Healthcare Provider Update: Healthcare Provider for Caterpillar: Caterpillar Inc. primarily offers its employees healthcare benefits through various providers, including Blue Cross Blue Shield, Cigna, and UnitedHealthcare. These providers typically offer a range of healthcare plans catering to the diverse needs of Caterpillar's workforce. Potential Healthcare Cost Increases in 2026: As healthcare costs rise, Caterpillar may face significant increases in its healthcare expenditures in 2026. The anticipated uptick in Affordable Care Act (ACA) premiums could lead to an inflationary impact on company-sponsored health plans, with reports suggesting that companies like Caterpillar might see costs soar due to a perfect storm of increasing medical expenses and the potential expiration of enhanced federal premium subsidies. Consequently, the company could experience upwards of 8.5% in healthcare cost increases in 2026, reflecting broader industry trends and putting additional pressure on corporate healthcare budgets. Click here to learn more

In our complete retirement guide for Caterpillar employees, we discuss numerous variables to consider when determining whether to retire from Caterpillar. Some of these issues are healthcare and benefit changes, interest rates, the new 2024 tax rates, inflation, and many others. Keep in mind that we are not linked with Caterpillar, and we recommend contacting your Caterpillar benefits department for more information.

Author:

Nicole Webb - Senior Vice President, Financial Advisor

Individuals need to be aware of any new changes implemented by the IRS. The key elements influencing employees will be the following:

- The standard deduction for 2024 will rise to $14,600 for single filers and married couples filing separately, $29,200 for joint filers, and $21,900 for heads of household.

- Taxpayers over the age of 65 or blind can increase their standard deduction by $1,550. If you are not married or have no surviving spouse, the payment increases to $1,950.

As a taxpayer employed by a corporation, you should be aware of the following key changes to the Earned Income Tax Credit (EITC):

- For tax year 2024, the maximum Earned Income Tax Credit amount is $7,830 for qualifying taxpayers with three or more qualifying children, up from $7,430 in 2023.

- Married taxpayers filing separately may qualify: If you meet other conditions, you can claim the EITC as a married couple filing separately. This was unavailable in earlier years.

Deduction for cash charitable contributions: The special deduction, which enabled single non-itemizers to deduct up to $300 and married filing jointly couples to deduct $600 in cash donations to qualifying charities, has expired.

Child Tax Credit Changes:

- The highest tax credit per qualified child is $2,000 for children under five and $3,000 for children aged six to seventeen. Furthermore, you cannot obtain a portion of the credit in advance, as was the case in 2023.

- As a parent or guardian, you are eligible for the Child Tax Credit if your adjusted gross income is less than $200,000 when filing alone or less than $400,000 when filing jointly with a spouse.

- Individuals with a tax bill that is less than the credit amount are eligible for a 70% partial refund.

2024 Tax Brackets

Inflation decreases purchasing power over time because the same basket of products becomes more expensive as prices rise. To maintain your current quality of life after leaving your business, you must account for rising expenditures in your retirement plan. While the Federal Reserve aims for a 2% inflation rate each year, in 2023 the rate jumped to 4.9%, a significant increase from 1.4% in 2020. While overall expenses have risen considerably, there are several key areas to consider if you are nearing or in retirement from your job, such as healthcare.

It is critical to consider all of these aspects when developing your overall plan for retirement from your company.

*Source: IRS.gov, Yahoo, Bankrate, Forbes

Recent Layoff Announcements & Other Caterpillar NewsCaterpillar made massive layoffs in 2022 and 2023 as part of a cost-cutting strategy to address dwindling revenues and market concerns. The employment layoffs were concentrated in manufacturing and support activities, with the goal of streamlining operations and reducing costs. Caterpillar's restructuring efforts align with its objective to maintain financial stability in the face of global economic headwinds (BrianHeger.com).

