Retirement Guide for Verizon Employees

By: Tammy Mogilski

Author:

Tammy Mogilski - Senior Vice President, Financial Advisor CLU®, ChFC®, CFP®

In our comprehensive retirement guide for Verizon employees, we go through many factors which you may take into account when deciding on the proper time to retire from Verizon. Some of those factors include: healthcare & benefit changes, interest rates, the new 2024 tax rates, inflation, and much more. Keep in mind we are not affiliated with Verizon, and we recommend reaching out to your corporate benefits department for further information.

Table of Contents

2024 Tax Changes & Inflation

It is imperative for individuals to be aware of new changes made by the IRS. The main factors that will impact employees will be the following:

- The 2024 standard deduction will increase to $14,600 for single filers and those married filing separately, $29,200 for joint filers, and $21,900 for heads of household.

- Taxpayers who are over the age of 65 or blind can add an additional $1,550 to their standard deduction. That amount jumps to $1,950 if also unmarried or not a surviving spouse.

Retirement account contributions: Contributing to your company's 401k plan can cut your tax bill significantly, and the amount you can save has increased for 2024. The amount individuals can contribute to their 401(k) plans in 2024 will increase to $23,000 -- up from $22,500 for 2023. The catch-up contribution limit for employees age 50 and over will increase to $7,500.

There are important changes for the Earned Income Tax Credit (EITC) that you, as a taxpayer employed by a corporation, should know:

- The tax year 2024 maximum Earned Income Tax Credit amount is $7,830 for qualifying taxpayers who have three or more qualifying children, up from $7,430 for tax year 2023.

- Married taxpayers filing separately can qualify: You can claim the EITC as married filing separately if you meet other qualifications. This was not available in previous years.

Deduction for cash charitable contributions: The special deduction that allowed single nonitemizers to deduct up to $300—and married filing jointly couples to deduct $600— in cash donations to qualifying charities has expired.

Child Tax Credit changes:

- The maximum tax credit per qualifying child is $2,000 for children five and under – or $3,000 for children six through 17 years old. Additionally, you can't receive a portion of the credit in advance, as was the case in 2023.

- As a parent or guardian, you are eligible for the Child Tax Credit if your adjusted gross income is less than $200,000 when filing individually or less than $400,000 if you're filing a joint return with a spouse.

- A 70 percent, partial refundability affecting individuals whose tax bill falls below the credit amount.

2024 Tax Brackets

Inflation reduces purchasing power over time as the same basket of goods will cost more as prices rise. In order to maintain the same standard of living throughout your retirement after leaving your company, you will have to factor rising costs into your plan. While the Federal Reserve strives to achieve a 2% inflation rate each year, in 2023 that rate shot up to 4.9% which was a drastic increase from 2020’s 1.4%. While prices as a whole have risen dramatically, there are specific areas to pay attention to if you are nearing or in retirement from your company, like healthcare.

It is crucial to take all of these factors into consideration when constructing your holistic plan for retirement from your company.

*Source: IRS.gov, Yahoo, Bankrate, Forbes

Schedule An Appointment with a Retirement Group Advisor

Please choose a date that works for you from the available dates highlighted on the calendar.

Recent Layoff Announcements & Other Verizon News

Planning Your Retirement

Retirement planning is a verb; consistent action must be taken whether you’re 20 or 60.

The truth is that most Americans don’t know how much to save or the amount of income they’ll need.

No matter where you stand in the planning process, or your current age, we hope this guide provides you a good overview of the steps to take and resources that help you simplify your transition from your company into retirement and get the most from your benefits.

You know you need to be saving and investing, especially since time is on your side the sooner you start, but you don’t have the time or expertise to know if you’re building retirement savings that can last after leaving your company.

"A separate study by Russell Investments, a large money management firm, came to a similar conclusion. Russell estimates a good financial advisor can increase investor returns by 3.75 percent."

Source: Is it Worth the Money to Hire a Financial Advisor? The Balance, 2021

Starting to save as early as possible matters. Time on your side means compounding can have significant impacts on your future savings. And, once you’ve started, continuing to increase and maximize your contributions for your 401(k) plan is key.

