life insurance policy will provide a payout for the pension holder's spouse or family after he/she has passed.

Benefits and Drawbacks of Pension Maximization

Benefits of Pension Maximization:

- Monthly income from your Pension is Maximized: Not only will a Single Life Annuity provide the highest monthly income, investing a portion of your pension in a life insurance policy will extend your pension’s returns by creating a payout for your loved ones.

- You give yourself inheritance flexibility: In the case that you outlive your spouse, you are at liberty to designate your life insurance payout to other family members, this is especially appealing for people unsure that their spouse will out-live them.

- Tax Free Payment: When your spouse (or children) receive the life insurance payout, it is tax-free. Life insurance is excluded from income tax whereas any pension annuity payout, regardless of who the receiver is, each payment will be treated as taxable income.

Drawbacks of Pension Maximization:

- The Potential Loss of pension benefits: While Single Life Annuities tend to offer higher monthly payments, you may lose medical or other benefits if your employer offers them through a pension plan you did not elect.

- Lackluster life insurance payouts: With life insurance payouts being a central component of this strategy, less-than-anticipated payouts may or may not steer you away from this financial route.

- Insurance policies lapse, while pensions don’t: With life insurance at the center of this strategy, forgetting to renew your policy or pay monthly premiums can be a costly mistake. On the other hand, pension plans in the U.S. are up to a certain point, protected by the PBGC.

Overall, Pension Maximization is a useful financial strategy to those who are certain of their health condition, life expectancy, and are financially foreseeing for their loved ones after their own passing. On the other hand, individuals in a later stage of life or in poor health may not fully benefit from this strategy. Regardless of your situation, reaching out to a financial advisor is a safe way to decide whether or not pension maximization is right for you.

Your Kaiser Permanente 401(k) Plan

When is the last time you reviewed your company's 401(k)/TSA plan account or made any changes to it?

If it’s been a while, you’re not alone. 73% of plan participants spend less than five hours researching their 401(k) investment choices each year, and when it comes to making account changes, the story is even worse.

When you retire from your company, if you have balances in your 401(k)/TSA plan, you will receive a Participant Distribution Notice in the mail. This notice will show the current value that you are eligible to receive from each plan and explain your distribution options. It will also tell you what you need to do to receive your final distribution. Please call The Retirement Group at (800)-900-5867 for more information and we can help you get in front of a specific retirement-focused advisor.

Next Step:

- Watch for your Participant Distribution Notice and Special Tax Notice Regarding Plan Payments. These notices will help explain your options and what the federal tax implications may be for your vested account balance.

- "What has Worked in Investing" & "8 Tenets when picking a Mutual Fund".

- To learn about your distribution options, call The Retirement Group at (800)-900-5867. Click our e-book for more information on "Rollover Strategies for 401(k)s". Use the Online Beneficiary Designation to make updates to your beneficiary designations, if needed.

Note: If you voluntarily terminate your employment from your company, you may not be eligible to receive the annual contribution.

Note: Kaiser Permanente is mainly a non-profit organization. Therefore, most employees will have a TSA (Tax-Sheltered Annuity), also known as a 403 (b) retirement plan, instead of a 401(k). While most properties are mutual, you should ask your advisor about differences.

If you voluntarily terminate your employment from Kaiser Permanente, you will not be eligible to receive the annual contribution.

Over half of plan participants admit they don’t have the time, interest or knowledge needed to manage their 401(k) portfolio. But the benefits of getting help goes beyond convenience. Studies like this one, from Charles Schwab, show those plan participants who get help with their investments tend to have portfolios that perform better: The annual performance gap between those who get help and those who do not is 3.32% net of fees. This means a 45-year-old participant could see a 79% boost in wealth by age 65 simply by contacting an advisor. That’s a pretty big difference.

Getting help can be the key to better results across the 401(k) board.

A Charles Schwab study found several positive outcomes common to those using independent professional advice. They include:

- Improved savings rates – 70% of participants who used 401(k) advice increased their contributions.

- Increased diversification – Participants who managed their own portfolios invested in an average of just under four asset classes, while participants in advice-based portfolios invested in a minimum of eight asset classes.

- Increased likelihood of staying the course – Getting advice increased the chances of participants staying true to their investment objectives, making them less reactive during volatile market conditions and more likely to remain in their original 401(k) investments during a downturn. Don’t try to do it alone.

