In our exhaustive retirement guide for Merck employees, we address a variety of factors that you may consider when determining the appropriate time to retire from Merck. Interest rates, inflation, the new 2024 tax rates, healthcare and benefit changes, and other factors are among them. Please be advised that we are not affiliated with Merck. For additional information, we suggest that you contact your corporate benefits department.

Individuals must be aware of any new changes made by the IRS. The following elements will have a significant impact on employees.

-

The standard deduction in 2024 will rise to $14,600 for single filers and married couples filing separately, $29,200 for joint filers, and $21,900 for heads of households.

-

Taxpayers over the age of 65 and blind can increase their standard deduction by $1,550. If you are not married or do not have a surviving spouse, the payment increases to $1,950.

As a taxpayer employed by a corporation, you should be aware of the following changes to the Earned Income Tax Credit (EITC):

-

The maximum Earned Income Tax Credit amount for tax year 2024 is $7,830 for qualifying taxpayers with three or more qualifying children, up from $7,430 in tax year 2023.

-

Married taxpayers filing separately can qualify. If you meet additional requirements, you can claim the EITC as a married individual filing separately. This wasn't available in previous years.

The Child Tax Credit changes:

-

The maximum tax credit per qualifying kid is $2,000 for children aged five and younger, and $3,000 for children aged six to seventeen. You also cannot obtain a portion of the credit in advance, as was the case in 2023.

-

As a parent or guardian, you are eligible for the Child Tax Credit if your adjusted gross income is less than $200,000 when filing alone or less than $400,000 if filing jointly with your spouse.

-

Individuals whose tax bill is less than the credit amount are eligible for a partial refund of 70%.

2024 Tax Bracket

It is critical to examine all of these issues when developing a comprehensive retirement plan from your employer.

*Source: IRS.gov, Yahoo, Bankrate

Other Merck News & Recent Layoff Announcements

Operational Changes: Merck is restructuring its business to concentrate more on its core pharmaceuticals and vaccines segments, resulting in layoffs that will effect approximately 1,800 employees (Source: Bloomberg). Strategic Objectives: The organization intends to increase its investment in research and development and optimize its operational efficacy. Merck's financial performance was bolstered by a 10% increase in net sales for Q3 2023, which was primarily due to the robust demand for its COVID-19 treatments and vaccines (Source: Merck).

Blogs You May Enjoy:

Featured Video

Articles you may find interesting:

- Corporate Employees: 8 Factors When Choosing a Mutual Fund

- Use of Escrow Accounts: Divorce

- Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

- Stages of Retirement for Corporate Employees

- 7 Things to Consider Before Leaving Your Company

- How Are Workers Impacted by Inflation & Rising Interest Rates?

- Lump-Sum vs Annuity and Rising Interest Rates

- Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

- Corporate Employees: Do NOT Believe These 6 Retirement Myths!

- 401K, Social Security, Pension – How to Maximize Your Options

- Have You Looked at Your 401(k) Plan Recently?

- 11 Questions You Should Ask Yourself When Planning for Retirement

- Worst Month of Layoffs In Over a Year!

- Corporate Employees: 8 Factors When Choosing a Mutual Fund

- Use of Escrow Accounts: Divorce

- Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

- Stages of Retirement for Corporate Employees

- 7 Things to Consider Before Leaving Your Company

- How Are Workers Impacted by Inflation & Rising Interest Rates?

- Lump-Sum vs Annuity and Rising Interest Rates

- Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

- Corporate Employees: Do NOT Believe These 6 Retirement Myths!

- 401K, Social Security, Pension – How to Maximize Your Options

- Have You Looked at Your 401(k) Plan Recently?

- 11 Questions You Should Ask Yourself When Planning for Retirement

- Worst Month of Layoffs In Over a Year!

Retirement planning is a verb that requires persistent action regardless of age, whether you're 20 or 60.

The truth is that most Americans have no idea how much to save or how much income they will require.

Regardless of where you are in the planning process or your present age, we hope this guide gives you a clear overview of the steps to take and resources to help you streamline your transition from your workplace to retirement and get the most out of your benefits.

You understand the importance of saving and investing, especially since time is on your side the sooner you start, but you lack the time and experience to determine whether you are creating retirement funds that will persist when you leave your employer.

'A separate study by Russell Investments, a large money management firm, came to a similar conclusion . Russell estimates a good financial advisor can increase investor returns by 3.75 percent.'

Source: Is it Worth the Money to Hire a Financial Advisor?, the balance, 2021

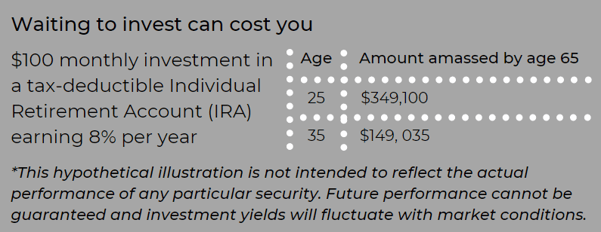

Starting to save as early as possible is important. With time on your side, compounding can have a tremendous impact on your future savings. Once you've started, it's critical to keep increasing and maximizing your 401(k) contributions.