There's a 79% potential boost in wealth at age 65 over a 20-year period when choosing to invest in your company's retirement plan.

*Source: Bridging the Gap Between 401(k) Sponsors and Participants, T.Rowe Price, 2020

As decades go by, you’re likely full swing into your career at your company and your income probably reflects that. However, the challenges of saving for retirement start coming from large competing expenses: a mortgage, raising children, and saving for their college.

One of the classic planning conflicts is saving for retirement versus saving for college. Most financial planners will tell you that retirement from your company should be your top priority because your child can usually find support from financial aid while you’ll be on your own to fund your retirement.

How much we recommend that you invest towards your retirement is always based on your unique financial situation and goals. However, consider investing a minimum of 10% of your salary toward retirement through your 30s and 40s.

As you enter your 50s and 60s, you’re ideally at your peak earning years with some of your major expenses, such as a mortgage or child-rearing, behind you or soon to be in the rearview mirror. This can be a good time to consider whether you have the ability to boost your retirement savings goal to 20% or more of your income. For many people, this could potentially be the last opportunity to stash away funds.

In 2024, workers age 50 or older can invest up to $23,000 into their retirement plan/401(k), and once they meet this limit, they can add an additional $7,500 in catch-up contributions for a combined annual total of $30,500. These limits are adjusted annually for inflation.

Why are 401(k)s and matching contributions so popular?

These retirement savings vehicles give you the chance to take advantage of three main benefits:

- Compound growth opportunities (as seen above)

- Tax saving opportunities

- Matching contributions

Matching contributions are just what they sound like: your company matches your own 401(k) contributions with money that comes from the company. If your company matches, the company money typically matches up to a certain percent of the amount that you put in.

Unfortunately, many people fail to take advantage of their company's matching contributions because they’re not contributing the required minimum to receive the full company match.

According to Bank of America's "2022 Financial Life Benefit Impact Report", despite 58% of eligible employees participating in a 401(k) plan, 61% of them contributed less than $5,000 during the current year.

The study also found that fewer than one in 10 participants’ contributions reached the ceiling on elective deferrals, under IRS Section 402(g) — which is $23,000 for 2024.

A 2020 study from Financial Engines titled “Missing Out: How Much Employer 401(k) Matching Contributions Do Employees Leave on the Table?”, revealed that employees who don’t maximize their company match typically leaves $1,336 of extra retirement money on the table each year.

For example, if your company will match up to 3% of your plan contributions and you only contribute 2% of your salary, you aren’t getting the full amount of the company match. By simply increasing your contribution by just 1%, your company is now matching the full 3% of your contributions for a total combined contribution of 6%. By doing so, you aren’t leaving money on the table.

Your Pension Plan

Verizon Cash Balance Pension

The Verizon Cash Balance Pension Plan is a type of defined benefit plan where the benefits are defined in terms of a hypothetical account balance.

The Verizon Management Pension Plan is available for managers and associates who have become fully vested employees as of October 28, 2012.

For Associates: You must accrue 15 years of service and at least 76 Points (years of age + years of service) - age penalties (3% per year until age 55).

For Managers: You must accrue 75 points (years of age + years of service) - age penalties (3% per year until age 55). If you have accrued at least 30 years of service, then NO age penalties will apply, and you will receive your full benefit unadjusted for early retirement.

Unlike traditional pension plans that base benefits on a final average pay formula, a cash balance plan credits a participant's account with a certain percentage of their pay each year, plus interest credits.

How the Verizon Cash Balance Pension Plan Works:

Account Credits:

● Pay Credits: Each year, Verizon credits the employee's cash balance account with a percentage of their eligible compensation. The percentage is typically based on the employee's age or years of service, or a combination of both. Example Pay Credit Structure:

○ Under 30 years of service: 4% of eligible compensation

○ 30-40 years of service: 5% of eligible compensation

○ Over 40 years of service: 6% of eligible compensation

● Interest Credits: In addition to pay credits, the plan adds interest to the account balance each year. The interest rate is typically tied to a specified index, such as the 30-year

Treasury bond rate, and may vary from year to year. Example Interest Credit:

○ If the interest credit rate for a given year is 4%, then the employee's account balance would grow by 4% due to interest in that year.