Get help with your company's 401(k) plan investments. Your nest egg will thank you.

It’s important to know that certain withdrawals are subject to regular federal income tax and, if you’re under age 59½, you may also be subject to an additional 10% penalty tax. You can determine if you’re eligible for a withdrawal, and request one, online or by calling your company's Benefits Center.

Rolling Over Your 401(k)

Because a withdrawal permanently reduces your retirement savings and is subject to tax, you should always consider taking a loan from the plan instead of a withdrawal to meet your financial needs. Unlike withdrawals, loans must be repaid, and are not taxable (unless you fail to repay them). In some cases, as with hardship withdrawals, you are not allowed to make a withdrawal unless you have also taken out the maximum loan available within the company plan.

You should also know that your company's plan administrator reserves the right to modify the rules regarding withdrawals at any time, and may further restrict or limit the availability of withdrawals for administrative or other reasons. All plan participants will be advised of any such restrictions, and they apply equally to all corporate employees.

Borrowing from your 401(k)

Should you? Maybe you lose your job with Kaiser, have a serious health emergency, or face some other reason that you need a lot of cash. Banks make you jump through too many hoops for a personal loan, credit cards charge too much interest, and … suddenly, you start looking at your 401(k) account and doing some quick calculations about pushing your retirement from Kaiser, off a few years to make up for taking some money out.

We understand how you feel: It’s your money, and you need it now. But, take a second to see how this could adversely affect your retirement plans after leaving Kaiser.

Consider these facts when deciding if you should borrow from your 401(k). You could:

- Lose growth potential on the money you borrowed.

- Deal with repayment and tax issues if you leave Kaiser.

- Repayment and tax issues, if you leave Kaiser.

Net Unrealized Appreciation (NUA)

When you qualify for a distribution you have three options:

- Roll-over your qualified plan to an IRA and continue deferring taxes.

- Take a distribution and pay ordinary income tax on the full amount.

- Take advantage of NUA and reap the benefits of a more favorable tax structure on gains.

How does Net Unrealized Appreciation work?

First an employee must be eligible for a distribution from their qualified company-sponsored plan. Generally at retirement or age 59 1⁄2, the employee takes a 'lump-sum' distribution from the plan, distributing all assets from the plan during a 1 year period. The portion of the plan that is made up of mutual funds and other investments can be rolled into an IRA for further tax deferral. The highly appreciated company stock is then transferred to a non-retirement account.

The tax benefit comes when you transfer the company stock from a tax-deferred account to a taxable account. At this time you apply NUA and you incur an ordinary income tax liability on only the cost basis of your stock. The appreciated value of the stock above its basis is not taxed at the higher ordinary income tax but at the lower long-term capital gains rate, currently 15%. This could mean a potential savings of over 30%.

As a corporate employee, you may be interested in understanding NUA from a financial advisor.

IRA Withdrawal

When you qualify for a distribution you have three options:

Your retirement assets may consist of several retirement accounts: IRAs, 401(k)s, taxable accounts, and others.

So, what is the most efficient way to take your retirement income after leaving your company?

You may want to consider meeting your income needs in retirement by first drawing down taxable accounts rather than tax-deferred accounts.

This may help your retirement assets with your company last longer as they continue to potentially grow tax deferred.

You will also need to plan to take the required minimum distributions (RMDs) from any company-sponsored retirement plans and traditional or rollover IRA accounts.

That is due to IRS requirements for 2023 to begin taking distributions from these types of accounts when you reach age 73. Beginning in 2023, the excise tax for every dollar of your RMD under-distributed is reduced from 50% to 25%.

There is new legislation that allows account owners to delay taking their first RMD until April 1 following the later of the calendar year they reach age 73 or, in a workplace retirement plan, retire.

Two flexible distribution options for your IRA

When you need to draw on your IRA for income or take your RMDs, you have a few choices. Regardless of what you choose, IRA distributions are subject to income taxes and may be subject to penalties and other conditions if you’re under 59½.

Partial withdrawals: Withdraw any amount from your IRA at any time. If you’re 73 or over, you’ll have to take at least enough from one or more IRAs to meet your annual RMD.

Systematic withdrawal plans: Structure regular, automatic withdrawals from your IRA by choosing the amount and frequency to meet your income needs after retiring from your company. If you’re under 59½, you may be subject to a 10% early withdrawal penalty (unless your withdrawal plan meets Code Section 72(t) rules).