Restructuring and Layoffs: Caterpillar has announced extensive restructuring measures that potentially result in the loss of 880 jobs, with the goal of enhancing profitability and operating efficiency. This is consistent with ongoing attempts to adjust to changing market conditions while maintaining shareholder value (Sources: Yahoo Finance, Fox Business). Union Contract Deal: In a positive step, Caterpillar negotiated a tentative agreement with the union that represents employees at four locations, preventing a possible strike. The new deal addresses demands for increased salaries, more safety measures, and improved healthcare benefits (Source: Fox Business). Financial Performance: In the first quarter of 2024, Caterpillar posted a profit per share of $5.75, indicating strong financial health despite reduced sales volumes. (Source: Caterpillar)

Featured Video

Articles you may find interesting:

- Corporate Employees: 8 Factors When Choosing a Mutual Fund

- Use of Escrow Accounts: Divorce

- Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

- Stages of Retirement for Corporate Employees

- 7 Things to Consider Before Leaving Your Company

- How Are Workers Impacted by Inflation & Rising Interest Rates?

- Lump-Sum vs Annuity and Rising Interest Rates

- Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

- Corporate Employees: Do NOT Believe These 6 Retirement Myths!

- 401K, Social Security, Pension – How to Maximize Your Options

- Have You Looked at Your 401(k) Plan Recently?

- 11 Questions You Should Ask Yourself When Planning for Retirement

- Worst Month of Layoffs In Over a Year!

- Corporate Employees: 8 Factors When Choosing a Mutual Fund

- Use of Escrow Accounts: Divorce

- Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

- Stages of Retirement for Corporate Employees

- 7 Things to Consider Before Leaving Your Company

- How Are Workers Impacted by Inflation & Rising Interest Rates?

- Lump-Sum vs Annuity and Rising Interest Rates

- Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

- Corporate Employees: Do NOT Believe These 6 Retirement Myths!

- 401K, Social Security, Pension – How to Maximize Your Options

- Have You Looked at Your 401(k) Plan Recently?

- 11 Questions You Should Ask Yourself When Planning for Retirement

- Worst Month of Layoffs In Over a Year!

Retirement planning is a verb that necessitates consistent action, regardless of one's age, whether they are 20 or 60.

The truth is that most Americans have no idea how much to save or how much income they will require.

Regardless of where you are in the planning process or your present age, we hope this guide gives you a clear overview of the steps to take and resources to help you streamline your transition from your workplace to retirement and get the most out of your benefits.

You understand the importance of saving and investing, especially since time is on your side the sooner you start, but you lack the time and experience to determine whether you are creating retirement funds that will persist when you leave your employer.

'A separate study by Russell Investments, a large money management firm, came to a similar conclusion . Russell estimates a good financial advisor can increase investor returns by 3.75 percent.'

Source: Is it Worth the Money to Hire a Financial Advisor?, the balance, 202

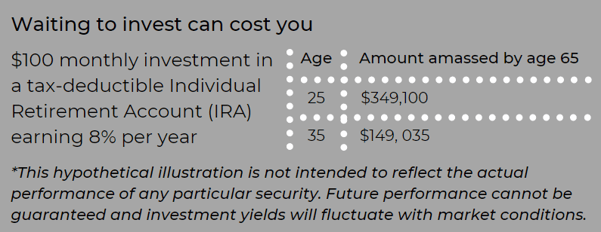

Starting to save as early as possible is important. With time on your side, compounding can have a tremendous impact on your future savings. Once you've started, it's critical to keep increasing and maximizing your 401(k) contributions.

When you invest in your company's retirement plan, you can potentially increase your wealth by 79% at age 65 over the course of 20 years.

*Source: Bridging the Gap Between 401(k) Sponsors and Participants, T.Rowe Price, 2020

One of the most common planning dilemmas is deciding whether to save for retirement or college. Most financial advisors will advise you that retirement from your employer should be your main priority because your child can usually receive financial assistance, however you will be on your own to fund your retirement.

How much we recommend you invest for retirement is always determined by your individual financial circumstances and aspirations. Consider investing at least 10% of your paycheck for retirement during your 30s and 40s.

As you enter your 50s and 60s, you should be in your peak earning years, with some large expenses, such as a mortgage or child-rearing, behind you or soon to be in the rearview mirror. This is an excellent moment to think about whether you can increase your retirement savings goal to 20% or more of your earnings. For many people, this may be their only chance to save money.

Workers aged 50 and over can invest up to $23,000 in their retirement plan/401(k) in 2024, and after this limit is met, they can add an additional $7,500 in catch-up contributions for a total yearly contribution of $30,500. Annually, these restrictions are updated for inflation.

Why are 401(k)s and matching contributions so popular?

These retirement savings vehicles offer three primary advantages:

-

Compound growth prospects (as shown above).

