Retirement Guide for Southern California Edison Employees

2022 Tax Changes and Inflation

With 2021 in the rearview, the IRS has released Revenue Procedure 2021-45, and Notice 2021-61, which detail the tax changes and cost of living adjustments for 2022. The main points of this new release that will most likely affect you would be: This year, the tax filing deadline is on April 18, instead of the typical April 15. The standard deduction for married couples filing jointly for tax year 2022 rises to $25,900, up $800 from the previous year. For single taxpayers and married individuals filing separately, the standard deduction rises to $12,950 for 2022, up $400, and for heads of households, the standard deduction will be $19,400 for tax year 2022, up $600. The personal exemption for tax year 2022 remains at $0, as it was for 2021; this elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act. If you experienced a job change, retirement or lapse in employment, the “lookback” rule may be an important option to consider when filing taxes this year. You’ll also have the option to use your 2019 earned income for your 2021 return, thanks to changes from the American Rescue Plan Act. This rule mainly is used for calculation of the Earned Income Tax Credit, and the Child Tax Credit. Remote workers might face double taxation on state taxes: due to the pandemic, many employees moved back home, which could have been outside of the state where they were employed. Last year, some states had temporary relief provisions to avoid double taxation of income, but many of those provisions have expired. There are only six states that currently have a ‘special convenience of employer’ rule: Connecticut, Delaware, Nebraska, New Jersey, New York, and Pennsylvania. If you don't currently reside in those states, consult with your tax advisor to determine if there are other ways to mitigate the double taxation.

Retirement account contributions: Contributing to a 401k can cut your tax bill significantly, and the amount you can save has increased for 2022. In 2022, the IRS has raised the contributions limit for a 401k to $20,500 - up by $1,000. Meanwhile, workers who are older than 50 years old are eligible for an extra catch-up contribution of $6,500. There are important changes for the Earned Income Tax Credit (EITC) that taxpayers should know: The income threshold has been increased for single filers with no children; the American Rescue Plan Act temporarily boosted it from $543 to $1,502 in 2021. This expansion has not been carried over to the 2022 tax year. Married taxpayers filing separately can qualify: you can claim the EITC as a married filing separately if you meet other qualifications. This wasn't available in previous years.

Increased deduction for cash charitable contributions: In years past, the threshold was $300 for both single and joint filers, but in 2022 that has changed to $300 for single filers, and up to $600 for joint filers.

Child Tax Credit changes: A $2,000 credit per dependent under age 17, income thresholds of $400,000 for married couples and $200,000 for all other filers (single taxpayers and heads of households), a 70 percent partial refundability affecting individuals whose tax bill falls below the credit amount.

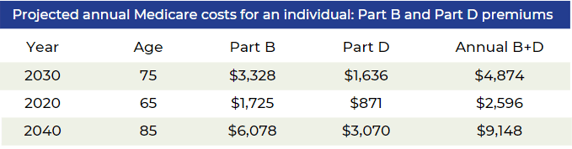

2022 Tax Brackets: Inflation reduces purchasing power over time, as the same basket of goods will cost more as prices rise. In order to maintain the same standard of living through retirement, you will have to factor rising costs into your plan. While the Federal Reserve strives to achieve a 2% inflation rate each year, in 2021 that rate shot up to 7%, a drastic increase from 2020’s 1.4%. While prices as a whole have risen dramatically, there are specific areas to pay attention to if you are nearing or in retirement, like healthcare. Many corporate retirees depend on Medicare as their main health care provider, and in 2022 that healthcare out-of-pocket premium is set to increase by 14.5%. In addition to Medicare increases, the cost of over-the-counter medications is also projected to increase by at least 10%. The Employee Benefit Research Institute (ERBI) found in their 2022 report that couples with average drug expenses would need $296,000 in savings just to cover those expenses in retirement. It is crucial to take all of these factors into consideration when constructing your retirement plan.

addition to Medicare increases, the cost of over-the-counter medications is also projected to increase by at least 10%. The Employee Benefit Research Institute (ERBI) found in their 2022 report that couples with average drug expenses would need $296,000 in savings just to cover those expenses in retirement. It is crucial to take all of these factors into consideration when constructing your retirement plan.