Age Penalties:

For Managers: You must accrue 75 points (years of age + years of service) - age penalties (3% per year until age 55). If you have accrued at least 30 years of service, then NO age penalties will apply, and you will receive your full benefit unadjusted for early retirement.

For Associates: You must accrue 15 years of service and at least 76 Points (years of age + years of service) - age penalties (3% per year until age 55).

The Associate formula for calculating your annual benefit is as follows:

(Pension Band x Years of Service) - Applicable Age Penalties X 12 = Annual Pension Benefit

Vesting:

Employees generally become vested in their cash balance accounts after completing five years of service. Once vested, the employee has a non-forfeitable right to their account balance, even if they leave the company before retirement.

Payout Options:

Upon retirement or separation from service, the employee can typically choose to receive the account balance as a lump sum payment or as an annuity. The lump sum is the actual balance of the account, while the annuity is a series of payments calculated based on the account balance and the employee’s life expectancy.

Example Calculation: (management)

Let’s say an employee has 20 years of service and an eligible compensation of $80,000 per year.

Step 1: Calculate the Pay Credit for the Year:

● Pay Credit Rate: 4% (based on years of service)

● Pay Credit: 4% of $80,000 = $3,200

Step 2: Calculate the Interest Credit for the Year:

● Starting Account Balance: $100,000

● Interest Rate: 4%

● Interest Credit: 4% of $100,000 = $4,000

Step 3: Determine the Year-End Account Balance:

● Starting Account Balance: $100,000

● Plus Pay Credit: $3,200

● Plus Interest Credit: $4,000

● Year-End Account Balance: $100,000 + $3,200 + $4,000 = $107,200

At the end of the year, the employee's cash balance account would total $107,200, which includes the original $100,000 balance, the $3,200 pay credit, and the $4,000 interest credit.

How It Differs from Traditional Pension Plans:

Unlike traditional defined benefit plans, which promise a specific monthly benefit at retirement based on salary and years of service, a cash balance plan provides an account balance that grows each year. This makes the benefit more understandable and portable for employees, as it functions somewhat like a defined contribution plan but with guaranteed growth through the interest credits.

Verizon Defined Benefit Pension Plan

The Verizon Defined Benefit Pension Plan offers eligible employees a defined benefit retirement plan, providing them with a steady income after retirement. The plan's benefits are based on a formula that considers factors such as years of service, final average pay, and the employee's age at retirement.

Key Features of the Verizon Pension Plan:

Eligibility:

Participation: Generally, full-time, part-time, and certain hourly employees who are not covered by a collective bargaining agreement are eligible to participate in the Verizon Pension Plan. The specific eligibility requirements can vary depending on the employee's hire date and other factors.

Benefit Calculation:

Final Average Pay Formula: The pension benefit is typically calculated using a "Final Average Pay" formula. This formula considers the employee's highest average pay over a specified number of consecutive years (often the last five years of service) and applies a percentage multiplier based on the total years of service.

Service Credits: Employees earn service credits for each year of employment with Verizon, which increases their pension benefit.

Example Calculation:

Employee Final Average Pay: $100,000

Years of Service: 25 years

Multiplier: 1.5% per year of service

Pension Benefit:

Annual Pension Benefit = Final Average Pay × Years of Service × Multiplier

Annual Pension Benefit = $100,000 x 25 x .015 = $37,500

In this example, the employee would receive an annual pension of $37,500 upon retirement.

Vesting:

Vesting Schedule: Employees typically become fully vested in their pension benefits after five years of service. Once vested, employees have the right to receive the pension benefits upon reaching retirement age, even if they leave the company before retirement.