-

Opportunities to save on taxes

-

Contributions that match

Matching contributions are exactly what they sound like: your firm will match your own 401(k) contributions with company funds. If your company matches, the money is typically matched up to a particular percentage of the amount you contribute.

Unfortunately, many consumers do not take advantage of their company's matching contributions because they do not contribute enough to obtain the full match.

According to Principal Financial Group research published in 2022, 62% of employees consider workplace 401(k) matches to be very helpful in meeting their retirement goals.

According to Bank of America's "2022 Financial Life Benefit Impact Report," while 58% of eligible employees participated in a 401(k), 61% contributed less than $5,000 in the current year.

The study also discovered that fewer than one in every ten members' contributions exceeded the elective deferral limit set by IRS Section 402(g), which is $23,000 in 2024.

According to Financial Engines' 2020 study "Missing Out: How Much Employer 401(k) Matching Contributions Do Employees Leave on the Table?", employees who do not maximize their business match typically leave $1,336 of extra retirement money on the table each year.

For example, if your business would match up to 3% of your plan contributions and you contribute only 2% of your salary, you will not receive the entire company match. By boosting your commitment by just 1%, your firm will now match the whole 3% of your contributions, for a total combined contribution of 6%. By doing so, you are not leaving money on the table.

Whether you're changing jobs or retiring, deciding what to do with your hard-earned retirement funds can be challenging. A company-sponsored plan, such as a pension or 401(k), may account for the majority of your retirement assets, but how much do you actually understand about it and how it works?

There appear to be an infinite number of restrictions that differ from one retirement plan to the next, including early withdrawal offers, interest rate affects, age penalties, and intricate tax implications.

Increasing your investment balance and lowering taxes are the keys to a successful retirement plan spending strategy. At The Retirement Group, we can explain how your company's 401(k) fits into your entire financial picture and how to make it work for you.

'Getting help and leveraging the financial planning tools and resources your company

makes available can help you understand whether you are on track, or need to

make adjustments to meet your long-term retirement goals...'

Source: Schwab 401(k) Survey Finds Savings Goals and Stress Levels on the Rise

Caterpillar Pension Plan- Overview

Eligibility

When leaving the company with a vested benefit under the Traditional Plan, you must understand how your age and time of separation may affect the timing and nature of your benefit. If you are a PEP participant with a vested benefit, you may get your pension at any time after leaving the employer.

Early Retirement Special Note:

If you meet the age and service requirements given above and choose to retire early, your pension under the Final Earnings Formula will be cut by 4% for each year (or 1/3% per month) payments begin before age 62.

Pension Plan Calculation

Final Average Monthly Earnings (FAME)

Your Final Average Monthly Earnings are the average of the greatest five years of earnings from your previous 10 years with the company as an eligible employee and plan participant. The calculation starts with the last 12 months prior to retirement or termination and works backwards in 12-month increments from that date.

Final Earnings Formula

The Final Earnings Formula generates a lifetime monthly pension equal to the excess of a percentage (typically 1.5%) of your Final Average Monthly Earnings multiplied by your Years of Service as an Eligible Employee and Participant in the Plan (up to 35 years) over your Credited Service Formula benefit.

Credited Services Formula

The Credited Service Formula calculates a lifetime monthly pension at your Normal Retirement Date based on the Credited Service earned as a full-time employee and plan participant, multiplied by the basic and supplemental pension rates:

*For those who retire on or after January 1, 2010, the basic pension rate is $43.35. The Company may alter the baseline pension rate periodically.

*The supplemental pension rate is decided by a table in your SPD, based on the class you were a member of for the longest duration within the 2-year period ending with your retirement or termination date.

Example #1:

Here's how the Credited Service Formula and Final Earnings Formula collaborated to calculate your Traditional benefit.

Pension Plan Distribution Options

Lump-Sum vs. Annuity

Retirees who are qualified for a pension are frequently given the option of receiving their pension payments throughout life or receiving a lump-sum payment all at once. The lump amount represents the equivalent present value of the monthly pension income stream, with the intention of taking the money (rolling it over to an IRA), investing it, and generating your own cash flow through methodical withdrawals throughout your retirement years.

The monthly pension has the advantage of being guaranteed to continue indefinitely. Thus, whether you live for ten, twenty, thirty, or more years after retiring from your firm, you are not at risk of outliving your monthly pension.