When you invest in your company's retirement plan, you can potentially increase your wealth by 79% at age 65 over the course of 20 years.

*Source: Bridging the Gap Between 401(k) Sponsors and Participants, T.Rowe Price, 2020

One of the most common planning dilemmas is deciding whether to save for retirement or college. Most financial advisors will advise you that retirement from your employer should be your main priority because your child can usually receive financial assistance, however you will be on your own to fund your retirement.

We always base our retirement investment recommendations on your specific financial circumstances and aspirations. Consider investing at least 10% of your earnings for retirement in your 30s and 40s.

As you enter your 50s and 60s, you should be at the pinnacle of your earning potential, with some of your major expenses, such as a mortgage or childrearing, behind you or soon to be behind you. This is an excellent moment to think about whether you can increase your retirement savings goal to 20% or more of your income. For many people, this could be their only chance to save money.

Workers over the age of 50 can invest up to $23,000 in their retirement plan/401(k) in 2024, and after this limit is reached, they can contribute an additional $7,500 in catch-up contributions for a total yearly contribution of $30,500. Annually, these restrictions are increased to reflect inflation.

Why are 401(k)s and matching contributions so popular?

These retirement savings vehicles offer three primary advantages:

-

Compound growth prospects (as shown above).

-

Opportunities to save on taxes

-

Contributions that match

Unfortunately, many consumers do not take advantage of their company's matching contributions because they do not contribute enough to obtain the full match.

According to Bank of America's "2022 Financial Life Benefit Impact Report," despite 58% of eligible employees enrolling in a 401(k) plan, 61% contributed less than $5,000 this year.

The study also discovered that fewer than one in every ten members' contributions exceeded the IRS Section 402(g) optional deferral limit, which is $23,000 in 2024.

A 2020 Financial Engines study titled "Missing Out: How Much Employer 401(k) Matching Contributions Do Employees Leave on the Table?" discovered that individuals who do not maximize their business match typically leave $1,336 of extra retirement money on the table each year.

For example, if your business matches up to 3% of your plan contributions and you only contribute 2% of your salary, you will not receive the entire company match. By just increasing your contribution by 1%, your firm now matches the entire 3% of your donations, for a total combined contribution of 6%. This ensures that you do not leave money on the table.

Whether you're switching jobs or retiring, deciding what to do with your hard-earned retirement assets can be tricky. A company-sponsored plan, such as a pension or 401(k), may account for the majority of your retirement assets, but do you really understand how it works?

There appear to be an infinite number of restrictions that differ from one retirement plan to the next, including early withdrawal offers, interest rate affects, age penalties, and intricate tax consequences.

A effective retirement plan spending strategy revolves around increasing your investment balance and lowering your taxes. At The Retirement Group, we can help you understand how your company's 401(k) fits into your overall financial picture, as well as how to maximize its benefits.

'Getting help and leveraging the financial planning tools and resources your company

makes available can help you understand whether you are on track, or need to

make adjustments to meet your long-term retirement goals...'

Source: Schwab 401(k) Survey Finds Savings Goals and Stress Levels on the Rise

Income in Retirement

Merck offers significant benefits to help you prepare for a healthy and financially secure retirement.

The Pension Plan is a defined benefit pension plan with payouts calculated using a cash balance method. Your pension is calculated as an account-based benefit, which rises with:

-

Annual company-provided pay credits based on the sum of your age and your cash balance service as of December 31 (see table at right);

-

Annual interest credits equal to the annual percentage change in the Consumer Price Index-Urban (CPI) plus 3% (minimum 3.3%).

Pay credits and interest credits will be added to your pension account on December 31 of each year.

Cash Balance Formula

When your benefit is paid, you can choose whether to receive it as a lump sum or as an annuity. In general, you have the option of receiving your pension benefit at any time after leaving your employment.1

After three years of work, you are fully vested in your pension benefits.

Lump Sum vs. Annuity

Retirees who are qualified for a pension are frequently given the option of receiving their pension payments throughout life or receiving a lump-sum payment all at once. The lump amount represents the equivalent present value of the monthly pension income stream, with the intention of taking the money (rolling it over to an IRA), investing it, and generating your own cash flow through methodical withdrawals throughout your retirement years.

The monthly pension has the advantage of being guaranteed to continue indefinitely. Thus, whether you live for ten, twenty, thirty, or more years after retiring from your firm, you are not at risk of outliving your monthly pension.