Planning Your Southern California Edison Retirement

Retirement planning is a verb. And consistent action must be taken whether you’re 20 or 60.

The truth is that most Americans don’t know how much to save or the amount of income they’ll need. No matter where you stand in the planning process, or your current age, we hope this guide gives you a good overview of the steps to take, and provides some resources that can help you simplify your transition into retirement and get the most from your benefits.

You know you need to be saving and investing, but you don’t have the time or expertise to know if you’re building retirement savings that can last.

"A separate study by Russell Investments, a large money management firm, came to a similar conclusion . Russell estimates a good financial advisor can increase investor returns by 3.75 percent."

Source: Is it Worth the Money to Hire a Financial Advisor?, the balance, 202

Starting to save as early as possible matters. Time on your side means compounding can have significant impacts on your future savings. And, once you’ve started, continuing to increase and maximize your 401(k) contributions is key, and can lead to huge windfalls later on in your life.

As decades go by, you’re likely full swing into your career, and your income probably reflects that. However, the challenges to saving for retirement start adding up: a mortgage, raising children and saving for their college.

One of the classic planning conflicts is saving for retirement, versus saving for college. Most financial planners will tell you that retirement should be your top priority, because your child can usually find support from financial aid while you’ll be on your own to fund your retirement.

How much we recommend that you invest toward retirement is always based on your unique financial situation and goals. However, consider investing a minimum of 10% of your salary toward retirement through your 30s and 40s. So long as your individual circumstances allow, it should be a goal to maximize Southern California Edison's contribution match.

Over 50? You can invest up to $19,500 into your retirement plan / 401(k).

As you enter your 50s and 60s, you’re ideally at peak earning years with some of your major expenses, such as a mortgage or child-rearing, behind you or soon to be in the rearview mirror. This can be a good time to consider whether you have the ability to boost your retirement savings goal to 20% or more of your income. For many people, this could potentially be the last opportunity to stash away funds.

In 2022, workers aged 50 or older can invest up to $27,000 into their retirement plan / 401(k). Once they meet this limit, they can add an additional $6,500 in catch-up contributions. These limits are adjusted annually for inflation.

If you’re over 50, you may be eligible to use a catch-up contribution within your IRA.

Why are 401(k)s and matching contributions so popular?

These retirement savings vehicles give you the chance to take advantage of three main benefits:

-

Compound growth opportunities (as seen above)

-

Tax saving opportunities

-

Matching contributions

Matching contributions are just what they sound like: your employer (in this case, Southern California Edison) matches your own 401(k) contributions with money that comes from the company. If Southern California Edison matches, the company money typically matches up to a certain percent of the amount you put in.

Unfortunately, many people don’t take full advantage of the employer match because they’re not putting in enough themselves.

$1,336 - A 2020 study from Financial Engines titled “Missing Out: How Much Employer 401(k) Matching Contributions Do Employees Leave on the Table?”, revealed that employees who don’t maximize the company match typically leave $1,336 of potential extra retirement money on the table each year.

- If Southern California Edison will match up to 3% of your plan contributions and you only contribute 2% of your salary, you aren’t getting the full amount of Southern California Edison's potential match.

- By bumping up your contribution by just 1%, Southern California Edison is now matching 3% (the max) of your contributions for a total contribution of 6% of your salary. You aren’t leaving money on the table.

Whether you live in the U.S. or Puerto Rico, you'll receive quite a bit of useful information from this article! Speak with a Southern California Edison-focused advisor by clicking the button below.