The main disadvantage of the monthly pension is the early and untimely death of the retiree and joint annuitant. This frequently results in a reduced payout or the pension being terminated entirely upon death. The other disadvantage is that, unlike Social Security, employer pensions seldom include a COLA (Cost of Living Allowance). As a result, if the dollar value of the monthly pension remains constant throughout retirement, it will lose purchasing power as inflation increases.

In contrast, choosing the lump-sum option allows you to invest, earn higher growth, and perhaps produce even more retirement income flow. Furthermore, if something happens to you, any unused account balance will be available to your surviving spouse or heirs. However, if you fail to invest the funds for sufficient development, the money may run out entirely, and you may regret not taking advantage of the pension's "income for life" guarantee.

In contrast, choosing the lump-sum option allows you to invest, earn higher growth, and perhaps produce even more retirement income flow. Furthermore, if something happens to you, any unused account balance will be available to your surviving spouse or heirs. However, if you fail to invest the funds for sufficient development, the money may run out entirely, and you may regret not taking advantage of the pension's "income for life" guarantee.

Finally, the "risk" assessment that should be performed to determine whether or not you should choose the lump sum or the guaranteed lifetime income that your employer pension provides is determined by the type of return required to match the annuity payments. After all, if a 1% to 2% return on the lump-sum is all that is required to generate the same monthly pension cash flow stream, the risk of outliving the lump-sum is reduced. However, if the pension payments can only be replaced with a higher and more risky rate of return, there is a bigger danger that those gains will not materialize and you would run out of funds.

Interest Rates and Life Expectancy

Current interest rates, as well as your life expectancy after retirement, have a substantial impact on lump sum payouts under defined benefit pension plans.

Rising interest rates are inversely related to pension lump sum values. The opposite is also true: declining or lower interest rates raise pension lump sum values. Interest rates are significant in calculating your lump payment option under the pension plan.

Before making pension decisions, the Retirement Group believes that all employees should receive a full RetireKit Cash Flow Analysis that compares their lump sum value to monthly annuity payout choices.

As appealing as a lump payment may seem, a monthly annuity for all or a portion of the pension may still be a viable alternative, particularly in a high interest rate environment.

Each person's circumstance is unique, and a complimentary Cash Flow Analysis from The Retirement Group will show you how your pension options stack up and play out over the duration of your retirement years, which might be two, three, four, or more decades.

Knowing where you stand allows you to make more informed decisions about when to retire and which pension distribution choice is best suited to your circumstances.

401k Savings Plan

Employees are encouraged to sign up for a 401(k) savings plan immediately away. Caterpillar has a 401(k) Plan, which allows you to save for retirement with pretax or Roth after-tax contributions, company matching contributions, and an annual employer contribution.

You can invest before or after tax (regular or Roth) and select from seven investment options with varied levels of risk. You can also transfer pre-tax and Roth funds from other qualifying plans.

Caterpillar has a 401(k) Plan, which allows you to save for retirement with pretax or Roth after-tax contributions, company matching contributions, and an annual employer contribution.

Enrollment is Automatic

Typically, you can enroll in the 401(k) Plan within 7 - 10 days after starting your job.

To encourage you to save for retirement, Caterpillar will automatically enroll you in the 401(k) Plan within 30 days of your start date.

They will deduct 6% of your base pay and 6% of your incentive compensation pretax. Your assets will be put in the Target Retirement Fund that corresponds to your 65th birthday. Furthermore, automatic 1% annual increases will occur until the individual reaches a 15% contribution level.

Note:

If you want to make a different election or opt out of these automatic elections, contact the Caterpillar Benefits Center.

Vesting

As a participant, you will be vested in the corporate match after three years of employment.

Next Step:

- Watch for your Participant Distribution Notice and Special Tax Notice Regarding Plan Payments. These notices will help explain your options and what the federal tax implications may be for your vested account balance.

- ' What has Worked in Investing ' & ' 8 Tenets when picking a Mutual Fund '.

- To learn about your distribution options, call The Retirement Group at (800)-900-5867. Click our e-book for more information on ' Rollover Strategies for 401(k)s '. Use the Online Beneficiary Designation to make updates to your beneficiary designations, if needed.

Note : If you voluntarily terminate your employment from Caterpillar, you may not be eligible to receive the annual contribution.

