Retirement Guide for AT&T Employees

2025 Tax Rates, Inflation, the AT&T Pension, and Interest Rate Implications

Planning for retirement isn't straightforward, especially when you're retiring from a prominent company like AT&T. Retirement planning a significant process that can (and will) impact the rest of your life. That's why we created this comprehensive guide for AT&T employees.

In this guide, we'll explain the many different factors that you may need to take into account when deciding on the proper time to retire from AT&T: health care, benefit changes, interest rates, upcoming tax changes, and much more.

Keep in mind we are not affiliated with AT&T. We recommend reaching out to your AT&T benefits department for further information. If you live in the United States, and are in your 50s or 60s, this guide will provide tailored insights for your retirement.

Table of Contents

Section 1: AT&T Interest Rate News

Section 1.1: AT&T Layoff News & Restructuring

Section 2: 2024 Tax Changes & Inflation

Section 2.1: Tax Code Updates

Section 2.2: Optimizing Retirement Contributions

Section 2.3: Dealing with Inflation

Section 3: Planning your AT&T Retirement

Section 3.1: Investing in the AT&T 401(k) Program

Section 3.2: 401(k) Investing Benchmarks by Decade

Section 4: The AT&T Pension Plan

Section 4.1: How the AT&T Pension Plan Works

Section 4.2: AT&T Pension Plan Overview & Examples

Section 4.3: Pension Payment Options

Section 5: The AT&T 401(k) Plan

Section 5.1: What happens to your 401(k) when you retire?

Section 5.2: Net Unrealized Appreciation (NUA) Strategy

Section 5.3: Leverage your 401(k) before you retire

Section 6: AT&T Retiree Health Care & Benefits

Section 6.1: Using an HSA for retirement health care

Section 6.2: Social Security & Medicare

Section 6.3: The Reality of Medical Costs in Retirement

Section 7: Divorce and Retirement Planning

Section 7.1: Divorce & Retirement Benefits Explained

Section 7.2: Your AT&T Pension and Divorce

Section 7.3: Divorcing close to retirement?

Section 8: Survivor Checklist

Section 8.1: In the event of your death...

Section 8.2: If you have a joint pension...

Section 8.3: If your survivor has AT&T medical coverage...

Section 9: Life After Your Career

Section 9.1: Financial benefits

Section 9.2: Emotional benefits

AT&T Interest Rate News

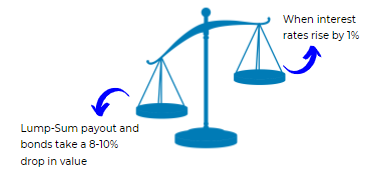

Paying attention to interest rates is crucially important when it comes to retirement planning. When you're considering your potential retirement date, you must understand how interest rates will impact your decision.

Perhaps most importantly, interest rates are used to determine the amount of money you receive for your pension lump sum.

AT&T Pension & Interest Rate Considerations

In 2024, AT&T uses the IRS Present Value segment rates from November 2023 to determine lump-sum values. If interest rates are higher than the previous year, lump sums will be less on average. The reverse is also true: if interest rates are lower, lump sum values will increase.

Interest rates often follow the fluctuations of the 10-Year Treasury Rate, which are higher now than they have been for years. However, the Federal Reserve shifted towards a less restrictive interest rate policy in the latter half of 2024, which could lead to a persisting downward trend in rates. If this trend persists through 2025, it could have implications for your lump sum.

AT&T employees living in the United States and approaching their 50s or 60s must vigilantly track current interest rate trends when deciding on the optimal timing for their retirement benefits commencement date.

Here's our latest Q&A video discussing strategies on how to increase your lump sum with fluctuating interest rates:

Schedule An Appointment with a Retirement Group Advisor

Please choose a date that works for you from the available dates highlighted on the calendar.

AT&T 2024 Layoff Announcements & Other AT&T News

2025 Tax Changes, Retirement Accounts & Inflation

Tax Code Updates for 2025

Staying informed about new changes made by the IRS is critically important. For employees in the United States, particularly those in their 50s or 60s, the critical factors to keep track of are the following:

- Standard deduction. In 2025, the standard deduction increased to $15,000 for single filers and married filing separately; $30,000 for joint filers, and $22,500 for heads of household.

- Additional deduction. Taxpayers who are over the age of 65 or blind can add an additional $1,600 to their standard deduction. This amount jumps to $2,000 if they are also unmarried or not a surviving spouse.

- Cash contributions to charity. The special deduction that allowed non-itemizers to deduct up to $300 in cash donations to charity — or $600 for those married filing jointly — has expired.

Many individuals interesting in reducing their tax burdens as much as possible are excited to learn about the Child Tax Credit. Although it only applies to those with children under the age of 18, it can be relevant to those who are approaching retirement if they have minor children — or if their children have children!

Chid Tax Credit updates for 2025:

- Maximum credit per qualifying child: $2,000 for children 5 and under; $3,000 for children 6 through 17.

- Child Tax Credit eligibility. As a parent or guardian, you are eligible for the Child Tax Credit if your adjusted gross income is less than $200,000, or $400,000 married filing jointly.

- Partial refundability. If your Child Tax Credit is greater than your tax, you can receive up to $1,600 as a cash refund.

How AT&T employees can optimize their retirement contributions

Contributing to your company's 401(k) plan can cut this year's tax bill significantly. With the right planning, these benefits can be compounded over time. In 2024, the amount you can save increased:

- 2024 limit. Individuals can contribute $23,000 to their 401(k) plans in 2024.

- Catch-up contributions. Employees age 50 and over can contribute an extra $7,500, bringing their total limit to $30,500.

- A major opportunity. Lowering your taxable income by up to $30,500 means less of your money is immediately taxed. As displayed by the table below, this could save you thousands on your tax bill.

Many investors choose to invest the money that they save in taxes this year. This bonus nest egg then has the opportunity to grow in the market, which can help pay the deferred tax when they make withdrawals from their accounts later in life.

2024 Tax Brackets

Addressing inflation in 2025

Following the searing rates of inflation Americans experienced in the early 2020s, the balmy rate of 2.4% for the 12-month period ending in September 2024 seems much more palatable (Source: Bureau of Labor Statistics). Still, inflation is still considered a volatile source of risk to your portfolio, and will reduce the purchasing power of your dollars over time whether you like it or not.

The Federal Reserve strives to achieve a 2% inflation rate each year, but the 8.3% inflation rate of 2022 reminded all of us that this target is anything but a guarantee. In order to maintain the same standard of living throughout your retirement after leaving AT&T, you will have to factor rising costs into your plan. This is doubly important for important sectors like health care and housing, which have been known to outpace the total inflation rate, sometimes by significant amounts.

An experienced advisor can help you prepare your portfolio for inflation, while taking into account the rest of your comprehensive plan. Speak with a financial advisor today to start planning for the impacts.