Whether you’re changing jobs or retiring, knowing what to do with your hard-earned retirement savings can be difficult. A plan sponsored by Southern California Edison, such as a pension and 401(k), may make up the majority of your retirement savings, but how much do you really know about that plan and how it works?

There are seemingly endless rules that vary from one retirement plan to the next, early out offers, interest rate impacts, age penalties, and complex tax impacts.

Increasing your investment balance and reducing taxes is the key to a successful retirement plan spending strategy. At The Retirement Group, we can help you understand how your Southern California Edison retirement scheme fits into your overall financial picture, and how to make that plan work for you.

Workers are far more likely to rely on their workplace defined contribution (DC) retirement plans as a source of income.

Getting help and leveraging the financial planning tools and resources Southern California Edison makes available can help you understand whether you are on track, or need to make adjustments to meet your long-term retirement goals...

Source: Schwab 401(k) Survey Finds Savings Goals and Stress Levels on the Rise

Sample Retirement Plan

Whether you work for a large oil company like ExxonMobil or a large telecom company like AT&T, each company has a unique plan. These plans are often complex, so it is important to work with an advisor who understands your plan. Regardless of which company you work for, your company plan is complicated and difficult to understand. To better understand your plan, let's look at a few examples from AT&T, Shell, ExxonMobil, and Chevron and see how they compare to other Fortune 500 companies.

Perhaps Southern California Edison is among those following a similar model to Shell, where the company determines the contribution percentage by looking at specific factors related to each employee.

In the Shell Retirement Plan, the company's annual contribution is tier based, with higher contributions coming once an employee has passed a years of service threshold.

After Completing... Company Contribution 1 year of accredited service 2.5%6 years of accredited service 5%9 years of accredited service 10%

-

On the other hand, it's possible your company determines its contribution based on a combination of specific factors, like ExxonMobil.

ExxonMobil basic pension benefit is determined by:

- Final Average Pensionable Pay x Years of Service x 1.6% = Final Average Pensionable Pay subtotal

- Primary Social Security x Years of Service x 1.5% = Social Security offset

- Final Average Pensionable Pay subtotal - Social Security offset = Basic Pension Monthly Benefit.

-

ExxonMobil is just one of many companies using a Social Security offset when calculating Pension Benefits. Various energy companies calculate the offset formula differently, which is why it's important to contact an advisor who knows your specific plan for Southern California Edison.

Complex Formula

Your company may use a more complex formula, like Chevron. Chevron calculates an employee's monthly annuity through the Legacy Chevron retirement plan by taking 1.6% of monthly highest average earnings, times by years of BAS minus their Social Security Offset.

While this formula calculates a monthly pension benefit, you can determine the lump sum equivalent by using the annuity to lump sum conversion table on Fidelity's website.

If a Pension is offered, your company's retirement plan will generally allow for different forms of payment:

Your Southern California Edison 401(k) Plan

When is the last time you reviewed your 401(k) plan account with Southern California Edison or made any changes to it?

If it’s been a while, you’re not alone. 73% of plan participants spend less than five hours researching their 401(k) investment choices each year, and when it comes to making account changes, the story is even worse.

When you retire, if you have balances in your 401(k) plan, you will receive a Participant Distribution Notice in the mail. This notice will show the current value that you are eligible to receive from each plan and explain your distribution options. It will also tell you what you need to do to receive your final distribution. Please call The Retirement Group at (800)-900-5867 for more information and we can help you get in front of a retirement-focused advisor.

Next Step:

Watch for your Participant Distribution Notice and Special Tax Notice Regarding Plan Payments. These notices will help explain your options and what the federal tax implications may be for your vested account balance.

'What has Worked in Investing' & '8 Tenets when picking a Mutual Fund'.

To learn about your distribution options, call The Retirement Group at (800)-900-5867. Click our e-book for more information on 'Rollover Strategies for 401(k)s'

Use the AT&T Online Beneficiary Designation to make updates to your beneficiary designations, if needed.