401(k) Plan Highlights

The figure below provides a concise summary of the Caterpillar 401(k) Plan. Please refer to the Summary Plan Description for more details.

Company Benefits Annual Enrollment

Annual enrollment for your Caterpillar benefits usually occurs each fall.

Before it begins, you will be mailed enrollment materials and an upfront confirmation statement reflecting your benefit coverage to the address on file. You’ll find enrollment instructions and information about your benefit options from Caterpillar and contribution amounts. You will have the option to keep the benefit coverage shown on your upfront confirmation statement or select benefit options offered by Caterpillar that better support your needs. You may be able to choose to enroll in eBenefits and receive this information via email instead.

Next Steps:

- Watch for your annual enrollment information in the September/November time frame.

- Review your benefits information and utilize the tools and resources available on Caterpillar's Benefits Center website.

- Enroll in eBenefits.

Things to keep in mind :

- 47% of Americans cite healthcare as their greatest economic concern.

- Medical bills are the No. 1 cause of bankruptcy in the United States.

- For older Americans, healthcare costs represent the second-largest expense, behind housing.

Short-Term & Long-Term Disability

Short-Term: Depending on your plan, you may have access to short-term disability (STD) benefits through Caterpillar.

Long-Term: Your plan's long-term disability (LTD) benefits are designed to provide you with income if you are absent from Caterpillar for six consecutive months or longer due to an eligible illness or injury.

What Happens If Your Employment with Caterpillar Ends

Your life insurance coverage and any optional coverage you purchase for your spouse/domestic partner and/or children ends on the date your employment with Caterpillar ends, unless your employment ends due to disability. If you die within 31 days of your termination date from Caterpillar, benefits are paid to your beneficiary for your basic life insurance, as well as any additional life insurance coverage you elected.

Note:

- You may have the option to convert your life insurance to an individual policy or elect portability on any optional coverage.

- If you stop paying supplementary contributions, your coverage will end.

- If you are at least 65 and you pay for supplemental life insurance, you should receive information in the mail from the insurance company that explains your options.

- Make sure to update your beneficiaries. See Caterpillar's SPD for more details.

Beneficiary Designations

As part of your Caterpillar retirement planning and estate planning, it’s important to name someone to receive the proceeds of your benefit programs in the event of your death. That’s how Caterpillar will know whom to send your final compensation and benefits. This can include life insurance payouts and any pension or savings balances you may have.

Next Step:

- When you retire from Caterpillar, make sure that you update your beneficiaries. Caterpillar should have an Online Beneficiary Designation form for life events such as death, marriage, divorce, child birth, adoptions, etc.

If you are unsure about Caterpillar's benefits, schedule a call to speak with one of our retirement-focused advisors

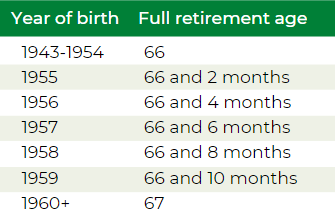

For many retirees, understanding and claiming Social Security can be difficult but identifying optimal ways to claim Social Security is essential to your retirement income planning. Social Security benefits are not designed to be the sole source of your retirement income, but a part of your overall withdrawal strategy.

Knowing the foundation of Social Security, and using this knowledge to your advantage, can help you claim your maximum benefit.

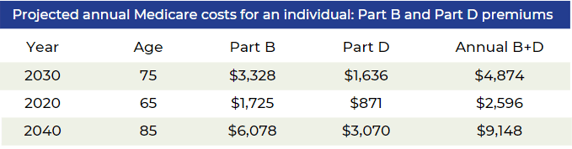

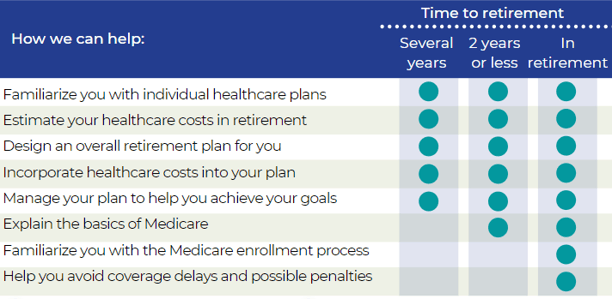

It’s your responsibility to enroll in Medicare parts A and B when you first become eligible — and you must stay enrolled to have coverage for Medicare-eligible expenses. This applies to your Medicare eligible dependents as well.

