With 2021 wrapped up and going into the new year, the IRS just released Revenue Procedure 2021-45 and Notice 2021-61 which detail the tax changes and cost of living adjustments for 2022. The main points of this new release that will most likely affect HP employees would be:

- This year, the tax filing deadline is on April 18, instead of the typical April 15.

- The standard deduction for married couples filing jointly for tax year 2022 rises to $25,900 up $800 from the prior year.

- For single taxpayers and married individuals filing separately, the standard deduction rises to $12,950 for 2022, up $400, and for heads of households, the standard deduction will be $19,400 for tax year 2022, up $600.

Also, the personal exemption for tax year 2022 remains at 0, as it was for 2021. This elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act.

If you experienced a job change, retirement or lapse in employment from HP, the “lookback” rule may be an important option to consider when filing taxes this year. You’ll also have the option to use your 2019 earned income for your 2021 return thanks to changes from the American Rescue Plan Act. This rule is mainly used for calculation of the Earned Income Tax Credit and the Child Tax Credit.

Remote workers employed by HP might face double taxation on state taxes. Due to the pandemic, many employees moved back home which could have been outside of the state where they were employed. Last year, some states had temporary relief provisions to avoid double taxation of income, but many of those provisions have expired. There are only six states that currently have a ‘special convenience of employer’ rule: Connecticut, Delaware, Nebraska, New Jersey, New York, and Pennsylvania. If you work remotely for HP, and if you don't currently reside in those states, consult with your tax advisor if there are other ways to mitigate the double taxation.

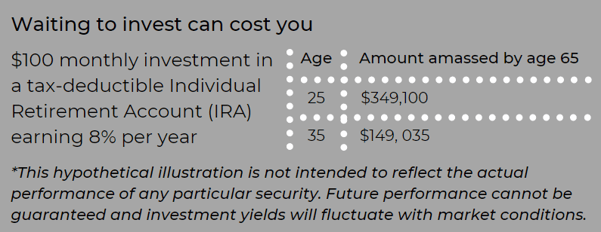

Retirement account contributions: Contributing to your HP 401k plan can cut your tax bill significantly, and the amount you can save has increased for 2022. In 2022, the IRS has raised the contribution limit for a 401k to $20,500 - up by $1,000. Meanwhile, HP workers who are older than 50 years old are eligible for an extra catch-up contribution of $6,500.

There are important changes for the Earned Income Tax Credit (EITC) that you, as a taxpayer employed by HP, should know:

- The income threshold has been increased for single filers with no children; the American Rescue Plan Act temporarily boosted it from $543 to $1,502 in 2021; this expansion has not been carried over to the 2022 tax year.

- Married taxpayers filing separately can qualify: You can claim the EITC as a married filing separately if you meet other qualifications. This wasn't available in previous years.

Increased deduction for cash charitable contributions: In years past, the threshold was $300 for both single and joint filers, but in 2022 that changed to $300 for single filers and up to $600 for joint filers.

Child Tax Credit changes:

- A $2,000 credit per dependent under age seventeen..

- Income thresholds of $400,000 for married couples and $200,000 for all other filers (single taxpayers and heads of households).

- A 70 percent, partial refundability affecting individuals whose tax bill falls below the credit amount.

2022 Tax Brackets

-png.png?width=575&name=image%20(18)-png.png)

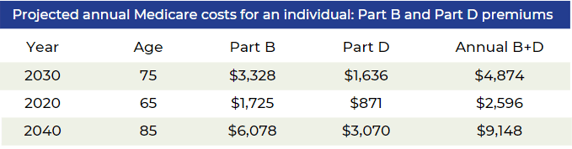

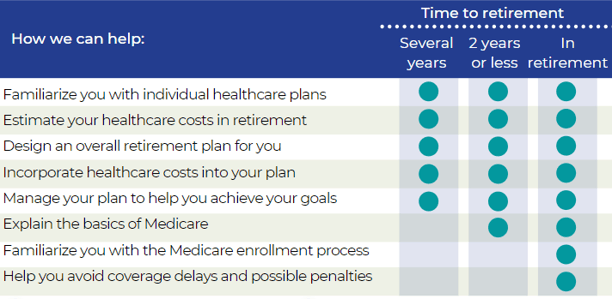

Inflation reduces purchasing power over time as the same basket of goods will cost more as prices rise. In order to maintain the same standard of living throughout your retirement after leaving HP, you will have to factor rising costs into your plan. While the Federal reserve strives to achieve 2% inflation rate each year, in 2021 that rate shot up to 7% a drastic increase from 2020’s 1.4%. While prices as a whole have risen dramatically, there are specific areas to pay attention to if you are nearing or in retirement from HP, like healthcare. Many HP corporate retirees depend on Medicare as their main health care provider and in 2022 that healthcare out-of-pocket premium is set to increase by 14.5%. In addition to Medicare increases, the cost of over-the-counter medications is also projected to increase by at least 10%. The Employee Benefit Research Institute (ERBI) found in their 2022 report that couples with average drug expenses would need $296,000 in savings just to cover those expenses in retirement. It is crucial to take all of these factors into consideration when constructing your holistic plan for retirement from HP.