*Source: IRS.gov, Yahoo, Bankrate, Forbes

Retirement planning isn't a one-and-done activity. But it's not something you can put off forever.

The truth is, most Americans don't know how much they need for retirement. However, when we look at the realities of planning, this may not be too much of a surprise. Retirement planning is a complex activity that must be done regularly, whether you're 30 or 60. And for many of us, the gravity of that complexity leads us to delay planning — sometimes, until it's nearly too late.

No matter where you're at in the planning process now, it's time to reevaluate. You know you need to be saving and investing, because "time in the market" beats "timing the market". But even if you've been investing for years, the game changes entirely once you switch from saving to spending.

That's where The Retirement Group comes in. We've partnered with Wealth Enhancement to offer a wide range of retirement planning resources. With a qualified, competent, and caring advising team by your side, AT&T employees in the United States can make the most of what they've saved, and better plan for what they still need.

Don't leave your retirement transition to chance. Whether you're focused on maximizing the potential of your benefits, planning for rising health care costs, or creating effective tax diversification in your portfolio, The Retirement Group can help.

"A separate study by Russell Investments, a large money management firm, came to a similar conclusion. Russell estimates a good financial advisor can increase investor returns by 3.75 percent."

Source: Is it Worth the Money to Hire a Financial Advisor? The Balance, 2021

Investing in the AT&T 401(k) Program

Compound interest has been referred to as the "8th Wonder of the World". When you invest money, and re-invest the proceeds from those investments, your money compounds. Over time, this compounding can have a significant effect on the value of your portfolio. That's why starting to invest as early as possible matters so much. The AT&T 401(k) program offers a prime opportunity for employees to invest and save, reaping the benefits of compound interest.

The benefits of investing in your 401(k)

401(k)s offer significant benefits for those who invest in them:

- Tax-deferment: When you invest money in a 401(k), it is removed from your taxable income for the year in which you invest. Not only does this reduce your tax bill for this year, it allows you to invest the amount you saved. The potential proceeds from these investments can help you pay the deferred taxes when you make withdrawals in retirement.

- Employer match: Many employers offer what's referred to as a "match", which means they will match up to a certain amount of money that you invest in your 401(k) each year. We'll explain the details later in this section.

- Compound interest: 401(k)s as an investment account allow you to take advantage of compound interest, which we illustrate below.

Waiting to invest in your 401(k) can cost you. This hypothetical illustration shows the potential risks of waiting just 10 years to start investing in an IRA. Assuming a $100 monthly investment and an annual return of 8%, an investor who starts at age 25 instead of age 35 would have an extra $200,000 in their account when they reach age 65. This example certainly underscores the importance of starting early, but it also illustrates the importance of repeated, continuous investment. $100 a month might not seem like a lot to start out with, but by sticking with it, both of the investors in our example amassed a significant nest egg that will be able to support them in retirement.

401(k) investing: Benchmarks by decade

The further you get in your career, the greater your income. This general rule may makes it appear that individuals in their mid to late careers have more money that they can invest. However, retirement saving competes directly with a number of other expenses, like your mortgage, raising children, paying for college, and more.

In the United States, it's important to develop a strategy for 401(k) investing that you can stick to. Strategies always vary from person to person, because everyone's financial situation is unique, but there are some popular benchmarks that you can keep track of:

- If you're in your 30s and 40s, retirement planning often conflicts with saving for college. While many financial planners will tell you to focus on retirement, because financial aid can offset tuition costs, consider investing a minimum of 10% of your income toward retirement during this age range.

- As you enter your 50s and 60s, you'll ideally be in your peak earning years — and with some major expenses behind you. This can be a good time to consider whether or not you can boost your retirement savings goal to 20% or more of your income. For many of us, this is the last time we have to stash away funds.

- Starting at age 50, retirement investors are allowed to make “catch-up” contributions to certain types of accounts. These contributions allow you to save even more as you navigate the home stretch into retirement.

Why are 401(k) matching contributions so popular?

Matching contributions are just what they sound like: Your company matches your own personal 401(k) contributions up to some point, using money that comes from the company. Typically, if your employer offers a match, they will match up to a certain percent of the amount that you invest.

For example, let's say AT&T offers you a 5% match to your 401(k) investments. If your salary is $100,000 and you invest $5,000 in your 401(k), AT&T would then match that amount, also investing $5,000 in your 401(k) — resulting in a $10,000 increase to your 401(k) balance. If you invested $10,000 instead, AT&T would match $5,000 of that amount, bringing your total annual 401(k) investment to $15,000 for that year.

401(k) employer match contributions are so popular because they are effectively "free money". If you don't invest enough to take full advantage of your employer's match, then you are leaving money on the table. Research published by Principal Financial Group in 2022 found that 62% of workers deemed company 401(k) matches significantly important to reaching their retirement goals.

Unfortunately, many people fail to take advantage of these programs. According to Bank of America's "2022 Financial Life Benefit Impact Report", despite 58% of eligible employees participating in a 401(k) plan, 61% of them contributed less than $5,000 during the current year. The study also found that fewer than one in 10 participants’ contributions reached the ceiling on elective deferrals, under IRS Section 402(g) — which is $23,000 for 2024.

A 2020 study from Financial Engines titled “Missing Out: How Much Employer 401(k) Matching Contributions Do Employees Leave on the Table?”, revealed that employees who don’t maximize their company match typically leave $1,336 of extra retirement money on the table each year. That amount of money could make a serious difference to your retirement portfolio.

AT&T employees in the United States stand to benefit from the information in this article! Read Wealth Enhancement's "Complete Guide to Retirement Accounts" article, or speak with an AT&T-focused advisor by clicking the button below.

The AT&T Pension Plan

Whether you’re changing jobs or retiring in the United States, knowing what to do with your hard-earned retirement savings can be difficult. For many Americans, employer-sponsored retirement plans like 401(k)s and pensions make up the majority of their savings.

But how much do you know about how your pension actually works?

When you start to dig in, it's easy to become intimidated. Endless rules, early retirement offers, interest rate impacts, age penalties, complex tax implications... and it all varies from plan to plan!

Increasing the size of your portfolio and reducing your tax burden are key to a successful retirement strategy, but understanding is always the first step. Although The Retirement Group isn't affiliated with AT&T, we can help you understand how your telecom industry 401(k) fits into your overall financial picture, especially if you are retirement age or older.

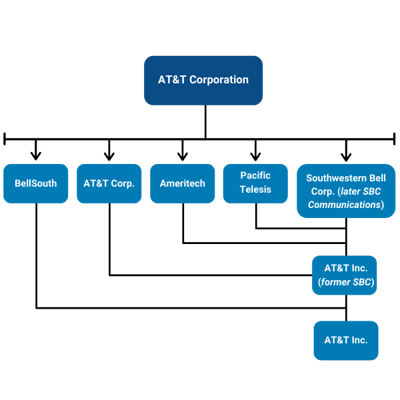

AT&T History: The Backstory

AT&T has a complicated history of breaking up and merging back together. In 1984, the giant corporation was split into regional telecommunications companies known as the "Baby Bells." Since the break-up, these companies have merged once again to form the present-day AT&T. Due to AT&T's mergers, understanding the complexities of the pension plans can be a challenge, especially for individuals living in the United States.