You should know how your retiree medical plan choices or Medicare eligibility impacts your plan options. Before you retire from Caterpillar, contact the U.S. Social Security Administration directly at 800-772-1213, call your local Social Security Office or visit ssa.gov .

They can help determine your eligibility, get you and/or your eligible dependents enrolled in Medicare or provide you with other government program information. For more in-depth information on Social Security, please call us.

Check the status of your Social Security benefits before you retire from Caterpillar. Contact the U.S. Social Security Administration, your local Social Security office, or visit ssa.gov.

Are you eligible for Medicare or will be soon?

If you or your dependents are eligible after you leave your telecom industry company, Medicare generally becomes the primary coverage for you or any of your dependents as soon as they are eligible for Medicare. This will affect Caterpillar-provided medical benefits.

You and your Medicare-eligible dependents must enroll in Medicare Parts A and B when you first become eligible. Medical and MH/SA benefits payable under the Caterpillar-sponsored plan will be reduced by the amounts Medicare Parts A and B would have paid whether you actually enroll in them or not.

For details on coordination of benefits, refer to Caterpillar's summary plan description.

If you or your eligible dependent don’t enroll in Medicare Parts A and B, your provider can bill you for the amounts that are not paid by Medicare or your Caterpillar-specific medical plan … making your out-of-pocket expenses significantly higher.

According to the Employee Benefit Research Institute (EBRI), Medicare will only cover about 60% of an individual’s medical expenses. This means a 65-year-old couple, with average prescription-drug expenses for their age, will need $259,000 in savings to have a 90% chance of covering their healthcare expenses. A single male will need $124,000 and a single female, thanks to her longer life expectancy, will need $140,000.

Check Caterpillar's plan summary to see if you’re eligible to enroll in Medicare Parts A and B.

If you become Medicare-eligible for reasons other than age, you must contact Caterpillar’s benefit center about your status.

The ideas of happily ever after and until death do us part won’t happen for 28% of couples over the age of 53. Most couples saved together for decades, assuming they would retire together. After a divorce, they face the expenses of a pre-or post-retirement life, but with half their savings.

If you’re divorced or in the process of divorcing, your former spouse(s) may have an interest in a portion of your retirement benefits from Caterpillar. Before you can start your pension — and for each former spouse who may have an interest — you’ll need to provide Caterpillar with the following documentation:

- A copy of the court-filed Judgment of Dissolution or Judgment of Divorce along with any Marital Settlement Agreement (MSA)

- A copy of the court-filed Qualified Domestic Relations Order (QDRO)

Provide Caterpillar with any requested documentation to avoid having your pension benefit delayed or suspended. To find out more information on strategies if divorce is affecting your Caterpillar retirement benefits, please give us a call.

You’ll need to submit this documentation to Caterpillar’s online pension center regardless of how old the divorce or how short the marriage. *Source: The Retirement Group, “Retirement Plans - Benefits and Savings,” U.S. Department of Labor, 2019; “Generating Income That Will Last Throughout Retirement,” Fidelity, 2019

You were married for at least 10 years prior to the divorce.

You are currently unmarried.

Your ex-spouse is entitled to Social Security benefits.

Your own Social Security benefit amount is less than your spousal benefit amount, which is equal to one-half of what your ex’s full benefit amount would be if claimed at Full Retirement Age (FRA).

Unlike with a married couple, your ex-spouse doesn’t have to have filed for Social Security

before you can apply for your divorced spouse’s benefit.

Divorce doesn’t disqualify you from survivor benefits. You can claim a divorced spouse’s survivor benefit if the following are true:

- Your ex-spouse is deceased.

- You are at least 60 years of age.

- You were married for at least 10 years prior to the divorce.

- You are single (or you remarried after age 60).

In the process of divorcing?

If your divorce isn’t final before your retirement date from Caterpillar, you’re still considered married. You have two options:

- Retire from Caterpillar before your divorce is final and elect a joint pension of at least 50% with your spouse — or get your spouse’s signed, notarized consent to a different election or lump sum.