The main disadvantage of the monthly pension is the early and untimely death of the retiree and joint annuitant. This frequently results in a reduced payout or the pension being terminated entirely upon death. The other disadvantage is that, unlike Social Security, employer pensions seldom include a COLA (Cost of Living Allowance). As a result, if the dollar value of the monthly pension remains constant throughout retirement, it will lose purchasing power as inflation increases.

In contrast, choosing the lump-sum option allows you to invest, earn higher growth, and perhaps produce even more retirement income flow. Furthermore, if something happens to you, any unused account balance will be available to your surviving spouse or heirs. However, if you fail to invest the funds for sufficient development, the money may run out entirely, and you may regret not taking advantage of the pension's "income for life" guarantee.

Finally, the "risk" assessment that should be performed to determine whether or not you should choose the lump sum or the guaranteed lifetime income that your employer pension provides is determined by the type of return required to match the annuity payments. After all, if a 1% to 2% return on the lump-sum is all that is required to generate the same monthly pension cash flow stream, the risk of outliving the lump-sum is reduced. However, if the pension payments can only be replaced with a higher and more risky rate of return, there is a bigger danger that those gains will not materialize and you would run out of funds.

Interest Rates and Life Expectancy

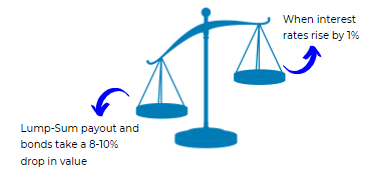

Current interest rates, as well as your life expectancy after retirement, have a substantial impact on lump sum payouts under defined benefit pension plans.

Rising interest rates are inversely related to pension lump sum values. The opposite is also true: declining or lower interest rates raise pension lump sum values. Interest rates are significant in calculating your lump payment option under the pension plan.

Before making pension decisions, the Retirement Group believes that all employees should receive a full RetireKit Cash Flow Analysis that compares their lump sum value to monthly annuity payout choices.

As appealing as a lump payment may seem, a monthly annuity for all or a portion of the pension may still be a viable alternative, particularly in a high interest rate environment.

Each person's circumstance is unique, and a complimentary Cash Flow Analysis from The Retirement Group will show you how your pension options stack up and play out over the duration of your retirement years, which might be two, three, four, or more decades.

Knowing where you stand allows you to make more informed decisions about when to retire and which pension distribution choice is best suited to your circumstances.

401k Savings Plan

Employees are encouraged to immediately enroll in their 401(k) savings plan.

Merck offers a qualified retirement savings plan, or 401(k), to enhance your Pension Plan retirement income.

This plan allows you to save before, Roth, or after-tax, based on your needs.

About the Savings Plan

-

You can start participating in the Merck Savings Plan as soon as you are hired; there is no waiting time.

-

Full, immediate vesting—which means you always own your and company-matching contributions.

-

Easy payroll deductions, including pre-tax, Roth, and after-tax contributions up to IRS restrictions.

-

Company-matching contributions of 75 cents every dollar saved (of the first 6% of total pay, up to IRS contribution restrictions) to encourage and augment your savings.

-

A variety of investment options designed to help you develop a well-diversified portfolio.

-

Tax-deferred investment of your (and the company's) contributions

-

Emergency access to your account—via loan, withdrawal and distribution provisions

When you retire and have balances in your 401(k), you will get a Participant Distribution Notice in the mail. This message will display the current value that you are eligible to receive from each plan and explain your distribution options.

It will also explain what you must do to obtain your final allocation.

For additional information, please call The Retirement Group at (800)-900-5867, and we will connect you with a retirement-focused advisor.

Next Step:

-

Look for your Participant Distribution Notice and Special Tax Notice Regarding Plan Payments. These mailings will assist you understand your options and the potential federal tax implications for your vested account balance.

-

' What has Worked in Investing ' & ' 8 Tenets when picking a Mutual Fund '.

-

To learn about your distribution options, call The Retirement Group at (800)-900-5867. Click our e-book for more information on ' Rollover Strategies for 401(k)s '. Use the Online Beneficiary Designation to make updates to your beneficiary designations, if needed.

Note : If you voluntarily terminate your employment from Merck, you may not be eligible to receive the annual contribution.

More than half of plan participants say they lack the time, desire, or understanding required to manage their 401(k) portfolio. But the benefits of seeking assistance extend beyond convenience. According to Charles Schwab's research, plan participants who receive investment advice tend to have portfolios that perform better: The annual performance difference between those who receive assistance and those who do not is 3.32%, net of expenses. This suggests that a 45-year-old person may increase their wealth by 79% by the age of 65 simply by contacting an advisor. That's a significant difference.

Getting assistance can be the key to improved outcomes across the 401(k) board.

Getting assistance can be the key to improved outcomes across the 401(k) board.