How the AT&T Pension Plan Works

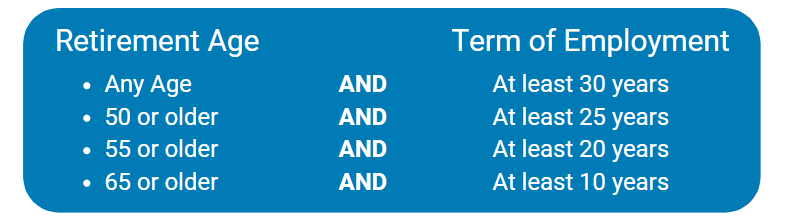

You are eligible for a vested pension benefit after five years of service in the United States, but your benefit will be negatively affected if you do not reach service breakpoints for your employment position, as shown in this chart. You must meet both minimum requirements to be eligible.

Starting the Pension Benefit process (if applicable)

When you are ready to begin receiving your pension benefit, contact the Fidelity Service Center or go to access.att.com > Retiree, Former Employee or Dependent > Login > Fidelity. You may get started up to 180 days in advance of your benefit start date. If you're nearing retirement age, this may be an important time to review your options.

*Source: AT&T Nonbargained SPD

Service Pension Eligibility & Calculation: The Modified Rule of 75

AT&T uses what they call the “modified rule of 75”, also known as "Mod 75", to determine an employee’s retirement eligibility, pension, and retiree medical benefits. Let's dive into the details:

You must reach "75"... In order to be eligible for retirement benefits from AT&T, your age plus your years of service must be equal to or greater than 75.

For instance, if you're 50, and you've been working for AT&T for 25 uninterrupted years, then you would be eligible for retirement benefits, because 50 + 25 = 75. Likewise, if you're 65, and you've been working for AT&T for 10 years, you would also be eligible for benefits. Additionally, if you have worked for AT&T for at least 30 years, then you are automatically eligible for benefits, no matter what age you are.

Keep in mind that, if you leave AT&T for any period of time, that time will be counted against your years of service. These calculations are made down to the day, so keep track of how long you've been employed by AT&T... and how long your breaks are!

Will AT&T freeze their pension?

In 2006, Verizon froze their pension. This raises the question, will AT&T ever follow suit? What would it look like if they did?

Companies freeze pensions to reduce their long-term liabilities. Pension obligations can become very costly and unpredictable over time, which is why so many companies have shifted retirement benefits from these "defined benefit" plans to "defined contribution" plans like 401(k)s. This places more responsibilities on employees, and relieves pressure from investors in the company.

If AT&T did freeze their pension program, it would mean that employees would no longer be able to accrue any additional future benefits. This can be particularly impactful for employees approaching their 50s or 60s, who often rely on defined benefit plans for retirement. This being said, even if AT&T did freeze their pension, employees would still be able to collect the benefits which they have already earned.

AT&T Pension Plan Overview & Examples

The AT&T Pension Benefit Plan is a defined benefit pension plan and a defined contribution pension plan, sponsored by AT&T. The company created various pension plans based on different groups of employees. In this guide, we'll be discussing the pension plans specifically for Management and Hourly employees in the United States. These are different plans, and yours may differ, but in general, most plans behave similarly for participants across all ages.

Benefits under the plan are provided through separate programs. A "program" is the portion of the plan that provides benefits to a particular group of participants or beneficiaries. For example

- Management employees are eligible for plans like the Cash Balance Account (although it was frozen in 2002) and the Current Active Management (CAM) Plan.

- Hourly employees are eligible for benefits calculated by the "Pension Band System", which determines payout options based on job role and years of experience.

First, we will cover the eligibility and vesting of benefits.

AT&T Pension Detail: Eligibility and Vesting

Eligibility and Vesting for AT&T Management Employees

The pension plans of management employees have specific eligibility rules and vesting timelines:

- 1. Cash Balance Account. This was a core plan for Management employees starting in 1997. The plan vested after five years of service, meaning employees became eligible to collect benefits upon reaching five years. This account was frozen in 2002, so it no longer accumulates benefits. However, the existing balance remains payable at retirement. Employees can choose a lump-sum payout option for this account (more on that later).

- 2. Current Active Management (CAM) Pension Plan. Started in 2001, this is the primary plan for current management employees. Employees hired after March 15, 2001 are eligible after three years of service. Plan participants can choose either a lump sum or annuity payout. Note that early retirement may reduce benefits, depending on the employee's age.

Eligibility and Vesting for AT&T Hourly Employees

For Hourly employees, AT&T's pension plan operates under the "Pension Band System", which defines retirement benefits based on specific job roles and service length. Here are the details:

1. Pension Bands. Each hourly role within the company is assigned a "pension band", which corresponds to a monthly benefit level calculated on years of service and band placement. Employees in higher pension bands or with more years of service typically receive greater benefits.

2. Early Retirement Penalties. Hourly employees who take early retirement may see reduced monthly benefits.

To illustrate these concepts, we will next show example pension benefit calculations for both Management and Hourly employees. Note that each employee's benefit is determined by specific factors, such as hire date, years of service, salary, and the plans they're enrolled in. The Retirement Group has worked with numerous AT&T employees, so our specialists will be able to work through the specifics with you — so you can receive the highest possible benefit. While these examples are typical and generic, they may not apply precisely to your unique situation.

Example Pension Benefit Calculation: Hourly AT&T Employee with Pension Band System

Meet Joe, an AT&T employee who is interested in retiring in 2025.

About Joe: Joe is an Hourly employee at AT&T working as a Cable Splicing Technician, assigned to Pension Band 120. He was hired in 1994. Because he wants to retire soon, he wants to calculate his Hourly Pension Benefit.

Under the Pension Band system, Joe's monthly benefit can be determined by multiplying his years of service by the benefit amount associated with his pension band:

Monthly Benefit

Years of Service

Monthly Pension Benefit

Pension Band 120 = $60.00 per service year

Joe's years of service = 25 years

Calculation:

$60.00 (monthly benefit) x 25 (years of service) = $1,500 per month

While this formula calculates a monthly pension benefit, you can determine the lump sum equivalent by using the annuity to lump sum conversion table on Fidelity's website.

Note that if Joe retires early, his benefit may be reduced based on an age-related penalty. For example, a 0.5% reduction to his benefit can be applied for each month before his standard retirement age.