Your tax advisor can help you understand distribution options, determine RMD requirements, calculate RMDs, and set up a systematic withdrawal plan.

Your Kaiser Permanente Benefits

Kaiser Permanente Benefits Annual Enrollment

Annual enrollment for your Kaiser Permanente benefits usually occurs each fall.

Before it begins, you will be mailed enrollment materials and an upfront confirmation statement reflecting your benefit coverage to the address on file. You’ll find enrollment instructions and information about your benefit options and contribution amounts. You will have the option to keep the benefit coverage shown on your upfront confirmation statement or select benefits that better support your needs. You may be able to choose to enroll in eBenefits and receive this information via email instead.

Next Steps:

-

Watch for your annual enrollment information in the September/November time frame.

-

Review your benefits information and utilize the tools and resources available on the Kaiser Permanente Benefits Center website.

-

Enroll in eBenefits.

Things to keep in mind :

-

47% of Americans cite healthcare as their greatest economic concern.

-

Medical bills are the No. 1 cause of bankruptcy in the United States.

-

For older Americans, healthcare costs represent the second-largest expense, behind housing.

Short-Term & Long-Term Disability

Short-Term: Depending on your plan, you may have access to short-term disability (STD) benefits.

Long-Term: Your plan's long-term disability (LTD) benefits are designed to provide you with income if you are absent from work for six consecutive months or longer due to an eligible illness or injury.

What Happens If Your Employment Ends

Your life insurance coverage and any optional coverage you purchase for your spouse/domestic partner and/or children ends on the date your employment ends, unless your employment ends due to disability. If you die within 31 days of your termination date, benefits are paid to your beneficiary for your basic life insurance, as well as any additional life insurance coverage you elected.

Note:

-

You may have the option to convert your life insurance to an individual policy or elect portability on any optional coverage.

-

If you stop paying supplementary contributions, your coverage will end.

-

If you are at least 65 and you pay for supplemental life insurance, you should receive information in the mail from the insurance company that explains your options.

-

Make sure to update your beneficiaries. See the Kaiser Permanente SPD for more details.

Beneficiary Designations

As part of your retirement and estate planning, it’s important to name someone to receive the proceeds of your benefits programs in the event of your death. That’s how Kaiser Permanente will know whom to send your final compensation and benefits. This can include life insurance payouts and any pension or savings balances you may have.

Next Step:

- When you retire, make sure that you update your beneficiaries. Kaiser Permanente has an Online Beneficiary Designation form for life events such as death, marriage, divorce, child birth, adoptions, etc.

If you are unsure about Kaiser Permanente benefits, schedule a call to speak with one of our Kaiser Permanente-focused advisors

Social Security & Medicare

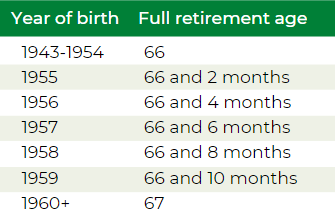

For many retirees, understanding and claiming Social Security can be difficult but identifying optimal ways to claim Social Security is essential to your retirement income planning. Social Security benefits are not designed to be the sole source of your retirement income, but a part of your overall withdrawal strategy.

Knowing the foundation of Social Security, and using this knowledge to your advantage, can help you claim your maximum benefit.

It’s your responsibility to enroll in Medicare parts A and B when you first become eligible — and you must stay enrolled to have coverage for Medicare-eligible expenses. This applies to your Medicare eligible dependents as well.

You should know how your retiree medical plan choices or Medicare eligibility impact your plan options. Before you retire, contact the U.S. Social Security Administration directly at 800-772-1213, call your local Social Security Office or visit ssa.gov .

They can help determine your eligibility, get you and/or your eligible dependents enrolled in Medicare or provide you with other government program information. For more in-depth information on Social Security, please call us.

Check the status of your Social Security benefits before you retire. Contact the U.S. Social Security Administration, your local Social Security office, or visit ssa.gov.

Are you eligible for Medicare, or will be soon?

If you or your dependents are eligible after you leave Kaiser Permanente, Medicare generally becomes the primary coverage for you or any of your dependents as soon as they are eligible for Medicare. This will affect your company-provided medical benefits.