A Charles Schwab study discovered some favorable results common to those who sought independent professional guidance. They include:

-

Improved savings rates - 70% of individuals who received 401(k) guidance raised their contributions.

-

Increased diversification - Participants who managed their own portfolios invested in an average of just under four asset classes, whereas those in advice-based portfolios invested in at least eight asset classes.

-

Increased chances of staying the course - Receiving assistance enhanced participants' odds of sticking to their investing goals, making them less reactive during unpredictable market conditions and more likely to stick with their original 401(k) investments during a downturn. accomplish not try to accomplish it alone. Seek assistance with your company's 401(k) plan investments. Your nest egg will thank you.

In Service Withdrawals

In general, you can withdraw funds from your account while still employed with your firm, subject to the conditions indicated below.

Certain withdrawals are subject to standard federal income tax, and if you're under age 59½, you may be subject to an additional 10% penalty tax. You can check your eligibility and request a withdrawal online or by phoning your company's Benefits Center.

Rolling Over Your 401(k)

An in-service dividend can be rolled over to an IRA if the plan participant is under the age of 72. Direct rollovers eliminate both the 10% early withdrawal penalty and the necessary 20% tax withholding. More information, as well as potential rollover and withdrawal limits, can be found in your company's plan summary.

Because a withdrawal permanently decreases your retirement savings and is taxed, you should always consider borrowing from the plan to fulfill your financial needs. Loans, unlike withdrawals, must be repaid and are not taxable (unless they are not paid back). In other circumstances, such as hardship withdrawals, you cannot make a withdrawal unless you have also taken out the maximum loan allowable under the employer plan.

You should also be aware that your company's plan administrator reserves the right to change the regulations governing withdrawals at any moment, and may further restrict or limit the availability of withdrawals for administrative or other reasons. All plan participants will be notified of any such limits, which apply equally to all corporate workers.

Borrow from your 401(k)

Should you? Perhaps you lose your job with your firm, have a serious health issue, or have another reason for needing a large sum of money. Banks require excessive paperwork for personal loans, credit cards have high interest rates, and you may consider deferring retirement from your firm to compensate.

We understand how you feel: this is your money, and you need it now. However, consider how this may have an undesirable effect on your retirement plans after leaving your job.

Consider these facts while determining whether to borrow from your 401(k). You can:

-

You lose the opportunity for development on the money you borrowed.

-

If you leave your company, you will have to deal with payback and tax concerns.

-

If you leave your company, you may face repayment and tax concerns.

Net Unrealized Appreciation (NUA)

When you qualify for a distribution, you have three choices:

-

Roll over your eligible plan to an IRA and continue to defer taxes.

-

Take a distribution and pay regular income taxes on the entire amount.

-

Take advantage of NUA and profit from a more favorable tax structure for gains.

How does Net Unrealized Appreciation Work?

First, an employee must be eligible for a distribution from a qualified company-sponsored plan. At retirement or age 59 1⁄2, employees often get a 'lump-sum' distribution from their plan, which distributes all assets over a year period. The portion of the plan that consists of mutual funds and other investments can be transferred to an IRA for additional tax deferral. The highly appreciated firm shares is subsequently moved into a non-retirement account.

The tax benefit occurs when you transfer business stock from a tax-deferred account to a taxable account. At this point, you apply NUA and pay ordinary income tax on the cost basis of your shares. The stock's appreciated value above its basis is taxed at the lower long-term capital gains rate, which is now 15%, rather than the higher ordinary income tax. This could result in savings of over 30%.

You may want to learn more about NUA by scheduling a complimentary one-on-one consultation with a financial advisor from The Retirement Group.

IRA Withdrawal

When you qualify for a distribution, you have three choices:

Your retirement assets could include a variety of retirement accounts, such as IRAs, 401(k)s, and taxable accounts.

So, what is the most efficient manner to withdraw your retirement income after leaving your company?

You may wish to consider fulfilling your retirement income demands by first withdrawing from taxable assets rather than tax-deferred investments.

This may extend the life of your company's retirement assets by allowing them to grow tax-deferred.

You should also plan to take required minimum distributions (RMDs) from any company-sponsored retirement plans, as well as traditional or rollover IRA accounts.

This is due to the IRS's mandate in 2024 to begin taking withdrawals from these types of accounts when you reach the age of 73. Beginning in 2024, the excise tax on each dollar of under-distributed RMD will be decreased from 50% to 25%.

There is new legislation that allows account holders to postpone taking their first RMD until April 1 of the calendar year in which they reach age 73 or, in a company retirement plan, retire.

Two flexible distribution alternatives for your IRA.

When it comes to drawing on your IRA for income or taking your RMDs, you have a few options. IRA distributions are taxed and may incur penalties if under 59½.