Note: If you voluntarily terminate your employment with Southern California Edison, you may not be eligible to receive the annual contribution

Over half of plan participants admit they don’t have the time, interest or knowledge needed to manage their 401(k) portfolio. But the benefits of getting help goes beyond convenience. Studies like this one, from Charles Schwab, show those plan participants who get help with their investments tend to have portfolios that perform better: The annual performance gap between those who get help and those who do not is 3.32% net of fees. This means a 45-year-old participant could see a 79% boost in wealth by age 65 simply by contacting an advisor. That’s a pretty big difference.

Getting help can be the key to better results across the 401(k) board.

A Charles Schwab study found several positive outcomes common to those using independent professional advice. They include:

Improved savings rates – 70% of participants who used 401(k) advice increased their contributions.

Increased diversification – Participants who managed their own portfolios invested in an average of just under four asset classes, while participants in advice-based portfolios invested in a minimum of eight asset classes.

Increased likelihood of staying the course – Getting advice increased the chances of participants staying true to their investment objectives, making them less reactive during volatile market conditions and more likely to remain in their original 401(k) investments during a downturn. Don’t try to do it alone.

Get help with your 401(k) investments. Your nest egg will thank you.

In-Service Withdrawals

Generally speaking, you can withdraw amounts from your account while still employed under the circumstances described below.

It’s important to know that certain withdrawals are subject to regular federal income tax and, if you’re under age 59½, you may also be subject to an additional 10% penalty tax. You can determine if you’re eligible for a withdrawal, and request one, online or by calling the Southern California Edison Benefits Center.

Rolling Over Your 401(k)

As long as the plan participant is younger than age 72, an in-service distribution can be rolled over to an IRA. A direct rollover would avoid the 10% early withdrawal penalty as well as the mandatory 20% tax withholding. Your plan summary outlines more information and possible restrictions on rollovers and withdrawals.

Because a withdrawal permanently reduces your retirement savings and is subject to tax, you should always consider taking a loan from the plan instead of a withdrawal to meet your financial needs. Unlike withdrawals, loans must be repaid, and are not taxable (unless you fail to repay them). In some cases, as with hardship withdrawals, you are not allowed to make a withdrawal unless you have also taken out the maximum available plan loan.

You should also know that the plan administrator reserves the right to modify the rules regarding withdrawals at any time, and may further restrict or limit the availability of withdrawals for administrative or other reasons. All plan participants will be advised of any such restrictions, and they apply equally to all employees.

Borrowing from your 401(k)

Should you? Maybe you lose your job, have a serious health emergency, or face some other reason that you need a lot of cash. Banks make you jump through too many hoops for a personal loan, credit cards charge too much interest, and … suddenly, you start looking at your 401(k) account and doing some quick calculations about pushing your retirement off a few years to make up for taking some money out.

We understand how you feel: It’s your money, and you need it now. But, take a second to see how this could adversely affect your retirement plans.

Consider these facts when deciding if you should borrow from your 401(k). You could:

Lose growth potential on the money you borrowed.

Deal with repayment and tax issues if you leave your employer.

Repayment and tax issues, if you leave your employer.

Net Unrealized Appreciation (NUA)

When you qualify for a distribution you have three options:

Roll-over your qualified plan to an IRA and continue deferring taxes.

Take a distribution and pay ordinary income tax on the full amount.

Take advantage of NUA and reap the benefits of a more favorable tax structure on gains.

How does Net Unrealized Appreciation work?

First an employee must be eligible for a distribution from their qualified plan; generally at retirement or age 59 1⁄2, the employee takes a 'lump-sum' distribution from the plan, distributing all assets from the plan during a 1 year period. The portion of the plan that is made up of mutual funds and other investments can be rolled into an IRA for further tax deferral. The highly appreciated company stock is then transferred to a non-retirement account.