Retirement Age:

Normal Retirement Age: The plan's normal retirement age is generally 65, but employees may retire earlier or later, with adjustments made to their benefits depending on the retirement age.

Early Retirement: Employees who retire before the normal retirement age may receive reduced benefits. The reduction is typically based on how many years before the normal retirement age they choose to retire.

Additional Plan Features:

● Survivor Benefits: The Verizon Pension Plan often includes options for providing survivor benefits to a spouse or other designated beneficiaries. This allows employees to elect a reduced pension benefit to ensure that their spouse continues to receive benefits after their death.

● Lump-Sum Option: Some employees may have the option to receive their pension benefits as a lump sum instead of as a monthly annuity. The availability of this option and the calculation method varies depending on the employee's circumstances and the specific provisions of the plan.

Final Average Pay (FAP) Calculation

Final Average Pay is generally determined by taking the average of an employee’s highest consecutive years of pay during their employment. For Verizon, this often involves the highest five consecutive years of pay, though the specific period may vary depending on the plan details.

Earnings Included in FAP

○ Base Salary: Regular salary or wages.

○ Bonuses and Incentive Pay: Certain bonuses and incentive payments may be included.

○ Overtime and Shift Differentials: Depending on the plan, these may also be included.

Years of Pay Considered

○ The plan typically considers the highest five consecutive years of pay. This could be the last five years of employment if those are the highest, or another period if earlier years had higher earnings.

Example Calculation:

Let’s say an employee has the following earnings in their highest five consecutive years:

● Year 1: $85,000

● Year 2: $90,000

● Year 3: $92,000

● Year 4: $94,000

● Year 5: $96,000

Final Average Pay Calculation:

Final Average Pay = (85,000 + 90,000 + 92,000 + 94,000 + 96,0005) / 5 = $91,400

In this example, the employee's Final Average Pay would be $91,400.

Age Penalties and Reductions in the Defined Benefit Final Average Pay Formula

The Verizon Pension Plan includes provisions for age penalties and reductions that apply when an employee retires before reaching the plan’s normal retirement age, typically set at 65. These penalties are designed to account for the longer period over which benefits will be paid if an employee retires early, resulting in a reduced pension benefit.

Age Penalties and Early Retirement Reductions:

The Verizon Pension Plan’s Defined Benefit Final Average Pay (FAP) formula calculates retirement benefits based on an employee’s final average pay, years of service, and a multiplier. However, if an employee chooses to retire before the normal retirement age, their pension

benefit is reduced to reflect the longer payout period. This reduction is applied through an age-related penalty, typically calculated as a percentage reduction for each year the employee retires before the age of 65.

Key Points:

1. Normal Retirement Age: The plan generally considers 65 as the normal retirement age, with full benefits available to employees retiring at this age.

2. Early Retirement Penalty: If an employee retires before age 65, a reduction is applied to the pension benefit. This reduction is often a fixed percentage (e.g., 5-6%) per year that the retirement age is below 65.

Example Calculation:

Assume an employee has the following pension characteristics:

● Final Average Pay: $80,000

● Years of Service: 30 years

● Multiplier: 1.5% per year of service

● Retirement Age: 60 (5 years before normal retirement age)

● Reduction Rate: 6% per year early

Step 1: Calculate the Full Pension Benefit (without reduction):

Annual Pension Benefit = Final Average Pay × Years of Service × Multiplier

Annual Pension Benefit =80,000 × 30 × 0.015 = 36,000

Step 2: Apply the Early Retirement Reduction:

The reduction for retiring 5 years early would be: 6% × 5 years = 30% total reduction

Step 3: Calculate the Reduced Pension Benefit:

Reduced Annual Pension Benefit = 36,000 × (1−0.30) =$25,200 per year

In this example, if the employee retires at age 60, five years before the normal retirement age, their annual pension would be reduced from $36,000 to $25,200 due to the 30% penalty.

Why Age Penalties Exist:

The purpose of these reductions is to balance the longer period during which the pension benefits will be paid if an employee retires early. Since the pension plan is designed to provide lifetime income, retiring earlier than the normal retirement age extends the period over which the benefits are paid, necessitating a lower annual amount to ensure the plan's financial sustainability.