Partial withdrawals: You can withdraw any amount from your IRA at any time. If you're 73 or older, you must withdraw at least enough from one or more IRAs to pay your annual RMD.

Systematic withdrawal plans: Set up regular, automatic withdrawals from your IRA based on the quantity and frequency of your income needs once you retire from your company. If you're under 59½, you may face a 10% early withdrawal penalty (unless your withdrawal plan follows Code Section 72(t) regulations).

Your tax advisor can assist you with understanding distribution alternatives, determining RMD obligations, calculating RMDs, and developing a systematic withdrawal strategy.

About Retirement Health Care

-

Group retiree medical coverage (including prescription medication coverage) is offered if you meet the plan's age and service eligibility conditions at the conclusion of your employment, until you reach age 65 and become eligible for Medicare.

-

Merck retirees and eligible dependents who are 65 years or older and Medicare-eligible can purchase individual health insurance (including prescription drug coverage) through a private health exchange and may receive financial assistance from Merck through a health reimbursement account.

HSA's

Health Savings Accounts (HSAs) are frequently praised for their effectiveness in managing healthcare costs, particularly for people with high-deductible health plans. However, their advantages go beyond medical cost management, establishing HSAs as a potentially superior retirement savings vehicle compared to typical retirement plans such as 401(k)s, particularly after employer matching contributions are exhausted.

Understanding HSAs

HSAs are tax-advantaged accounts intended for people who have high-deductible health insurance policies. For 2024, the IRS classifies high-deductible plans as having a minimum deductible of $1,600 for individuals and $3,200 for families. HSAs provide pre-tax contributions, tax-free investment growth, and tax-free withdrawals for qualified medical costs, making them a triple-tax-advantaged account.

HSAs' annual contribution limits in 2024 are $4,150 for individuals and $8,300 for families, with an additional $1,000 allowed for those 55 and older. Unlike Flexible Spending Accounts (FSAs), HSA funds do not expire at the end of the year; they grow and can be carried forward indefinitely.

Comparing HSAs versus 401(k)s after Matching

Once an employer's maximum 401(k) match is reached, additional contributions result in less immediate financial rewards. This is where HSAs can serve as a strategic complement. 401(k)s provide tax-deferred growth and tax-deductible contributions, but withdrawals are taxed. In contrast, HSAs allow for tax-free withdrawals for medical expenses, which account for a major amount of retirement costs.

HSA as a Retirement Tool

After age 65, the HSA stretches its muscles as a powerful retirement tool. Funds can be withdrawn for any reason, subject only to standard income tax if spent for non-medical expenses. This flexibility is similar to that of regular retirement plans, but it also includes tax-free withdrawals for medical bills, which is a substantial benefit given escalating healthcare costs in retirement.

Furthermore, unlike 401(k)s and Traditional IRAs, HSAs have no Required Minimum Distributions (RMDs), giving you more flexibility over your tax planning in retirement. This makes HSAs especially appealing to those who may not need to access their funds immediately after retirement or who want to reduce their taxable income.

Investment Strategy for HSAs.

Initially, it is prudent to invest conservatively in an HSA, with an emphasis on ensuring that there are enough liquid assets to cover the near-term deductible and other out-of-pocket medical expenses. However, if a financial cushion has been formed, using the HSA as a retirement account and investing in a diverse mix of equities and bonds can considerably improve the account's long-term growth potential.

Utilizing HSAs in retirement

In retirement, HSAs can cover a variety of expenses:

-

Healthcare Costs-Pre-Medicare: HSAs can cover healthcare costs to bridge you to Medicare.

-

Healthcare Costs After Medicare: HSAs can be used to pay for Medicare premiums as well as out-of-pocket medical expenses such as dental and eye treatment, which are frequently not covered by Medicare.

-

Long-term Care: Funds may be used for approved long-term care services and insurance payments.

-

Non-medical Expenses: After age 65, HSA funds can be used for non-medical expenses without penalty, but withdrawals are subject to income tax.

In conclusion, HSAs have distinct advantages that can make them a better alternative for retirement savings, especially once the benefits of 401(k) matching are fully realized. HSAs are an important component of a comprehensive retirement strategy because of their fund flexibility and tax advantages. Individuals can improve their financial health in retirement by strategically managing contributions and withdrawals, ensuring both medical and financial security.

Your life insurance coverage, as well as any optional coverage you acquire for your spouse/domestic partner and/or children, expires on the date your employment with your firm ends, unless it is due to disability. If you die within 31 days of your company's termination date, your beneficiary receives benefits for both your basic life insurance and any supplemental life insurance coverage you choose.

Note:

-

You may be able to change your life insurance to an individual policy or choose portability for any optional coverage.

-

If you cease paying additional contributions, your coverage will expire.

-

If you are at least 65 years old and pay for additional life insurance, the insurance company should send you literature in the mail explaining your options.