The tax benefit comes when you transfer the company stock from a tax-deferred account to a taxable account. At this time you apply NUA and you incur an ordinary income tax liability on only the cost basis of your stock. The appreciated value of the stock above its basis is not taxed at the higher ordinary income tax but at the lower long-term capital gains rate, currently 15%. This could mean a potential savings of over 30%.

As an employee at Southern California Edison, you may be interested in understanding NUA from a financial advisor.

IRA Withdrawal

Your retirement assets under Southern California Edison may consist of several retirement accounts IRAs, 401(k)s, taxable accounts, and others.

So, what is the most efficient way to take your retirement income?

You may want to consider meeting your income needs in retirement by first drawing down taxable accounts rather than tax-deferred accounts. This may help your retirement assets last longer as they continue to potentially grow tax deferred. You will also need to plan to take the required minimum distributions (RMDs) from any employer-sponsored retirement plans and traditional or rollover IRA accounts.

That is due to IRS requirements for 2020 to begin taking distributions from these types of accounts when you reach age 72. If you do not, the IRS may assess a 50% penalty on the amount you should have taken.

There is new legislation that allows individuals who didn’t turn 70½ by the end of 2019 to take RMDs on April 1 of the year they turn 72.

Two flexible distribution options for your IRA

When you need to draw on your IRA for income or take your RMDs, you have a few choices. Regardless of what you choose, IRA distributions are subject to income taxes and may be subject to penalties and other conditions if you’re under 59½.

Partial withdrawals: Withdraw any amount from your IRA at any time. If you’re 72 or over, you’ll have to take at least enough from one or more IRAs to meet your annual RMD.

Systematic withdrawal plans: Structure regular, automatic withdrawals from your IRA by choosing the amount and frequency to meet your retirement income needs. If you’re under 59½, you may be subject to a 10% early withdrawal penalty (unless your withdrawal plan meets Code Section 72(t) rules).

Your tax advisor can help you understand distribution options, determine RMD requirements, calculate RMDs, and set up a systematic withdrawal plan.

Your Southern California Edison Benefits

Southern California Edison Benefits Annual Enrollment

Annual enrollment for your Southern California Edison benefits usually occurs each fall.

Before it begins, you will be mailed enrollment materials and an upfront confirmation statement reflecting your benefit coverage to the address on file. You’ll find enrollment instructions and information about your benefit options and contribution amounts. You will have the option to keep the benefit coverage shown on your upfront confirmation statement or select benefits that better support your needs. You may be able to choose to enroll in eBenefits and receive this information via email instead.

Next Steps:

-

Watch for your annual enrollment information in the September/November time frame.

-

Review your benefits information and utilize the tools and resources available on the Southern California Edison Benefits Center website.

-

Enroll in eBenefits.

Things to keep in mind :

-

47% of Americans cite healthcare as their greatest economic concern.

-

Medical bills are the No. 1 cause of bankruptcy in the United States.

-

For older Americans, healthcare costs represent the second-largest expense, behind housing.

Short-Term & Long-Term Disability

Short-Term: Depending on your plan, you may have access to short-term disability (STD) benefits.

Long-Term: Your plan's long-term disability (LTD) benefits are designed to provide you with income if you are absent from work for six consecutive months or longer due to an eligible illness or injury.

What Happens If Your Employment Ends

Your life insurance coverage and any optional coverage you purchase for your spouse/domestic partner and/or children ends on the date your employment ends, unless your employment ends due to disability. If you die within 31 days of your termination date, benefits are paid to your beneficiary for your basic life insurance, as well as any additional life insurance coverage you elected.

Note:

-

You may have the option to convert your life insurance to an individual policy or elect portability on any optional coverage.

-

If you stop paying supplementary contributions, your coverage will end.

-

If you are at least 65 and you pay for supplemental life insurance, you should receive information in the mail from the insurance company that explains your options.

-

Make sure to update your beneficiaries. See the Southern California Edison SPD for more details.