To illustrate the effect this penalty could have, let's assume Joe retires 24 months early. (For illustrative purposes, we will still assume that Joe will have worked a total of 25 years.) Because each month is worth 0.5%, his entire monthly benefit would be reduced by 12%, making his benefit $1,320 per month. This is obviously a significant reduction — but, given extenuating life circumstances, it could make sense for Joe to retire early.

Example Pension Benefit Calculation: Management AT&T Employee with Cash Balance Account

Meet Sarah, an AT&T employee who is interested in retiring in 2025.

About Sarah: Sarah is a Management employee who joined AT&T in 1995 and transitioned to the Cash Balance Account in 1997. This account was frozen in 2002, meaning her final balance from 2002 would be payable upon retirement, but hasn't been growing with contributions since 2002.

If Sarah's Cash Balance Account balance in 2002 was $50,000:

1. Vesting Period. Because Sarah has met her vesting period (5 years), she is fully eligible for the balance.

2. Payout Options. At retirement, she can either receive a lump sum payout of the full amount or convert this balance to an annuity for monthly income.

If Sarah chooses an annuity payout, her monthly income would depend on other factors, such as her age, and the plan's annuity rate at retirement.

Example Pension Benefit Calculation: Management AT&T Employee with Current Active Management (CAM) Plan

For our third example, meet Alex, an AT&T employee who is interested in retiring in 2025.

About Alex: Alex is a Management employee who joined AT&T in 2000 and participates in the Current Active Management (CAM) Plan. Unlike the Cash Balance Account, the CAM Plan is still active today. Let's say, over the course of his employment and contributions, Alex's CAM Plan balance has grown to $200,000 by the time he retires.

1. Vesting Period. The CAM Plan's vesting period is 3 years, so Alex has met that requirement.

2. Payout Options. Alex can receive his amount as a lump sum or annuity. However, like other pension plan options, he may incur early retirement penalties if he retires before his standard retirement date.

Final Pension Example: AT&T Employee with Multiple Pension Types

For our final example, meet Tracy, an AT&T employee who is interested in retiring in 2025.

About Tracy: Tracy joined AT&T in 1985 as an hourly employee and contributed to the Hourly Pension Band System. In 1997, she moved into management and contributed to the Cash Balance Account. In 2002, the Cash Balance Account was frozen, and Tracy transitioned to the Current Active Management (CAM) Plan.

Tracy's Pension Enrollment and Benefit Amounts

1. Hourly Pension Band Plan (1985 - 1997). Earned $1,500 monthly benefit

2. Cash Balance Account (1997 - 2002). Earned $300 monthly benefit.

3. CAM Plan (2002 - present). Earned $2,400 monthly benefit.

Determining Tracy's Retirement Benefit

Tracy's pension benefit will be calculated with AT&T's "greater of" rule for Management employees. Specifically, AT&T will pay Tracy the greater benefit amount of the following options:

1. Cash Balance Account (from 1997 - 2002)

2. Grandfathered Plan (applicable for employees hired before 1997)

3. CAM Plan (for Management employees hired after March 15, 2001)

Applying the $400 Rule

If the difference between the single life annuity from the CAM benefit and the highest applicable formula (Grandfathered) is:

- Greater than $400: Tracy's benefit is paid as a partial lump sum plus a residual annuity.

- Less than $400: Tracy receives the full benefit as a lump sum.

Since Tracy's CAM annuity amount ($2,400) exceeds the combined annuity of Tracy's Hourly and Cash Balance Account benefits ($1,800) by more than $400, then the $400 rule applies to her situation.

Tracy will be entitled to a partial lump sum with a residual annuity. The lump sum and annuity portions are calculated as follows:

$1,500

Hourly pension band benefit

$300

Cash Balance Account benefit

$1,800

Combination of Hourly and Cash Balance paid as lump sum

$2,400

CAM Plan benefit

$1,800

Lump sum benefit

$600

Difference paid as annuity

Under the CAM Plan, it is possible for your pension benefit to decrease in your 60s due to your life expectancy. This is NOT because you've hit 30 years of service. It is a common misconception at AT&T that your pension benefit decreases when you hit 30 years of service.

Note also that early retirement penalties may apply to the CAM Plan, according to Table A or Table B penalties:

Table A Penalties

Retiring younger than Age 55 with 30 or more years of service? Expect a penalty of 1/4% per month or 3% per year

Retiring younger than Age 55 with fewer than 30 years of service? Expect a penalty of 1/2% per month or 6% per year

Table B Penalties

You will often walk away with only 20% - 30% of your total benefit

Management - Cash Balance Account

In 1997 Joe Smith switches to Management and participates in the Cash Balance Account:

- - After 5 years of service Joe will be fully vested with no term age penalties

- - If he receives salary increases, this will affect the calculation of his final benefit

- - Joe will receive his benefit in the form of a Lump Sum, upon retirement

- - In May of 2002 this account type was frozen by AT&T

Now we’ll discuss CAM. This is the plan that the majority of managers fall under today. It was introduced in 2001 and is the only plan that currently isn’t frozen.

In 2001, Joe starts his CAM pension plan:

CAM Pension Plan

- - Assume $0 opening balance as he came from Hourly

- - Joe was hired before 6/12/01 so he is fully vested and eligible immediately

- - Joe's pension benefit may decrease during his early 60's due to life expectancy.

- - (Misconception: When you hit 30 years of service pension benefit decreases)

- - Early retirement discounts & penalties may apply, refer to table A & B (penalties below)

Bridging Your Service

If you're an Hourly or Management employee who's taken an extended leave of absence from AT&T, and if AT&T gave you a new NCS date, you may be dealing with bridging. "Bridging" can complicate pension calculations. Often, the Fidelity pension service will not be able to provide an employee with bridging with a pension estimate online, and you’ll have to order manual calculations.

There are various rules regarding bridging. One important thing to note is that if you leave AT&T and come back, your NCS is not instantly credited from the day you return. There is a waiting period until you can take credit for your years of service during your second tenure.

In terms of changing from Hourly to Management, or vice versa, you will end up with two pensions and two 401(k)s. We will make sure that we maximize every account that you have and not leave anything out, especially as you start reaching retirement age.

Note: We recommend you read the AT&T Summary Plan Description. The Retirement Group is not affiliated with AT&T.

Next Steps: Pension Plan

- Understand how interest rates affect your retirement and pension decisions, as a United States resident.

-

AT&T will need you to provide documents that show proof of birth, marriage, divorce, Social Security number, and more, for you and your spouse/legally recognized partner.

-

AT&T provides access to Beneficiary Designation online so you can make updates to your beneficiary designations, if applicable. Please read your SPD for more details.

- Use the Retirekit tool to understand cash flow, interest rates, and explore which pension option might be the best fit for you as you approach your 50s or 60s.

We can help you utilize the Retirekit and provide you with enhanced knowledge about your personal retirement scenario. The Retirement Group offers a free consultation to help you plan for the future.