*Source: IRS.gov, Yahoo, Bankrate

Featured Video

Articles you may find interesting:

- Corporate Employees: 8 Factors When Choosing a Mutual Fund

- Use of Escrow Accounts: Divorce

- Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

- Stages of Retirement for Corporate Employees

- 7 Things to Consider Before Leaving Your Company

- How Are Workers Impacted by Inflation & Rising Interest Rates?

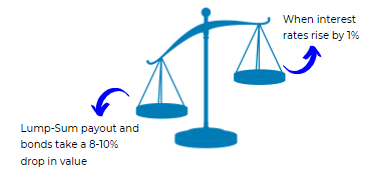

- Lump-Sum vs Annuity and Rising Interest Rates

- Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

- Corporate Employees: Do NOT Believe These 6 Retirement Myths!

- 401K, Social Security, Pension – How to Maximize Your Options

- Have You Looked at Your 401(k) Plan Recently?

- 11 Questions You Should Ask Yourself When Planning for Retirement

- Worst Month of Layoffs In Over a Year!

- Corporate Employees: 8 Factors When Choosing a Mutual Fund

- Use of Escrow Accounts: Divorce

- Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

- Stages of Retirement for Corporate Employees

- 7 Things to Consider Before Leaving Your Company

- How Are Workers Impacted by Inflation & Rising Interest Rates?

- Lump-Sum vs Annuity and Rising Interest Rates

- Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

- Corporate Employees: Do NOT Believe These 6 Retirement Myths!

- 401K, Social Security, Pension – How to Maximize Your Options

- Have You Looked at Your 401(k) Plan Recently?

- 11 Questions You Should Ask Yourself When Planning for Retirement

- Worst Month of Layoffs In Over a Year!

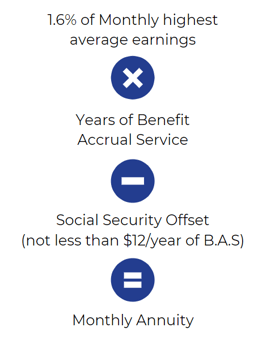

Highest Average Earnings is the monthly average of your regular earnings for the 36 consecutive months in which they’re the highest.

In most cases, this will be the sum of your last 36 months divided by 36.

The applicable interest rate is a separate average of each of the three segment rates for the fifth, fourth and third months preceding your annuity start date. The three segment rates are calculated by the IRS according to regulations that are also part of the Pension Protection Act of 2006 and reflect the yields of short-, mid-, and long-term corporate bonds. (Note: Chevron also has Legacy Unocal and Legacy Texaco Retirement Plans)

Different Plans

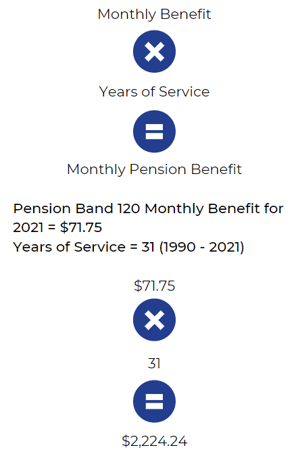

Similar to Chevron, AT&T has many different plans available. With AT&T, they have different pension plan formulas for management & non-management. Lets look at a sample non-management plan.

AT&T non-management employees have their own Craft/non-management pension plan. Let's take a look at a pension example for a gentleman by the name of Joe Smith who is hourly and using the Craft/non-management pension plan.

In 1990, Joe is hired by AT&T and participates in the Craft Pension Plan:

Craft Pension Plan

-

Craft has a defined benefit plan that uses pension bands.

-

A pension band determines your benefits based on your job title/grade level/occupation.

- Joe will receive a monthly dollar amount into his account for each year of service.

-

Joe's benefit (pension band may change yearly).

-

A pension band determines your benefits based on your job title/grade level/occupation.

Rising Interest Rates e-book

https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2022

https://news.yahoo.com/taxes-2022-important-changes-to-know-164333287.html

https://www.nerdwallet.com/article/taxes/federal-income-tax-brackets

https://www.the-sun.com/money/4490094/key-tax-changes-for-2022/

https://www.bankrate.com/taxes/child-tax-credit-2022-what-to-know/

How does HP Inc. ensure that the pension plan benefits will remain stable and secure for employees in the future, and what measures are being implemented to mitigate financial volatility associated with these benefits? Employees of HP Inc. should be particularly aware of how the transition of their pension payments to Prudential will affect their financial security and what protections are in place to ensure that these payments are maintained without disruption.