Beneficiary Designations

As part of your retirement and estate planning, it’s important to name someone to receive the proceeds of your benefits programs in the event of your death. That’s how Southern California Edison will know whom to send your final compensation and benefits. This can include life insurance payouts and any pension or savings balances you may have.

Next Step:

When you retire, make sure that you update your beneficiaries. Southern California Edison has an Online Beneficiary Designation form for life events such as death, marriage, divorce, child birth, adoptions, etc.

If you are unsure about Southern California Edison benefits, schedule a call to speak with one of our Southern California Edison-focused advisors

Social Security & Medicare

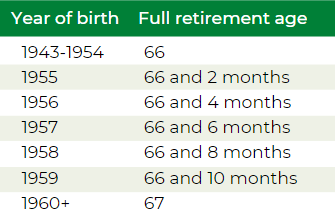

For many retirees, understanding and claiming Social Security can be difficult but identifying optimal ways to claim Social Security is essential to your retirement income planning. Social Security benefits are not designed to be the sole source of your retirement income, but a part of your overall withdrawal strategy.

Knowing the foundation of Social Security, and using this knowledge to your advantage, can help you claim your maximum benefit.

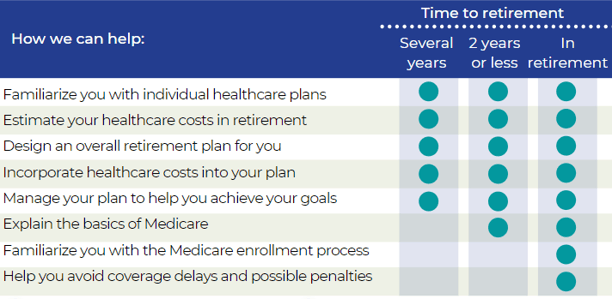

It’s your responsibility to enroll in Medicare parts A and B when you first become eligible — and you must stay enrolled to have coverage for Medicare-eligible expenses. This applies to your Medicare eligible dependents as well.

You should know how your retiree medical plan choices or Medicare eligibility impact your plan options. Before you retire, contact the U.S. Social Security Administration directly at 800-772-1213, call your local Social Security Office or visit ssa.gov.

They can help determine your eligibility, get you and/or your eligible dependents enrolled in Medicare or provide you with other government program information. For more in-depth information on Social Security, please call us.

Check the status of your Social Security benefits before you retire. Contact the U.S. Social Security Administration, your local Social Security office, or visit ssa.gov.

Are you eligible for Medicare, or will be soon?

If you or your dependents are eligible after you leave Southern California Edison, Medicare generally becomes the primary coverage for you or any of your dependents as soon as they are eligible for Medicare. This will affect your company-provided medical benefits.

You and your Medicare-eligible dependents must enroll in Medicare Parts A and B when you first become eligible. Medical and MH/SA benefits payable under the Southern California Edison-sponsored plan will be reduced by the amounts Medicare Parts A and B would have paid whether you actually enroll in them or not.

For details on coordination of benefits, refer to your summary plan description.

If you or your eligible dependent don’t enroll in Medicare Parts A and B, your provider can bill you for the amounts that are not paid by Medicare or your Southern California Edison-specific medical plan … making your out-of-pocket expenses significantly higher.

According to the Employee Benefit Research Institute (EBRI), Medicare will only cover about 60% of an individual’s medical expenses. This means a 65-year-old couple, with average prescription-drug expenses for their age, will need $259,000 in savings to have a 90% chance of covering their healthcare expenses. A single male will need $124,000 and a single female, thanks to her longer life expectancy, will need $140,000.

Check your plan summary to see if you’re eligible to enroll in Medicare Parts A and B.

If you become Medicare-eligible for reasons other than age, you must contact the Southern California Edison benefit center about your status. *Source: Southern California Edison Summary Plan Description

Divorce

The ideas of 'happily ever after" and 'til' death do us part' simply won’t materialize for 28% of couples over the age of 50. Most couples have saved together for decades, assuming all along that they would retire together. After a divorce, they face the expenses of a pre-or post-retirement life, but with half their savings (or even less).