You and your Medicare-eligible dependents must enroll in Medicare Parts A and B when you first become eligible. Medical and MH/SA benefits payable under the Kaiser Permanente-sponsored plan will be reduced by the amounts Medicare Parts A and B would have paid whether you actually enroll in them or not.

For details on coordination of benefits, refer to your summary plan description.

If you or your eligible dependent don’t enroll in Medicare Parts A and B, your provider can bill you for the amounts that are not paid by Medicare or your Kaiser Permanente-specific medical plan … making your out-of-pocket expenses significantly higher.

According to the Employee Benefit Research Institute (EBRI), Medicare will only cover about 60% of an individual’s medical expenses. This means a 65-year-old couple, with average prescription-drug expenses for their age, will need $259,000 in savings to have a 90% chance of covering their healthcare expenses. A single male will need $124,000 and a single female, thanks to her longer life expectancy, will need $140,000.

Check your plan summary to see if you’re eligible to enroll in Medicare Parts A and B.

If you become Medicare-eligible for reasons other than age, you must contact the Kaiser Permanente benefit center about your status. *Source: Kaiser Permanente Summary Plan Description

Divorce

The ideas of 'happily ever after" and 'til' death do us part' simply won’t materialize for 28% of couples over the age of 50. Most couples have saved together for decades, assuming all along that they would retire together. After a divorce, they face the expenses of a pre-or post-retirement life, but with half their savings (or even less).

If you’re divorced or in the process of divorcing, your former spouse(s) may have an interest in a portion of your retirement benefits. Before you can start your pension — and for each former spouse who may have an interest — you’ll need to provide Kaiser Permanente with the following documentation:

-

A copy of the court-filed Judgment of Dissolution or Judgment of Divorce along with any Marital Settlement Agreement (MSA)

-

A copy of the court-filed Qualified Domestic Relations Order (QDRO)

Provide Kaiser Permanente with any requested documentation to avoid having your pension benefit delayed or suspended. To find out more information on strategies if divorce is affecting your retirement benefits, please give us a call.

You’ll need to submit this documentation to your company’s online pension center regardless of how old the divorce or how short the marriage. *Source: The Retirement Group, “Retirement Plans - Benefits and Savings,” U.S. Department of Labor, 2019; “Generating Income That Will Last Throughout Retirement,” Fidelity, 2019

-

Social Security and Divorce You can apply for a divorced spouse’s benefit if the following criteria are met: You’re at least 62 years of age.

-

You were married for at least 10 years prior to the divorce.

-

You are currently unmarried.

-

Your ex-spouse is entitled to Social Security benefits.

-

Your own Social Security benefit amount is less than your spousal benefit amount, which is equal to one-half of what your ex’s full benefit amount would be if claimed at Full Retirement Age (FRA). Unlike with a married couple, your ex-spouse doesn’t have to have filed for Social Security before you can apply for your divorced spouse’s benefit, but this only applies if you’ve been divorced for at least two years and your ex is at least 62 years of age. If the divorce was less than two years ago, your ex must already be receiving benefits before you can file as a divorced spouse.

Unlike with a married couple, your ex-spouse doesn’t have to have filed for Social Security before you can apply for your divorced spouse’s benefit.

Divorce doesn’t even disqualify you from survivor benefits. You can claim a divorced spouse’s survivor benefit if the following are true:

-

Your ex-spouse is deceased

-

You are at least 60 years of age

-

You were married for at least 10 years prior to the divorce

-

You are single (or you remarried after age 60)

In the process of divorcing?

If your divorce isn’t final before your retirement date, you’re still considered married. You have two options:

-

Retire before your divorce is final and elect a joint pension of at least 50% with your spouse — or get your spouse’s signed, notarized consent to a different election or lump sum.

-

Delay your retirement until after your divorce is final and you can provide the required divorce documentation.*

Source: The Retirement Group, “Retirement Plans - Benefits and Savings,” U.S. Department of Labor, 2019; “Generating Income That Will Last Throughout Retirement,” Fidelity, 2019

Survivor Checklist

In the unfortunate event that you aren’t able to collect your benefits, your survivor will be responsible for taking action.

What your survivor needs to do:

-

Report your death. As soon as possible, report your death to your company's benefits service center by calling your spouse, a family member, or even a friend.

-

Obtain benefits from life insurance. The benefits service center at Kaiser Permanente must be contacted by your spouse or another designated beneficiary in order to obtain life insurance benefits.