- Delay your retirement from Caterpillar until after your divorce is final and you can provide the required divorce documentation.*

Source: The Retirement Group, “Retirement Plans - Benefits and Savings,” U.S. Department of Labor, 2019; “Generating Income That Will Last Throughout Retirement,” Fidelity, 2019

In the unfortunate event that you aren’t able to collect your benefits from Caterpillar, your survivor will be responsible for taking action.

While you may be ready for some rest and relaxation, without the stress and schedule of your full-time career with Caterpillar, it may make sense to you financially, and emotionally, to continue to work.

Financial benefits of working

Make up for decreased value of savings or investments. Low interest rates make it great for lump sums but harder for generating portfolio income. Some people continue to work to make up for poor performance of their savings and investments.

Maybe you took an offer from Caterpillar and left earlier than you wanted with less retirement savings than you needed. Instead of drawing down savings, you may decide to work a little longer to pay for extras you’ve always denied yourself in the past.

Meet financial requirements of day-to-day living. Expenses can increase during your retirement from Caterpillar and working can be a logical and effective solution. You might choose to continue working in order to keep your insurance or other benefits — many employers offer free to low cost health insurance for part-time workers.

Emotional benefits of working

You might find yourself with very tempting job opportunities at a time when you thought you’d be withdrawing from the workforce.

Staying active and involved. Retaining employment after Caterpillar, even if it’s just part-time, can be a great way to use the skills you’ve worked so hard to build over the years and keep up with friends and colleagues.

Enjoying yourself at work. Just because the government has set a retirement age with its Social Security program doesn’t mean you have to schedule your own life that way. Many people genuinely enjoy their employment and continue working because their jobs enrich their lives.

Caterpillar employees interested in planning their retirement may be interested in live webinars hosted by experienced financial advisors. Click here to register for our upcoming webinars for Caterpillar employees.

By: Nicole Webb

- “National Compensation Survey: Employee Benefits in the United States, March 2019,' Bureau of Labor Statistics, U.S. Department of Labor.

- “Generating Income That Will Last throughout Retirement.” Fidelity, 22 Jan. 2019, www.fidelity.com/viewpoints/retirement/income-that-can-last-lifetime .

- “Retirement Plans-Benefits & Savings.” U.S. Department of Labor, 2019, www.dol.gov/general/topic/retirement .

- AT&T Summary Plan Description, 2019

- Chevron Summary Plan Description, 2019

- Shell Summary Plan Description, 2019

- ExxonMobil Summary Plan Description, 2019

- https://seekingalpha.com/article/4268237-order-withdrawals-retirement-assets

- https://www.aon.com/empowerresults/ensuring-retirees-get-health-care-need/

- 8 Tenets when picking a Mutual Fund e-book

- Determining Cash Flow Need in Retirement e-book

- Early Retirement Offers e-book

- Lump Sum vs. Annuity e-book

- Social Security e-book

Rising Interest Rates e-book

https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2022

https://news.yahoo.com/taxes-2022-important-changes-to-know-164333287.html

https://www.nerdwallet.com/article/taxes/federal-income-tax-brackets

https://www.the-sun.com/money/4490094/key-tax-changes-for-2022/

https://www.bankrate.com/taxes/child-tax-credit-2022-what-to-know/

How does the transition from the Solar Plan to the Caterpillar Inc. Retirement Income Plan impact current or former employees of Caterpillar Inc. in terms of retirement benefits and service credits? Considering both plans' differences, what aspects should employees of Caterpillar Inc. understand to ensure they are maximizing their retirement benefits under this merged structure?

Transition from Solar Plan to Caterpillar Inc. Retirement Income Plan: The transition from the Solar Plan to the Caterpillar Inc. Retirement Income Plan maintained the benefits of those previously covered under the Solar Plan without impact. Both plans allowed the continuation of prior service credits and the incorporation of benefits payable under previous retirement plans. For current or former employees, understanding the nuances of how prior service credits and benefits are integrated can maximize their retirement benefits under the merged structure.

What specific criteria must Caterpillar Inc. employees meet to qualify for early retirement and what implications does this have on their pension benefits? For employees planning early retirement, what calculations or benefit reductions should they be prepared for according to Caterpillar Inc.’s policies?

Criteria for Early Retirement at Caterpillar Inc.: Employees wishing to take early retirement must meet specific age and service requirements detailed in the plan documents. For early retirement, benefits calculations and potential reductions are significant. Employees need to prepare for possible reductions in their pension benefits depending on their age and years of credited service at retirement.