-

Make care to notify your beneficiaries. For more information, consult your company's sales and profit statement.

Beneficiary Designations

As part of your retirement and estate planning, you should designate someone to receive the proceeds of your benefit programs in the event that you die. This is how your employer will choose who should receive your ultimate compensation and benefits. This includes life insurance payouts, as well as any pension or savings balances you may have.

Next step:

- When you retire, make sure to update your beneficiaries and the Beneficiary Designation form to reflect life events such as death, marriage, divorce, childbirth, adoption, and so on.

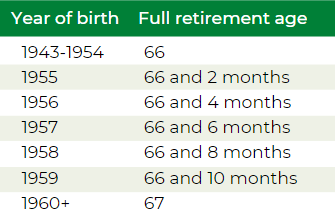

Understanding and claiming Social Security can be challenging for many retirees, but determining the best ways to do so is critical to your retirement income planning. Social Security benefits are not intended to be the primary source of retirement income, but rather to supplement your total withdrawal strategy.

Knowing the fundamentals of Social Security and applying that knowledge to your advantage will help you collect the most benefit.

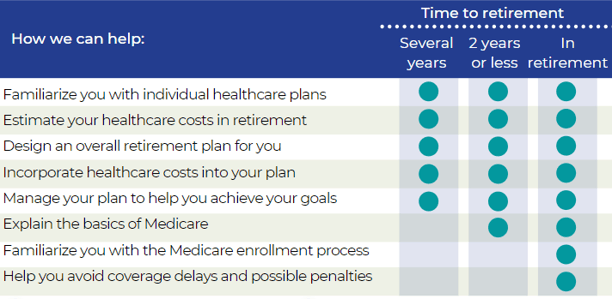

It is your duty to enroll in Medicare Parts A and B when you first become eligible, and you must remain enrolled to receive coverage for Medicare-eligible expenses. This also applies to your dependents who are qualified for Medicare benefits.

You should understand how your retiree medical plan selections and Medicare eligibility affect your plan alternatives. Before you resign from your employer, contact the Social Security Administration at 800-772-1213, your local Social Security Office, or ssa.gov.

They can assist you in determining your eligibility, enrolling you and/or your eligible dependents in Medicare, and providing information about other government programs. Please call us if you need additional information about Social Security.

Before retiring from your company, check the status of your Social Security benefits. Contact the United States Social Security Administration, your local Social Security office, or go to ssa.gov.

Are you currently eligible for Medicare or will you be soon?

If you or your dependents become eligible after leaving your telecom industry company, Medicare normally takes over as your primary coverage as soon as they become eligible. This will have an impact on the medical benefits supplied by Merck.

When you initially become eligible for Medicare, you and your dependents must enroll in Parts A and B of the program. Medical and MH/SA benefits payable under the company-sponsored plan will be lowered by the sums Medicare Parts A and B would have paid, whether or not you enrolled in them.

For more information on benefit coordination, see your company's summary plan description.

If you or an eligible-dependant do not enroll in Medicare Parts A and B, your provider may bill you for amounts not covered by Medicare or your company's medical plan. This increases your out-of-pocket spending dramatically.

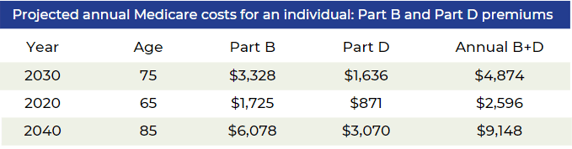

According to the Employee Benefit Research Institute (EBRI), Medicare only covers approximately 60% of an individual's medical expenses. This indicates that a 65-year-old couple with average prescription-drug expenses for their age will require $259,000 in savings to cover 90% of their healthcare costs. A single guy will need $124,000, whereas a single female, because to her longer life expectancy, will require $140,000.

Check Merck's plan summary to see if you’re eligible to enroll in Medicare Parts A and B.

If you become Medicare-eligible for reasons other than age, you must contact Merck’s benefit center about your status.

For 28% of couples over the age of 53, happily ever after and until death do us part will not come true. Most couples save for decades, expecting they would retire together. Following a divorce, they must face the expenses of a pre- or post-retirement lifestyle while only having half of their savings.

If you're divorced or in the process of divorce, your ex-spouse(s) may be interested in a portion of your company's retirement benefits. Before you may begin your pension—and for each former spouse who may be interested—you must submit your firm with the necessary documentation:

-

A copy of the court-filed Judgment of Dissolution or Judgment of Divorce, together with any Marital Settlement Agreement (MSA)

-

A copy of the court's Qualified Domestic Relations Order (QDRO)

Regardless of how long or brief your marriage was, you must submit this evidence to your company's online pension center. *Source: The Retirement Group, "Retirement Plans - Benefits and Savings," U.S. Department of Labor, 2019, and "Generating Income That Will Last Throughout Retirement," Fidelity, 2019.