If your pension is joint:

-

Pay out the joint pension first. The joint pension is not automatic. Your joint pensioner will need to complete and return the paperwork from Kaiser Permanente's pension center to start receiving joint pension payments.

-

Make sure you have enough money to pay for daily expenses. It is necessary for your spouse to have sufficient savings to cover the gap of at least one month between the end of your pension and the start of their own pension.

If your survivor has medical coverage through Kaiser Permanente:

-

Decide whether to keep medical coverage.

-

If your survivor is enrolled as a dependent in your Kaiser Permanente-sponsored retiree medical coverage when you die, he or she needs to decide whether to keep it. Survivors have to pay the full monthly premium.

Life After Kaiser Permanente

While you may be ready for some rest and relaxation, without the stress and schedule of your full-time career, it may make sense to you financially, and emotionally, to continue to work.

Financial benefits of working

Make up for decreased value of savings or investments . Low interest rates make it great for lump sums but harder for generating portfolio income. Some people continue to work to make up for poor performance of their savings and investments.

Maybe you took a company offer and left earlier than you wanted and with less retirement savings than you needed. Instead of drawing down savings, you may decide to work a little longer to pay for extras you’ve always denied yourself in the past.

Meet financial requirements of day-to-day living . Expenses can increase during retirement and working can be a logical and effective solution. You might choose to continue working in order to keep your insurance or other benefits — many employers offer free to low cost health insurance for part-time workers.

Emotional benefits of working

You might find yourself with very tempting job opportunities at a time when you thought you’d be withdrawing from the workforce.

Staying active and involved. Retaining employment, even if it’s just part-time, can be a great way to use the skills you’ve worked so hard to build over the years and keep up with friends and colleagues.

Enjoying yourself at work . Just because the government has set a retirement age with its Social Security program doesn’t mean you have to schedule your own life that way. Many people genuinely enjoy their employment and continue working because their jobs enrich their lives.

Fortune 500 employees interested in planning their retirement may be interested in live webinars hosted by experienced financial advisors. Click here to register for our upcoming webinars for Fortune 500 employees.

Sources

-

“National Compensation Survey: Employee Benefits in the United States, March 2019," Bureau of Labor Statistics, U.S. Department of Labor.

-

“Generating Income That Will Last throughout Retirement.” Fidelity, 22 Jan. 2019, www.fidelity.com/viewpoints/retirement/income-that-can-last-lifetime .

-

“Retirement Plans-Benefits & Savings.” U.S. Department of Labor, 2019, www.dol.gov/general/topic/retirement .

-

AT&T Summary Plan Description, 2019

-

Chevron Summary Plan Description, 2019

-

Shell Summary Plan Description, 2019

-

ExxonMobil Summary Plan Description, 2019

-

https://seekingalpha.com/article/4268237-order-withdrawals-retirement-assets

-

https://www.aon.com/empowerresults/ensuring-retirees-get-health-care-need/

-

Early Retirement Offers e-book

-

Lump Sum vs. Annuity e-book

-

Social Security e-book

-

Rising Interest Rates e-book

-

Closing The Retirement Gap e-book

-

Financial PTSD e-book

-

What has Worked in Investing e-book

-

Composite Corp Bond Rate history (10 years)http://www.irs.gov/retirement/article/0,,id=123229,00.html https://www.irs.gov/retirement-plans/composite-corporate-bond-rate-table

-

IRS 72(t) code: https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-tax-on-early-distributions

-

Missing out: How much employer 401(k) matching contributions do employees leave on the table?

-

Jester Financial Technologies, Worksheet Detail - Health Care Expense Schedule

-

Social Security Administration. Benefits Planner: Income Taxes and Your Social Security Benefits. Social Security Administration. Retrieved October11, 2016 from https://www.ssa.gov/planners/taxes.html

-

http://hr.chevron.com/northamerica/us/payprograms/executiveplans/dcp/

-

https://www.lawinsider.com/contracts/1tRmgtb07oJJieGzlZ0tjL/chevron-corp/incentive-plan/2018-02-02

-

https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2022

-

https://news.yahoo.com/taxes-2022-important-changes-to-know-164333287.html

-

https://www.nerdwallet.com/article/taxes/federal-income-tax-brackets

-

https://www.the-sun.com/money/4490094/key-tax-changes-for-2022/

-

https://www.bankrate.com/taxes/child-tax-credit-2022-what-to-know/