In the context of the Pension Equity Plan (PEP) and the Traditional Pension Plan, how do the benefit calculations differ for employees at Caterpillar Inc., particularly for those who switched from the Traditional Plan to the PEP? What considerations should current Caterpillar Inc. employees take into account when evaluating which plan may offer them more secure benefits?

Differences Between PEP and Traditional Pension Plan: The benefit calculations for the Pension Equity Plan (PEP) and the Traditional Pension Plan differ significantly. PEP calculates a lump sum based on salary and years of service, while the Traditional Plan calculates benefits based on final earnings or credited service formulas. Employees need to consider which plan offers more secure benefits based on their individual career trajectory and earnings history.

What steps must Caterpillar Inc. employees take to ensure that their Credited Service is accurately calculated and maintained throughout their employment, especially in light of the company's policies regarding breaks in service? How might phases of employment, such as parental leave or temporary positions, affect this calculation?

Credited Service Calculation and Maintenance: To ensure accurate credited service calculation, employees must maintain thorough records and communicate any changes in employment status, such as breaks in service or changes in personal information, to the plan administrator. Understanding the rules for service credits during different phases of employment, such as parental leave or temporary positions, is crucial.

How can employees at Caterpillar Inc. file a claim for benefits under the retirement plans, and what are the essential details they need to provide to ensure their claims are processed smoothly? If they encounter issues or denials, what recourse do they have within the Caterpillar Inc. system to appeal these decisions?

Filing a Claim for Benefits: Employees should provide detailed and accurate information when filing a claim for benefits under the retirement plans. If issues or denials occur, they have the right to appeal these decisions. Familiarity with the claims procedure and required documentation can streamline this process.

For employees approaching retirement, what resources are available through Caterpillar Inc. to help them navigate the complexities of their retirement benefits? What steps should an employee take if they wish to understand their benefits better or need assistance with retirement planning?

Resources for Navigating Retirement Benefits: Caterpillar Inc. offers resources to assist employees in navigating the complexities of their retirement benefits. Employees approaching retirement should utilize these resources and may need to engage with the company's human resources or benefits departments for personalized assistance.

What are the implications of the changes to the cash-out limit for de minimis benefits at Caterpillar Inc., which will take effect after December 31, 2023? How does this change affect employees who may have a vested interest in understanding their financial benefit options upon termination or retirement?

Implications of Cash-Out Limit Changes: The increase in the cash-out limit for de minimis benefits affects how small vested benefits are processed upon termination or retirement. Employees with small benefit amounts should understand how these changes may impact their options and tax implications.

How does Caterpillar Inc. ensure that its pension benefits are protected from creditors, and what specific provisions exist to safeguard these benefits? Moreover, how do legal instruments like Qualified Domestic Relations Orders (QDROs) interact with Caterpillar Inc.'s benefits system for employees undergoing divorce?

Protection of Pension Benefits from Creditors: Caterpillar Inc.'s retirement plans are designed with protections to safeguard benefits from creditors, including adherence to Qualified Domestic Relations Orders (QDROs) during instances like divorce. Employees should understand how these legal instruments can affect their retirement savings.

In what ways does the Caterpillar Inc. Retirement Income Plan provide coverage for disability retirement, and how is this benefit calculated for employees? What factors influence eligibility and how do employees initiate claims if they find themselves in need of these benefits?

Disability Retirement Coverage: The plan provides specific provisions for disability retirement, including how benefits are calculated and eligibility criteria. Employees should be aware of how disability affects their benefits and the process for initiating claims if needed.

How can Caterpillar Inc. employees contact the company to learn more about their retirement benefits, and what information should they have ready when making inquiries? Additionally, what specific departments at Caterpillar Inc. should employees reach out to for the most efficient assistance regarding their retirement plan questions?

Contacting the Company for Retirement Benefit Information: Employees can contact the Caterpillar Benefits Center for inquiries about their retirement benefits. Knowing the specific departments to contact for efficient assistance is crucial for addressing concerns and making informed decisions about retirement planning.

/General/General%2011.png?width=1280&height=853&name=General%2011.png)

-2.png?width=300&height=200&name=office-builing-main-lobby%20(52)-2.png)

.webp?width=300&height=200&name=office-builing-main-lobby%20(27).webp)

-2.png)

.webp)