As you get closer to your retirement date, contact an AT&T focused advisor at The Retirement Group, and also read the applicable SPD Summary to start your retirement process.

Pension Payment Options

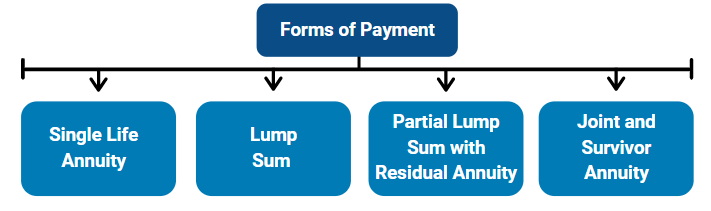

Lump Sum vs. Annuity: Making the Choice

Given the recent changes at AT&T, this choice is incredibly relevant to AT&T employees and retirees. Click here to watch our free webinar about lump-sum and annuity.

Interest Rates and Life Expectancy

AT&T's pension plan offers a choice between a lump-sum payout or a monthly pension. Plans may offer a lump sum option as a way to reduce their long-term liabilities — which can be beneficial to you, if interest rates are favorable at the time of retirement.

Generally, lower interest rates result in higher lump sum payouts, while rising interest rates can reduce the payouts.

As you approach retirement, monitor interest rates closely. A low-rate environment can increase the initial value of a lump sum, while a higher-rate environment can reduce it.

Additionally, life expectancy plays an important role. Younger retirees or those with longer life expectancies may find the annuity more attractive for its lifetime income guarantee — because they predict that they'll have more life to live. Those with shorter life expectancies, and those who want the potential to leave a lasting legacy to their families, might prefer the flexibility and benefits of a lump sum.

Timing Considerations

For AT&T employees nearing retirement, timing your pension payout can make a difference. AT&T allows employees to defer pension collection to a later date, which may be advantageous to you if you anticipate lower interest rates in the future. For example, if rates are expected to be lower in 2030 and you're planning to retire in 2029, deferring your pension to 2030 could help maximize your lump sum. According to AT&T’s Summary Plan Description, “If you do not wish to immediately elect to receive your Pension Benefit, you may elect to start receiving your Pension Benefit as of the first (1st) day of any month following your Termination of Employment and before reaching your Normal Retirement Age.”

Regularly calculating your pension options based on project interest rates, life expectancy, and personal needs for survivor benefits and tax planning will allow you to make the most of your AT&T retirement benefits. If you need a helpful advisor who's been through the process before, reach out for an introductory meeting today.

The AT&T 401(k) Plan

When was the last time you checked your AT&T 401(k)?

If it's been a while, you're not alone. About 59% of employers offering a 401(k) used auto-enrollment in 2021, according to CNBC. While this greatly boosts plan participation, it can also mean that individual employees are less likely to take their 401(k) into their own hands — or even to check it at all.

Do you know what's in your AT&T 401(k)?

Almost half of 401(k) investors don't know what investments are in their workplace retirement plan, per this CNBC survey. Because the vast majority of 401(k)s use a risk-adjusted target-date fund (TDF) as their default investment, this isn't necessarily a bad thing. However, it does mean that many Americans are leaving potential options on the table.

What happens to your AT&T 401(k) when you retire?

When you retire, if you have a balance in any 401(k) plan, you will receive a Participant Distribution Notice in the mail. This notice will show the current value that you are eligible to receive from each plan and explain your distribution options. It will also tell you what you need to do to receive your final distribution. You will also receive a Special Tax Notice Regarding Plan Payments, which will explain what the Federal tax implications may be for your vested account balance in your state. If you have questions about your options, please call The Retirement Group at (800)-900-5867 for more information. We can help get you in front of an AT&T-focused advisor.

Warning: If you voluntarily terminate your employment from AT&T, you will not be eligible to receive the annual contribution.

Net Unrealized Appreciation (NUA) Strategy for 401(k)s

When you qualify for a distribution in the United States, you have three options:

- Roll-over your qualified plan to an IRA and continue deferring taxes.

- Take a distribution and pay ordinary income tax on the full amount.

- Take advantage of Net Unrealized Appreciation (NUA) and reap the benefits of a more favorable tax structure.

Option 3 sounds promising, but it depends on one question: How does an NUA strategy actually work?

NUA Explained: As a prerequisite, an employee who wants to utilize NUA must be eligible for a distribution from their qualified plan. This is generally at retirement or age 59 1/2. Another prerequisite: NUA only applies to company stock that has been offered as a part of the 401(k) plan. In other words, if you're an employee, manager, or executive who has acquired AT&T stock through the AT&T 401(k), NUA could be a viable tax-efficient strategy for you.

To start the NUA strategy, the individual takes a "lump sum" distribution from the 401(k) plan, withdrawing all assets during a 1-year period. Any mutual fund holdings or other investments in the plan can be rolled into an IRA for further tax deferral, and are irrelevant to the NUA aspect of this strategy. The highly appreciated company stock is then transferred to a non-retirement account.

The tax benefit comes when you transfer the company stock from your 401(k) to a taxable account, like a brokerage account

For income tax purposes, the shares you received in your 401(k) plan have two parts: the cost basis, which is what you paid for the shares; and the appreciation, which is the current value of the shares minus the cost basis.

When you transfer the stock from your 401(k) to a taxable account, you trigger a taxable event. However, regular income tax is only applied to the cost basis of your stock. The appreciated value of the stock above its basis is not taxed at the higher ordinary income tax, but at the lower long-term capital gains rate, which is currently 15%. This means the NUA strategy could bring a potential savings of over 30%, depending on your tax bracket.

As an AT&T employee, you may be interested in understanding NUA from an experienced financial advisor. One of our advisors is showcasing this free webinar on understanding NUA. Click here to watch the complimentary webinar!

Taking strategic distributions from retirement accounts

Your retirement assets likely comprise a complex array several retirement accounts, IRAs, 401(k)s, taxable accounts, and others. What is the most efficient way to take your retirement income?

You may want to consider meeting your income needs in retirement by first drawing down taxable accounts rather than tax-deferred accounts. By taking retirement distributions from taxable accounts first, you'll allow the investments in tax-deferred accounts to grow further, maximizing tax-efficient growth.

However, keep in mind that you'll need to take required minimum distributions (RMDs) from any employer-sponsored retirement plans and traditional or rollover IRA accounts due to IRS requirements. If you don't take your RMDs at age 73, the IRS may assess a stiff penalty on the amount you should have withdrawn.

Two flexible distribution options for your IRA

When you need to draw on your IRA for income or take your RMDs, you have a few choices. Regardless of what you choose, IRA distributions are subject to income taxes and may be subject to penalties and other conditions if you’re under 59½.

- Partial withdrawals: Withdraw any amount from your IRA at any time. If you’re 73 or over, you’ll have to take at least enough from one or more IRAs to meet your annual RMD.