HP Inc. ensures pension plan benefits remain stable and secure by transferring the payment obligations to Prudential, a highly-rated insurance company selected through a careful review by an Independent Fiduciary. This move is aimed at reducing financial volatility associated with HP's pension obligations while maintaining the same benefit amount for retirees. Prudential's established financial stability provides additional security to employees(HP Inc_November 1 2021_…).

What specific details can HP Inc. employees expect to learn in the Welcome Kit from Prudential, and how will these details help them understand their new payment system? HP Inc. pension participants will need to familiarize themselves with the information outlined in the Welcome Kit to make informed decisions regarding their pension benefits going forward.

The Welcome Kit from Prudential will provide HP Inc. employees with instructions to set up an online account, along with details on managing payments, tax withholdings, and other resources. This information will allow employees to familiarize themselves with Prudential’s system and ensure a seamless transition without disruptions(HP Inc_November 1 2021_…).

In what ways does the selection process for Prudential as the insurance provider reflect the commitment of HP Inc. to the well-being of its employees? Understanding the rationale behind this decision will give HP Inc. employees insights into the fiduciary responsibilities and governance processes that protect their retirement benefits.

The selection of Prudential reflects HP Inc.'s commitment to employee well-being, as it involved the Independent Fiduciary conducting an extensive review of insurance providers. Prudential was chosen based on its financial strength and ability to manage pension payments securely, showing HP's focus on protecting retirement benefits(HP Inc_November 1 2021_…).

How will the annuity payments from Prudential differ from the previous pension payments in terms of tax implications and reporting for HP Inc. employees? It is crucial for employees of HP Inc. to comprehend the tax treatment of their new annuity payments to avoid any potential pitfalls in their personal financial planning.

The annuity payments from Prudential will be taxed similarly to the previous pension payments, though employees will receive two separate 1099-R forms for 2021 (one from Fidelity and one from Prudential). For future years, only a single form will be issued. This ensures employees are aware of how to manage tax reporting(HP Inc_November 1 2021_…).

What resources are available to HP Inc. employees seeking assistance regarding their pension benefits, and how can they effectively utilize these resources to address their concerns? Knowing how to access support and guidance will empower HP Inc. employees to manage their retirement benefits proactively.

HP Inc. employees seeking assistance can access live customer support through Fidelity or contact Prudential directly after the transition. Additionally, the Welcome Kit will include important contact information for managing their benefits, making it easy for employees to address concerns(HP Inc_November 1 2021_…).

How can HP Inc. employees verify the financial health and stability of Prudential, and why is this factor important in the context of their pension benefits? Employees must ask how Prudential's financial standing influences their view of long-term pension security and what metrics or ratings they should consider.

HP Inc. employees can verify Prudential’s financial health by reviewing Prudential's annual financial reports, which are publicly available. Prudential’s strong financial ratings were a key factor in its selection, assuring employees of long-term pension security(HP Inc_November 1 2021_…).

What steps should HP Inc. employees take to update their personal information, such as banking details and tax withholding preferences, following the transition to Prudential? Understanding these processes will ensure a smooth continuation of benefits for HP Inc. employees as they adapt to the new system.

Employees do not need to re-submit their personal information to Prudential, as HP will securely transfer all necessary data, including banking and tax withholding preferences. This ensures the continuation of pension payments without the need for employee intervention(HP Inc_November 1 2021_…).

How does HP Inc. plan to address potential changes in the financial landscape that may affect pension benefits, and what role does the insurance contract with Prudential play in this context? HP Inc. employees should be informed about the company's strategic outlook and how it aims to safeguard pension assets against economic uncertainties.

HP Inc. plans to address potential financial changes through its contract with Prudential, which guarantees pension payments will remain the same. Prudential manages these risks as part of its core business, providing added security against economic volatility(HP Inc_November 1 2021_…).

In what circumstances might HP Inc. employees see changes in their net pension payments following the transition to Prudential, despite assurances that payment amounts will remain unchanged? This understanding will help employees manage their expectations regarding future payments and any adjustments they may need to make.

Employees might see changes in their net pension payments due to tax adjustments or changes in withholding instructions, but the gross payment amount will remain unchanged. Any garnishments or other deductions will continue as before, ensuring consistency in payment structure(HP Inc_November 1 2021_…).

How can HP Inc. employees contact the company directly to learn more about the pension transition process, and what channels are available for them to have their questions addressed? Clear communication lines are essential for HP Inc. employees to ensure they receive timely and relevant information regarding their pension situations.

HP Inc. employees can contact the company through the Fidelity support line or directly through Prudential for any questions about the pension transition. The Welcome Kit and other resources will provide contact details, ensuring employees have access to timely support(HP Inc_November 1 2021_…).

/General/General%2010.png?width=1280&height=853&name=General%2010.png)

-2.png?width=300&height=200&name=office-builing-main-lobby%20(52)-2.png)

.webp?width=300&height=200&name=office-builing-main-lobby%20(27).webp)

-2.png)

.webp)