Verizon Stock Options and Restricted Stock Units (RSUs)

Verizon offers stock-based compensation to eligible employees, including stock options and Restricted Stock Units (RSUs), as part of its Long Term Incentive Plan (LTI). These equity awards are designed to align the interests of Verizon employees with those of shareholders by providing employees with an opportunity to share in the company’s success.

Stock Options:

Verizon offers stock-based compensation, including stock options and Restricted Stock Units (RSUs), as part of its Long-Term Incentive Plan (LTI). These equity awards are designed to incentivize and retain key employees by aligning their interests with those of the company’s shareholders.

They provide employees the right to purchase a specified number of shares of Verizon common stock at a predetermined price, known as the exercise or strike price, after a certain period (the vesting period) has elapsed. The options typically have an expiration date, after which they can no longer be exercised.

- * Vesting: Stock options at Verizon generally vest over a period of time, meaning employees must remain with the company for a certain number of years before they can exercise the options.

- *Exercise Price: The exercise price is usually set at the market price of Verizon’s stock on the date the options are granted. If the stock price rises above the exercise price, employees can purchase the stock at the lower exercise price, potentially selling it later at the current market price for a profit.

- * Expiration Date: Stock options come with an expiration date, often 10 years from the grant date, after which they can no longer be exercised.

* Eligibility: Stock options are generally awarded to higher-level executives, senior managers, and key employees who play a crucial role in the company’s success. The availability of stock options and the number granted typically depend on the employee’s position within the company, their performance, and their potential impact on Verizon’s long-term goals.

Restricted Stock Units (RSUs):

RSUs are another form of equity compensation offered by Verizon. An RSU is a promise to deliver shares of Verizon stock to the employee at a future date, subject to vesting requirements. Unlike stock options, RSUs do not require an employee to purchase the stock; they receive the stock outright once the RSUs vest.

- * Vesting Schedule: Like stock options, RSUs vest over a specified period, typically three years. Once vested, the employee receives shares of stock, which can be sold or held.

- * Dividend Equivalents: RSUs may include dividend equivalents, which provide employees with additional shares or cash payments equivalent to the dividends that would have been paid on the shares during the vesting period.

* Settlement: Upon vesting, RSUs are typically settled in shares of Verizon common stock, although some plans may allow or require cash settlement. - * Eligibility: RSUs are typically granted to senior executives, key managers, and other high-performing employees. Like stock options, the number of RSUs granted is usually tied to the employee's role, performance, and contribution to the company's strategic objectives.

Example of RSU Calculation:

Suppose an employee is granted 1,000 RSUs with a three-year vesting period. After three years, assuming all vesting conditions are met, the employee will receive 1,000 shares of Verizon stock. If Verizon’s stock price is $50 per share at the time of vesting, the total value of the RSUs would be $50,000.

- Initial Grant: 1,000 RSUs

- Vesting Period: 3 years

- Stock Price at Vesting: $50 per share

Total Value at Vesting: 1,000 RSUs × $50 = $50,000

This value is subject to tax at the time of vesting, and the employee may choose to sell some or all of the shares to cover the tax liability.

Verizon 409A Deferred Compensation and Executive Compensation Supplemental Savings Plan

Verizon provides a comprehensive 409A Deferred Compensation Plan and an Executive Compensation Supplemental Savings Plan designed to offer key executives and other highly compensated employees the ability to defer portions of their income and accumulate retirement savings in a tax-efficient manner.

409A Deferred Compensation Plan:

The 409A Deferred Compensation Plan allows eligible Verizon executives to defer a portion of their compensation until a future date, typically retirement or another event like separation from the company. This plan is governed by Section 409A of the Internal Revenue Code, which imposes strict rules on the timing of deferrals and distributions to avoid immediate taxation and penalties.

Key Features:

- Deferral Elections: Eligible participants can elect to defer portions of their salary, bonuses, and other compensation each year. The deferred amounts are credited to the participant's account and grow tax-deferred until distributed.