You can apply for a divorced spouse's benefit if the following conditions are met:

You're at least 62 years old.

You were married for at least ten years before the divorce.

You are currently unmarried.

Your ex-spouse is eligible for Social Security benefits.

Your individual Social Security benefit amount is lower than your spousal benefit amount, which is one-half of your ex's full benefit amount if claimed at Full Retirement Age (FRA).

Unlike a married pair, your ex-spouse does not need to have filed for Social Security before you may apply for your divorced spouse's benefit; however, this only applies if you've been divorced for at least two years and your ex is at least 62 years old. If your divorce occurred less than two years ago, your ex must be receiving benefits before you can register as a divorced spouse.

Unlike a married couple, you do not have to wait for your ex-spouse to file for Social Security before applying for your divorced spouse's benefit.

Divorce does not disqualify you for survivor benefits. You can claim a divorced spouse's survivor benefit if the following apply:

-

Your ex-spouse has died.

-

You are at least sixty years old.

-

You were married for at least ten years before the divorce.

-

You are single (or remarried after turning 60).

Are you going through a divorce?

If your divorce is not finalized by the time you retire from your company, you are still considered married. You have two choices:

Retire from your company before your divorce is finalized and opt for a combined pension of at least 50% with your spouse — or obtain your spouse's signed, notarized approval to a different election or lump amount.

Defer your retirement from your company until your divorce is finalized and you can supply the necessary divorce documentation*.

Source: The Retirement Group, “Retirement Plans - Benefits and Savings,” U.S. Department of Labor, 2019; “Generating Income That Will Last Throughout Retirement,” Fidelity, 2019

In the unfortunate event that you aren’t able to collect your benefits from your company, your survivor will be responsible for taking action.

What your survivor should do:

- Report your death. Your spouse, family member, or friend should contact your company's benefits service center as quickly as possible to report your death.

- Receive life insurance benefits. To get life insurance benefits, your spouse or other designated beneficiary must contact your company's benefits service center.

If you have a joint pension:

- Start making joint pension contributions. The joint pension is not automatic. To begin receiving joint pension payments, your joint pensioner must complete and return the papers provided by your company's pension center.

- Prepare financially to pay living expenditures. Your spouse will need to have enough funds to cover at least one month between the end of your company's pension payments and the start of his or her own pension payments.

If your survivor has medical insurance through your company:

- Decide whether or not to keep your medical coverage.

- If your survivor is enrolled as a dependent in your company's retiree medical coverage when you die, he or she must decide whether to continue it. Survivors must pay the entire monthly cost.

Financial advantages of working

Make up for the reduced value of savings or assets. Low interest rates are ideal for lump sums but make it difficult to generate portfolio income. Some people continue to work to compensate for poor returns on their savings and investments.

Perhaps you accepted a job offer and left your firm earlier than you desired, with less retirement savings than you required. Instead of depleting your money, you may decide to work a bit longer to afford items you've previously denied yourself.

Meet the financial needs of daily living. Expenses can rise after your retirement from your employer, and working can be a practical and successful option. You may choose to continue working in order to maintain your insurance or other benefits; many firms provide free or low-cost health insurance to part-time employees.

Emotional benefits of working

You may discover highly appealing career opportunities just as you were about to leave the workforce.

Remaining active and involved. Retaining employment after leaving your prior job, even if it's only part-time, can be a terrific opportunity to put your abilities to use while also keeping in touch with friends and coworkers.

Enjoying yourself at work. Just because the government has established a retirement age through its Social Security program does not obligate you to organize your personal life accordingly. Many people really appreciate their professions and continue to work because it enriches their lives.

Rising Interest Rates e-book

https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2022

https://news.yahoo.com/taxes-2022-important-changes-to-know-164333287.html

https://www.nerdwallet.com/article/taxes/federal-income-tax-brackets

https://www.the-sun.com/money/4490094/key-tax-changes-for-2022/

https://www.bankrate.com/taxes/child-tax-credit-2022-what-to-know/

How does Merck's new retirement benefits program support long-term financial security for employees, particularly regarding the changes to the pension and savings plans introduced in 2013? Can you elaborate on how Merck's commitment to these plans is designed to help employees plan for retirement effectively?

Merck's New Retirement Benefits Program: Starting in 2013, Merck introduced a comprehensive retirement benefits program aimed at providing all eligible employees, irrespective of their legacy company, uniform benefits. This initiative supports Merck's commitment to financial security by integrating pension plans, savings plans, and retiree medical coverage. This approach not only aims to help employees plan effectively for retirement but also aligns with Merck’s post-merger goal of standardizing benefits across the board.