If you’re divorced or in the process of divorcing, your former spouse(s) may have an interest in a portion of your retirement benefits. Before you can start your pension — and for each former spouse who may have an interest — you’ll need to provide Southern California Edison with the following documentation:

-

A copy of the court-filed Judgment of Dissolution or Judgment of Divorce along with any Marital Settlement Agreement (MSA)

-

A copy of the court-filed Qualified Domestic Relations Order (QDRO)

Provide Southern California Edison with any requested documentation to avoid having your pension benefit delayed or suspended. To find out more information on strategies if divorce is affecting your retirement benefits, please give us a call.

You’ll need to submit this documentation to your company’s online pension center regardless of how old the divorce or how short the marriage. *Source: The Retirement Group, “Retirement Plans - Benefits and Savings,” U.S. Department of Labor, 2019; “Generating Income That Will Last Throughout Retirement,” Fidelity, 2019

Social Security and Divorce You can apply for a divorced spouse’s benefit if the following criteria are met: You’re at least 62 years of age.

You were married for at least 10 years prior to the divorce.

You are currently unmarried.

Your ex-spouse is entitled to Social Security benefits.

Your own Social Security benefit amount is less than your spousal benefit amount, which is equal to one-half of what your ex’s full benefit amount would be if claimed at Full Retirement Age (FRA). Unlike with a married couple, your ex-spouse doesn’t have to have filed for Social Security before you can apply for your divorced spouse’s benefit, but this only applies if you’ve been divorced for at least two years and your ex is at least 62 years of age. If the divorce was less than two years ago, your ex must already be receiving benefits before you can file as a divorced spouse.

Unlike with a married couple, your ex-spouse doesn’t have to have filed for Social Security before you can apply for your divorced spouse’s benefit.

Divorce doesn’t even disqualify you from survivor benefits. You can claim a divorced spouse’s survivor benefit if the following are true:

-

Your ex-spouse is deceased

-

You are at least 60 years of age

-

You were married for at least 10 years prior to the divorce

-

You are single (or you remarried after age 60)

In the process of divorcing?

If your divorce isn’t final before your retirement date, you’re still considered married. You have two options:

-

Retire before your divorce is final and elect a joint pension of at least 50% with your spouse — or get your spouse’s signed, notarized consent to a different election or lump sum.

-

Delay your retirement until after your divorce is final and you can provide the required divorce documentation.*

Source: The Retirement Group, “Retirement Plans - Benefits and Savings,” U.S. Department of Labor, 2019; “Generating Income That Will Last Throughout Retirement,” Fidelity, 2019

Survivor Checklist

In the unfortunate event that you aren’t able to collect your benefits, your survivor will be responsible for taking action.

What your survivor needs to do:

-

Report your death. Your spouse, a family member, or even a friend should call your company’s benefits service center as soon as possible to report your death.

-

Collect life insurance benefits. Your spouse, or other named beneficiary, will need to call Southern California Edison's benefits service center to collect life insurance benefits.

If you have a joint pension:

-

Start the joint pension payments. The joint pension is not automatic. Your joint pensioner will need to complete and return the paperwork from Southern California Edison's pension center to start receiving joint pension payments.

-

Be prepared financially to cover living expenses. Your spouse will need to be prepared with enough savings to bridge at least one month between the end of your pension payments and the beginning of his or her own pension payments.

If your survivor has medical coverage through Southern California Edison:

-

Decide whether to keep medical coverage.

-

If your survivor is enrolled as a dependent in your Southern California Edison-sponsored retiree medical coverage when you die, he or she needs to decide whether to keep it. Survivors have to pay the full monthly premium.

Life After Southern California Edison

While you may be ready for some rest and relaxation, without the stress and schedule of your full-time career, it may make sense to you financially, and emotionally, to continue to work.