- Investment Options: Deferred amounts can be invested in a variety of investment options offered by the plan, mirroring the choices available in other Verizon savings plans. The account balance reflects the performance of the selected investments.

- Distributions: Participants can choose to receive their deferred compensation in a lump sum or in installments over a period of years. Distributions are typically made upon retirement, separation from service, or other specified events.

- Taxation: Distributions from the plan are subject to ordinary income tax at the time they are received. However, because the income was deferred, participants can potentially manage their tax liabilities more effectively by choosing a distribution schedule that aligns with lower income years.

Executive Compensation Supplemental Savings Plan:

The Executive Compensation Supplemental Savings Plan is designed to provide additional retirement benefits to Verizon's top executives. This plan supplements the company's standard savings and retirement plans, allowing for contributions and benefits that exceed the limits imposed by qualified retirement plans.

Key Features:

- Company Contributions: Verizon may make discretionary contributions to the executive's account under this plan. These contributions are in addition to any deferrals made by the executive and are intended to supplement the executive's retirement savings.

- Vesting: Contributions made by Verizon typically vest based on the executive's years of service with the company. Once vested, the contributions and any earnings on them belong to the executive.

- Payout Options: Similar to the 409A Deferred Compensation Plan, distributions from the Supplemental Savings Plan can be taken as a lump sum or in installments, depending on the executive's preferences and needs.

- Matching Contributions: In some cases, Verizon may match a portion of the executive's contributions, further enhancing the benefits under this plan.

Example Calculation #1:

Let’s assume an executive defers $100,000 into the 409A plan, and Verizon matches 50% of this deferral in the Supplemental Savings Plan, contributing an additional $50,000. If the investment grows at an annual rate of 5% over 10 years:

- Deferred Amount: $100,000

- Company Match: $50,000

- Growth (5% annually for 10 years):

- Deferred Amount: $100,000 * (1.05)^10 = $162,889

- Company Match: $50,000 * (1.05)^10 = $81,445

- Total Balance After 10 Years: $162,889 + $81,445 = $244,334

The total balance of $244,334 is available for distribution according to the plan’s rules.

Example Calculation #2:

Assume an executive defers $200,000 into the 409A plan, and Verizon matches 50% of this deferral in the Supplemental Savings Plan, contributing an additional $100,000. If the investment grows at an annual rate of 5% over 10 years:

- Deferred Amount: $200,000

- Company Match: $100,000

- Growth (5% annually for 10 years):

- Deferred Amount: $200,000 * (1.05)^10 = $325,779

- Company Match: $100,000 * (1.05)^10 = $162,889

- Total Balance After 10 Years: $325,779 + $162,889 = $488,668

The total balance of $488,668 is available for distribution according to the plan’s rules.

Verizon’s Executive Compensation Supplemental Savings Plan is designed to provide additional retirement benefits beyond what is available under the company's qualified retirement plans. This plan allows Verizon to make discretionary contributions to the accounts of eligible executives, supplementing their retirement savings.

Lump-Sum vs. Annuity

Retirees who are eligible for a pension are often offered the choice of receiving their pension payments for life, or receive a lump-sum amount all-at-once. The lump sum is the equivalent present value of the monthly pension income stream – with the idea that you could then take the money (rolling it over to an IRA), invest it, and generate your own cash flow by taking systematic withdrawals throughout your retirement years.

The upside of electing the monthly pension is that the payments are guaranteed to continue for life (at least to the extent that the pension plan itself remains in place and solvent and doesn’t default). Thus, whether you live 10, 20, 30, or more years after retiring from your company, you don’t have to worry about the risk of outliving the monthly pension.

The major downside of the monthly pension are the early and untimely passing of the retiree and joint annuitant. This often translates into a reduction in the benefit or the pension ending altogether upon the passing. The other downside, it that, unlike Social Security, company pensions rarely contain a COLA (Cost of Living Allowance). As a result, with the dollar amount of monthly pension remaining the same throughout retirement, it will lose purchasing power when the rate of inflation increases.