- Systematic withdrawal plans: Structure regular, automatic withdrawals from your IRA by choosing the amount and frequency to meet your retirement income needs. If you’re under 59½, you may be subject to a 10% early withdrawal penalty (unless your withdrawal plan meets Code Section 72(t) rules).

Your financial advisor can help you understand distribution options, determine RMD requirements, calculate RMDs, and set up a systematic withdrawal plan.

Don't have a financial advisor yet, or looking for a fresh start? Reach out to The Retirement Group and set up an appointment with one of our AT&T-focused advisors today.

The 401(k) benefits of working with a financial advisor

When faced with a problem or challenge, many of us are programmed to try to figure it out on our own rather than ask for help. But with 401(k) investing, choosing to go it alone rather than get help can significantly impact your outcomes, especially as you approach your 60s. That's why it's important to work with an advisor experienced with AT&T retirement benefits. According to a study from Charles Schwab, the annual performance gap between those who get help and those who do not is 3.32% net of fees. This means a 45-year-old participant could see a 79% boost in wealth by age 65 simply by contacting an advisor. That’s a big difference.

If you're looking for guidance from an advisor who's been through it before, reach out to a The Retirement Group advisor today. Remember, the benefits of getting help go beyond convenience.

Strategies to leverage your 401(k) before retirement

Did you know that there are ways you can tap into and leverage your 401(k) funds before retirement? Although these strategies may not apply to every situation, you may be able to use your 401(k) to bridge certain gaps in your financial plan.

Strategy #1. In-service withdrawals and 401(k) rollovers

An in-service withdrawal is when an employee takes money from their 401(k) while they're still employed. In-service withdrawals are a way that you can access money from your 401(k) early, and potentially roll it over into a different account type:

- Eligibility. In-service withdrawals are generally available to employees after they reach age 59 and a half, so they avoid the 10% early withdrawal penalty. However, some plans allow for earlier access to 401(k) funds under circumstances such as financial hardship.

- IRA rollover. These withdrawals are often used to roll over funds into an IRA or another retirement account while you're still employed. A direct rollover can avoid the 10% early withdrawal penalty, as well as any mandatory tax withholding. Rolling over your 401(k) into an IRA is a popular option for those looking for more control over their retirement savings. While your 401(k) might limit investment choices, IRAs can offer a broader range of investments.

- Tax implications. If your in-service withdrawal is not rolled over into an IRA, you may face income tax on the amount withdrawn.

It’s important to know that certain withdrawals are subject to regular federal income tax and you may also be subject to an additional 10% penalty tax depending on your age. You can determine if you’re eligible for a withdrawal, and request one, online or by calling your AT&T Benefits Center in the United States. Your plan summary outlines more information and possible restrictions on rollovers and withdrawals. You should also know that the plan administrator reserves the right to modify the rules regarding withdrawals at any time, and may further restrict or limit the availability of withdrawals for administrative or other reasons. All plan participants will be advised of any such restrictions, and they apply equally to all employees at AT&T.

However, you may not be making an in-service withdrawal to roll over your 401(k). If you need the money now, you may be withdrawing because you think you have no better option.

Taking a withdrawal permanently reduces your retirement savings and can be subject to tax. As such, you could consider taking a loan from your 401(k) to meet pressing financial needs, rather than a withdrawal.

Strategy #2. Taking a loan from your 401(k)

If you need money quickly, such as if you lose your job, face a serious health emergency, or need a lot of cash for some other reason, borrowing from your 401(k) can be an option. Banks will make you jump through many hoops for a personal loan, and credit cards charge too much interest... suddenly, your 401(k) balance might start looking like a usable asset.

Unlike an in-service withdrawal, a loan must be paid back. However, they are not taxable (unless you fail to repay them).

While taking a loan from your 401(k) may seem like a quick solution, it's important to consider the potential implications.

- Borrowing from the future. First and foremost, you may be setting your retirement plan back by a some time if you take money from your future and use it today.

- Lost growth potential. Even though you'll repay the loan, those funds will miss out on potential growth through investments during the repayment period. This can create a gap in your portfolio, especially if the market performs well while your money is out of the account.

- Repayment issues. If you leave your employer or lose your job, you may be forced to pay thee full loan within a short time frame. If you're unable to, the loan can be treated as an early withdrawal — and be penalized and taxed as such.

Borrowing from your 401(k) should be considered a last resort. If you're concerned that you may need to take a loan from your 401(k) to make ends meet, reach out to a The Retirement Group advisor today. We can help you integrate your loan into your holistic financial plan.

AT&T Retiree Health Care & Benefits

Health care costs are increasing drastically. According to the Centers for Medicare & Medicaid Services, health care in 2022 accounted for over 17% of the United State's GDP — which amounted to $4.5 trillion.

This raises the question: How will you be paying for health care in retirement?

Using an HSA for retirement health care

Health Savings Accounts (HSAs) are tax-advantaged accounts designed for individuals with high-deductible insurance plans. For 2024, the IRS defines high-deductible plans as those with a minimum deductible of $1,600 for individuals, or $3,200 for families.

HSAs are often celebrated for their utility in managing health care expenses in a tax-smart way, with three primary benefits:

- HSAs allow contributions to be made pre-tax.

- Investments within HSAs grow tax-free.

- Withdrawals are tax-free for qualified medical expenses.

Thanks to this triple tax advantage, HSAs are a potent retirement savings vehicle, especially after you've maxed out the employer match to your 401(k) in the United States.

HSA Contribution Limits & Retirement Strategy

In 2024, individuals can contribute $4,150 to an HSA, and families can contribute $8,300. Those aged 55 and older can contribute an additional $1,000.

When it comes to its place in your retirement toolbelt, HSAs really shine after you reach your employer's maximum match in 401(k) contributions. While 401(k)s offer tax-deductible contributions and tax-deferred growth, their withdrawals are taxable. HSAs bypass the withdrawal tax for qualified medical expenses, which are a significant (and increasing!) portion of retirement costs.

However, after age 65, the HSA flexes its muscles even more. After this age, funds can be withdrawn for any purpose, and subject to only regular income tax if used for non-medical expenses. This flexibility offers the benefits of traditional retirement accounts, but with the added advantage of tax-free withdrawals for qualified medical costs.

Further, HSAs to not have Required Minimum Distributions (RMDs) like 401(k)s and Traditional IRAs do, offering more control over tax planning in retirement. This makes HSAs particularly relevant for those who don't anticipate needing all of their funds right away in retirement — or who want to minimize their taxable income, perhaps as a part of a deferred compensation strategy.

HSA Investment Strategy Insights: Initially, conservative investment within an HSA is prudent. Early on, it's important to focus on ensuring that you have sufficient liquid funds to cover near-term deductible and out-of-pocket medical expenses. However, once you've established a solid financial cushion, treating an HSA like a retirement account by investing in a diversified mix of assets can significantly boost long-term opportunity — and flexibility.