What are the key differences between the legacy pension benefits offered by Merck before 2013 and the new cash balance formula implemented in the current retirement program? In what ways do these changes reflect Merck's broader goal of harmonizing benefits across various employee groups?

Differences in Pension Formulas: Before 2013, Merck calculated pensions using a final average pay formula which typically favored longer-term, older employees. The new scheme introduced a cash balance formula, reflecting a shift towards a more uniform accumulation of retirement benefits throughout an employee's career. This change was part of Merck's broader strategy to harmonize benefits across various employee groups, making it easier for employees to understand and track their pension growth.

In terms of eligibility, how have Merck's pension and savings plans adjusted for years of service and age of retirement since the introduction of the new program? Can you explain how these adjustments might affect employees nearing retirement age compared to newer employees at Merck?

Adjustments in Eligibility: The new retirement program revised eligibility criteria for pension and savings plans to accommodate a wider range of employees. Notably, the pension benefits under the new program are designed to be at least equal to the prior benefits for services rendered until the end of 2019, provided employees contribute a minimum of 6% to the savings plan. This adjustment aids both long-term employees and those newer to the company by offering equitable benefits.

Can you describe the transition provisions that apply to legacy Merck employees hired before January 1, 2013? How does Merck plan to ensure that these provisions protect employees from potential reductions in retirement benefits during the transition period?

Transition Provisions for Legacy Employees: For employees who were part of legacy Merck plans before January 1, 2013, Merck established transition provisions that allow them to earn retirement income benefits at least equal to their current pension and savings plan benefits through December 31, 2019. This ensures that these employees do not suffer a reduction in benefits during the transition period, offering a sense of security as they adapt to the new program.

How does employee contribution to the retirement savings plan affect the overall retirement benefits that Merck provides? Can you discuss the implications of Merck's matching contributions for employees who maximize their savings under the new retirement benefits structure?

Impact of Employee Contribution to Retirement Savings: In the new program, Merck encourages personal contributions to the retirement savings plan by matching up to 6% of employee contributions. This mutual contribution strategy enhances the overall retirement benefits, incentivizing employees to maximize their savings for a more robust financial future post-retirement.

What role does Merck's Financial Planning Benefit, offered through Ernst & Young, play in assisting employees with their retirement planning? Can you highlight how engaging with this benefit changes the financial landscapes for employees approaching retirement?

Role of Merck’s Financial Planning Benefit: Offered through Ernst & Young, this benefit plays a critical role in assisting Merck employees with retirement planning. It provides personalized financial planning services, helping employees understand and optimize their benefits under the new retirement framework. Engaging with this service can significantly alter an employee’s financial landscape by providing expert guidance tailored to individual retirement goals.

How should employees evaluate their options for retiree medical coverage under the new program compared to previous offerings? What considerations should be taken into account regarding the potential costs and benefits of the retiree medical plan provided by Merck?

Options for Retiree Medical Coverage: With the new program, employees must evaluate both subsidized and unsubsidized retiree medical coverage options based on their age, service length, and retirement needs. The program offers different levels of company support depending on these factors, making it crucial for employees to understand the potential costs and benefits to choose the best option for their circumstances.

In what ways does the introduction of voluntary, unsubsidized dental coverage through MetLife modify the previous dental benefits structure for Merck retirees? Can you detail how these changes promote cost efficiency while still providing valuable options for employees?

Introduction of Voluntary Dental Coverage: Starting January 2013, Merck shifted from sponsored to voluntary, unsubsidized dental coverage through MetLife for retirees. This change aligns with Merck’s strategy to promote cost efficiency while still providing valuable dental care options, allowing retirees to choose plans that best meet their needs without company subsidy.

How can employees actively engage with Merck's resources to maximize their retirement benefits? What specific tools or platforms are recommended for employees to track their savings and retirement progress effectively within the new benefits framework?

Engaging with Merck’s Retirement Resources: Merck provides various tools and platforms for employees to effectively manage and track their retirement savings and benefits. Employees are encouraged to utilize resources like the Merck Financial Planning Benefit and online benefit portals to make informed decisions and maximize their retirement outcomes.

For employees seeking additional information about the retirement benefits program, what are the best ways to contact Merck? Can you provide details on whom to reach out to, including any relevant phone numbers or online resources offered by Merck for inquiries related to the retirement plans?

Contacting Merck for Retirement Plan Information: Employees seeking more information about their retirement benefits can contact Merck through dedicated phone lines provided in the benefits documentation or by accessing detailed plan information online through Merck's official benefits portal. This ensures employees have ready access to assistance and comprehensive details regarding their retirement planning options.

/General/General%204.png?width=1280&height=853&name=General%204.png)

-2.png?width=300&height=200&name=office-builing-main-lobby%20(52)-2.png)

.webp?width=300&height=200&name=office-builing-main-lobby%20(27).webp)

-2.png)

.webp)