Financial benefits of working

Make up for decreased value of savings or investments . Low interest rates make it great for lump sums but harder for generating portfolio income. Some people continue to work to make up for poor performance of their savings and investments.

Maybe you took a company offer and left earlier than you wanted and with less retirement savings than you needed. Instead of drawing down savings, you may decide to work a little longer to pay for extras you’ve always denied yourself in the past.

Meet financial requirements of day-to-day living . Expenses can increase during retirement and working can be a logical and effective solution. You might choose to continue working in order to keep your insurance or other benefits — many employers offer free to low cost health insurance for part-time workers.

Emotional benefits of working

You might find yourself with very tempting job opportunities at a time when you thought you’d be withdrawing from the workforce.

Staying active and involved. Retaining employment, even if it’s just part-time, can be a great way to use the skills you’ve worked so hard to build over the years and keep up with friends and colleagues.

Enjoying yourself at work . Just because the government has set a retirement age with its Social Security program doesn’t mean you have to schedule your own life that way. Many people genuinely enjoy their employment and continue working because their jobs enrich their lives.

Fortune 500 employees interested in planning their retirement may be interested in live webinars hosted by experienced financial advisors. Click here to register for our upcoming webinars for Fortune 500 employees.

Sources

- “National Compensation Survey: Employee Benefits in the United States, March 2019," Bureau of Labor Statistics, U.S. Department of Labor.

- “Generating Income That Will Last throughout Retirement.” Fidelity, 22 Jan. 2019, www.fidelity.com/viewpoints/retirement/income-that-can-last-lifetime .

- “Retirement Plans-Benefits & Savings.” U.S. Department of Labor, 2019, www.dol.gov/general/topic/retirement .

- AT&T Summary Plan Description, 2019

- Chevron Summary Plan Description, 2019

- Shell Summary Plan Description, 2019

- ExxonMobil Summary Plan Description, 2019

- https://seekingalpha.com/article/4268237-order-withdrawals-retirement-assets

- https://www.aon.com/empowerresults/ensuring-retirees-get-health-care-need/

- 8 Tenets when picking a Mutual Fund e-book

- Determining Cash Flow Need in Retirement e-book

- Early Retirement Offers e-book

- Lump Sum vs. Annuity e-book

- Social Security e-book

- Rising Interest Rates e-book

- Closing The Retirement Gap e-book

- Rollover Strategies for 401(k)s e-book

- How to Survive Financially After a Job Loss e-book

- Financial PTSD e-book

- RetireKit

- What has Worked in Investing e-book

- Retirement Income Planning for ages 50-6 5 e-book

- Strategies for Divorced Individuals e-book

- TRG Webinar forCorporate Employees

- Composite Corp Bond Rate history (10 years)http://www.irs.gov/retirement/article/0,,id=123229,00.html https://www.irs.gov/retirement-plans/composite-corporate-bond-rate-table

- IRS 72(t) code: https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-tax-on-early-distributions

- Missing out: How much employer 401(k) matching contributions do employees leave on the table?

- Jester Financial Technologies, Worksheet Detail - Health Care Expense Schedule

- Social Security Administration. Benefits Planner: Income Taxes and Your Social Security Benefits. Social Security Administration. Retrieved October11, 2016 from https://www.ssa.gov/planners/taxes.html

- http://hr.chevron.com/northamerica/us/payprograms/executiveplans/dcp/

- https://www.lawinsider.com/contracts/1tRmgtb07oJJieGzlZ0tjL/chevron-corp/incentive-plan/2018-02-02

-

https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2022

-

https://news.yahoo.com/taxes-2022-important-changes-to-know-164333287.html

-

https://www.nerdwallet.com/article/taxes/federal-income-tax-brackets

-

https://www.the-sun.com/money/4490094/key-tax-changes-for-2022/

-

https://www.bankrate.com/taxes/child-tax-credit-2022-what-to-know/