What can an HSA cover?

In retirement, HSAs can cover a range of expenses:

- Medical expenses. You can use HSA funds tax-free for qualified medical expenses, which include most doctor visits, prescriptions, and dental or vision care.

- Medicare premiums. HSA funds can pay for Medicare Part B, Part D, and Medicare Advantage premiums.

- Long-term care. HSA funds can cover some amount of qualified long-term care insurance premiums or services.

- Non-medical expenses. After age 65, you can withdraw HSA funds for non-medical expenses without penalty, although these withdrawals will be taxed as regular income.

HSAs are a powerful retirement tool, with unique advantages that can augment your AT&T health care benefits. By making strategic contributions and considerate withdrawals, you can maximize your financial health in retirement, while also prioritizing your physical health.

AT&T Life Insurance if your employment ends

Your life insurance coverage, along with any optional coverage for your spouse, domestic partner, or children, ends on the date your employment ends, unless your employment ends due to a disability. If you pass away with 31 days after your termination date, benefits will be paid to your beneficiary for both your basic and any additional life insurance you elected.

Important notes on AT&T life insurance:

- You may have the option to convert your AT&T life insurance into an individual policy, or choose portability for any optional coverage.

- Coverage will end if you stop paying supplementary contributions.

- If you are over a certain age and have supplemental life insurance, you should receive a mailing from the insurance company outlining your options.

- Remember to update your beneficiaries. See the Summary Plan Description for more details.

AT&T Beneficiary Designations

When you're retirement and estate planning, it's important to remember to name someone to receive the proceeds of your benefits programs in the event of your death. These designations, known as "beneficiary designations", are how AT&T will know whom to send your final compensation and benefits to.

Simply stating in your will how you want the money in a retirement account to be distributed is not enough. You must have an up-to-date beneficiary designation to make sure your assets go where you intended.

Beyond just retirement accounts, beneficiary designations are used for life insurance payouts, pension, and even some bank or savings accounts.

Next steps:

- When you retire, make sure that you update your beneficiaries. AT&T has an Online Beneficiary Designation form for life events such as death, marriage, divorce, child birth, adoptions, and more.

- If you are unsure about how to align your AT&T beneficiary designations with your overall financial plan, schedule a call to speak with one of our AT&T-focused advisors.

Social Security & Medicare for AT&T Employees

Claiming Social Security is one thing — understanding the "why" behind your claim is something else entirely. Understanding Social Security is a difficult but crucial step towards your retirement paycheck. For many Americans, Social Security benefits are core to their retirement income strategy. However, when and why you claim them depends on your overall withdrawal strategy.

Next, let's explore three main steps you should follow to solidify your Social Security strategy at AT&T:

Step 1. Decide when to claim your Social Security benefits.

Social Security benefits can be significant, but at the end of the day, they're just one part of your overall financial picture. When considering the timing of your claim, keep this general principle in mind: The later you begin receiving benefits, the larger those benefits will be.

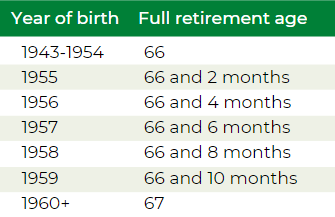

The full monthly Social Security retirement benefit is based on applying at the Full Retirement Age (FRA), which is age 67 for those born 1960 or later. For every year you wait after you reach the FRA, your benefit amount increases 8%. It reaches a maximum at age 70. If we do the math, we can determine that, if you start claiming at age 70, your monthly benefit will be 124% the full benefit.

However, you can also apply before you reach FRA, as early as age 62. You will receive a reduced benefit if you do so, but this option could make sense for those who want to start claiming their benefit earlier for longevity reasons.

Step 2. Understand the tax implications.

For all but the lowest income retirees, Social Security benefits are actually taxable. Only individuals with provisional income under $25,000, or $32,000 if married filing jointly, receive their benefits tax-free. Otherwise, up to 85% of your benefits will be treated as taxable income.

Furthermore, depending on where you live, your Social Security benefits may even be taxed at the state level. If you plan to move for retirement, the tax regime in the state you're moving to can be a relevant consideration.

Step 3. Start preparing today.

Even if your retirement is right around the corner, you can make decisions today that will impact you for years, or decades, to come. For instance, delaying your Social Security claiming date even a year or two can snowball into a significant benefit. To bridge the gap between their retirement date and their claiming date, some people create a "slush fund" while they're working to take the place of the Social Security benefits they would receive from claiming at FRA. Whether these funds come from a 401(k), IRA, or brokerage account, integrating a bit of extra padding in your planning can pay off in the long run.

Always remember, your Social Security benefit is just one part of your overall financial picture. And when you start to consider tax implications, withdrawal sequencing, and effective diversification (beyond just the asset class), the picture can start to get complicated. That's what we're here to help with. At The Retirement Group, we've been assisting AT&T employees to and through retirement for years. If you're interested in speaking with an experienced advisor who's been through the process before, reach out today.

AT&T Medicare Coverage for Retirees

Are you eligible for Medicare or will be soon? If you or your dependents are eligible after you leave AT&T, Medicare generally becomes the primary coverage for you or any of your dependents as soon as they are eligible for Medicare. This will affect your company-provided medical benefits.

It's your responsibility to enroll in Medicare Parts A and B when you first become eligible — and you must stay enrolled to have coverage for Medicare-eligible expenses. This applies to your Medicare-eligible dependents as well.

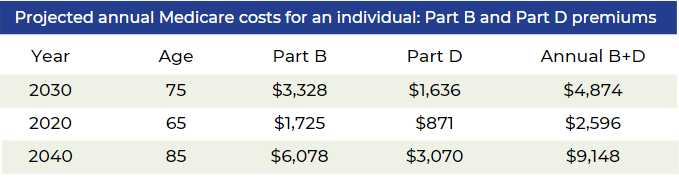

The Reality of Medical Costs in Retirement

Divorce and Retirement Planning

Divorce and Retirement Benefits Explained

Social Security Benefits. Divorce can significantly impact retirement benefits, including Social Security. Understanding how divorce affects Social Security is essential for retirement planning, especially if you were married for a substantial period. In some cases, divorced individuals may be eligible to claim benefits based on their former spouse's work record.

You can apply for a divorced spouse’s benefit if the following criteria are met:

- You’re at least 62 years of age.

- You were married for at least 10 years prior to the divorce.

- You are currently unmarried.

- Your ex-spouse is entitled to Social Security benefits.

- Your own Social Security benefit amount is less than your spousal benefit amount, which is equal to one-half of what your ex’s full benefit amount would be if claimed at Full Retirement Age (FRA).

Unlike a married couple, your ex-spouse doesn’t have to have filed for Social Security before you can apply for your divorced spouse’s benefit. However, this caveat only applies if you’ve been divorced for at least two years, and your ex is at least 62 years of age. If the divorce was less than two years ago, your ex must already be receiving benefits before you can file as a divorced spouse.

Social Security Survivor Benefits. Many people are surprised that divorce doesn't disqualify you from receiving survivor benefits if your spouse dies. You can claim a divorced spouse's survivor benefit if the following conditions are met:

- Your ex-spouse is deceased.

- You are at least 60 years old.

- You were married for at least 10 years.

- You are single, or you remarried after age 60.

If you qualify for survivor benefits and your own Social Security benefits, you can choose to start with survivor benefits and switch to your own later, or vice versa, depending on which option gives you the highest payout over time. If this pertains to you, we recommend speaking to a qualified financial advisor — because planning your Social Security strategy in advance is critical to maximizing your outcomes.

Your AT&T Pension and Divorce

If you're getting a divorce near or in retirement, there are a number of steps you must take before starting your AT&T pension. For each former spouse who may have an interest in your pension benefit, you'll need to provide AT&T with the following documentation:

- A copy of the court-filed Judgment of Dissolution or Judgment of Divorce along with any Marital Settlement Agreement (MSA)

- A copy of the court-filed Qualified Domestic Relations Order (QDRO)

You must provide AT&T with any requested documentation to avoid having your pension benefit delayed or suspended. To find out more information on strategies if divorce is affecting your retirement benefits, please give us a call.

Note: You’ll need to submit this documentation to your company’s online pension center regardless of how old the divorce or how short the marriage.

Are you in the process of divorcing close to retirement?

If your divorce isn’t final before your retirement date, you’re still considered married. You have two options regarding your AT&T pension:

- Retire before your divorce is final and elect a joint pension of at least 50% with your spouse — or get your spouse’s signed, notarized consent to a different election or lump sum.

- Delay your retirement until after your divorce is final and you can provide the required divorce documentation.

Survivor Checklist: Preparing Your Loved Ones for Their Benefits

If you aren't able to collect your retirement benefits because of your death, it's critically important for your surviving loved ones to be prepared to take action. It will be their responsibility to collect their survivor benefits. By following the tips in these three sections, you can prepare your loved ones to make the most of the benefits that they're entitled to:

In the event of your death...

If you die, there are two specific actions that your survivor needs to take promptly:

- Report your death. Your spouse, a family member, or even a friend should call AT&T's benefits service center as soon as possible to report your death.

- Collect life insurance benefits. Your named beneficiary, be it your spouse or someone else, will need to call AT&T's benefits service to collect their entitled life insurance benefits.

If you have a joint pension...

If you have have a joint pension through AT&T, your joint pensioner must start the payments following your death.

- Understand the joint pension details. Note that the joint pension is not automatic. Your joint pensioner will need to complete and return the paperwork from AT&T's pension center to start receiving payments.

- Be prepared to cover the gap. Your joint pensioner will need to be prepared with enough savings to bridge at least one month between the end of your regular pension payments and the beginning of the joint pension payments. For someone in their50s or 60s, this is especially important.

If your survivor has AT&T medical coverage...

If your survivor relies on AT&T for medical coverage, they must now decide whether to keep that coverage.

If they are enrolled as a dependent in the AT&T-sponsored retiree medical coverage when you die, they need to decide whether to keep it. Note that survivors in your state may be required to pay the full monthly premium.

Life After Your Career at AT&T

In decades past, our parents and grandparents have considered retirement to be the end of "working" in one's life. After all, why else would you call it retirement?

However, more recently, there has been an increasing trend towards working in retirement. Whether you're a business owner who exited but still has that "itch", or you're a professional considering the extra income, working in retirement can provide a variety of benefits.

Financial benefits of working in retirement

If you started saving late, or lost some of your investments in market downturns, working in retirement can help you fill in the gaps.

Maybe you took a great offer at a company, but left earlier than you wanted — and with less retirement savings than you needed. Instead of drawing down your savings early in retirement, you can work a little longer to make up the difference.

Working in retirement can also help you meet your day-to-day financial requirements. Expenses in retirement can actually unexpectedly increase, and the cost of living in the United States continues to rise. By working in retirement, you may be able to keep these expenses down, especially if your employer offers benefits like health care coverage.

Emotional benefits of working in retirement

While the financial benefits are real, retaining employment or exploring new opportunities can provide emotional benefits in retirement. It can help you stay active and involved, while giving you the chance to use the skills you've worked so hard to develop across your career.

Of course, many of us also just enjoy working. Providing value to others through work is a core part of being a human. Just because the Social Security Administration set a retirement age doesn't mean you have to listen!

Are you an AT&T employee interested in planning for retirement? Click here to register for our upcoming live webinars tailored for AT&T employees.

Sources

7.png)

- - “National Compensation Survey: Employee Benefits in the United States, March 2019," Bureau of Labor Statistics, U.S. Department of Labor.

- - “Generating Income That Will Last throughout Retirement.” Fidelity, 22 Jan. 2019, www.fidelity.com/viewpoints/retirement/income-that-can-last-lifetime.

- - “Retirement Plans-Benefits & Savings.” U.S. Department of Labor, 2019, www.dol.gov/general/topic/retirement.

- - AT&T Summary Plan Description, 2018

- - https://seekingalpha.com/article/4268237-order-withdrawals-retirement-assets

- - https://www.aon.com/empowerresults/ensuring-retirees-get-health-care-need/

- - 8 Tenets when picking a Mutual Fund e-book

- - Determining Cash Flow Need in Retirement e-book

- - Early Retirement Offers e-book

- - Lump Sum vs. Annuity e-book

- - Social Security e-book

- - Rising Interest Rates e-book

- - Closing The Retirement Gap e-book

- - Rollover Strategies for 401(k)s e-book

- - How to Survive Financially After a Job Loss e-book

- - Financial PTSD e-book

- - RetireKit

- - What has Worked in Investing e-book

- - Retirement Income Planning for ages 50-65 e-book

- - Strategies for Divorced Individuals e-book

- - TRG Webinar for AT&T Employees

- - Composite Corp Bond Rate history (10 years)http://www.irs.gov/retirement/article/0,,id=123229,00.html https://www.irs.gov/retirement-plans/composite-corporate-bond-rate-table

- - IRS 72(t) code: https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-tax-on-early-distributions

- - Missing out: How much employer 401(k) matching contributions do employees leave on the table?

- - Jester Financial Technologies, Worksheet Detail - Health Care Expense Schedule

- - Social Security Administration. Benefits Planner: Income Taxes and Your Social Security Benefits. Social Security Administration. Retrieved October11, 2016 from https://www.ssa.gov/planners/taxes.html

Historical National Health Expenditure Accounts, Centers for Medicare & Medicaid Services (CMS)

Putting a value on your value: Quantifying Vanguard Adviser’s Alpha