In contrast, selecting the lump-sum gives you the potential to invest, earn more growth, and potentially generate even greater retirement cash flow. Additionally, if something happens to you, any unused account balance will be available to a surviving spouse or heirs. However, if you fail to invest the funds for sufficient growth, there’s a danger that the money could run out altogether and you may regret not having held onto the pension’s “income for life” guarantee.

Ultimately, the “risk” assessment that should be done to determine whether or not you should take the lump sum or the guaranteed lifetime payments that your company pension offers, depends on what kind of return must be generated on that lump-sum to replicate the payments of the annuity. After all, if it would only take a return of 1% to 2% on that lump-sum to create the same monthly pension cash flow stream, there is less risk that you will outlive the lump-sum. However, if the pension payments can only be replaced with a higher and much riskier rate of return, there is, in turn, a greater risk those returns won’t manifest and you could run out of money.

Interest Rates and Life Expectancy

Current interest rates, as well as your life expectancy at retirement, have a significant impact on lump sum payouts of defined benefit pension plans.

Rising interest rates have an inverse relationship to pension lump sum values. The reverse is also true; decreasing or lower interest rates will increase pension lump sum values. Interest rates are important for determining your lump sum option within the pension plan.

The Retirement Group believes all employees should obtain a detailed RetireKit Cash Flow Analysis comparing their lump sum value versus the monthly annuity distribution options, before making their pension elections.

As enticing as a lump sum may be, the monthly annuity for all or a portion of the pension, may still be an attractive option, especially in a high interest rate environment.

Each person’s situation is different, and a complimentary Cash Flow Analysis, from The Retirement Group, will show you how your pension choices stack up and play out over the course of your retirement years which may be two, three, four or more decades in retirement.

By knowing where you stand, you can make a more prudent decision regarding the optimal time to retire, and which pension distribution option meets your needs the best.

Your 401(k) Plan

401(k) Savings Plan

Employees are encouraged to enroll in a 401(k) savings plan right away. You may invest on a before-tax and/or an after-tax basis (regular or Roth) and choose out of seven investment options, with varying degrees of risk. You can also roll over pre-tax and Roth amounts from other eligible plans.

Vesting

As a participant, you vest in the company match after three year. If you terminate employment with less than three years of service, you forfeit the company match, but keep the remainder.

In addition, if you have an account in an eligible plan of a former employer, you may be eligible to roll over a distribution from that account to the Savings Plan.

Note: If you contribute at least 6 percent of your pay, you will receive a company match of 6 percent of your pay.

When you retire, if you have balances in your 401(k) plan, you will receive a Participant Distribution Notice in the mail. This notice will show the current value that you are eligible to receive from each plan and explain your distribution options. It will also tell you what you need to do to receive your final distribution. Please call The Retirement Group at (800)-900-5867 for more information and we can get you in front of a retirement-focused advisor.

Next Step:

- Watch for your Participant Distribution Notice and Special Tax Notice Regarding Plan Payments. These notices will help explain your options and what the federal tax implications may be for your vested account balance.

- "What has Worked in Investing" & "8 Tenets when picking a Mutual Fund".

- To learn about your distribution options, call The Retirement Group at (800)-900-5867. Click our e-book for more information on "Rollover Strategies for 401(k)s". Use the Online Beneficiary Designation to make updates to your beneficiary designations, if needed.

Verizon Savings Plan for Management Employees

The Verizon Savings Plan for Management Employees is a defined contribution plan that offers eligible employees the opportunity to save for retirement.

Eligibility:

● Eligible Participants: Regular full-time or part-time employees, management employees, nonunion hourly employees, and certain union-represented employees are eligible to participate in the Verizon Savings Plan. Specific exclusions apply, such as employees covered by a collective bargaining agreement (unless specifically included by the agreement), hourly-paid employees of non-participating Verizon affiliates, and nonresident aliens not receiving U.S. income(SPD Management (Verizon)).

Contributions:

● Employee Contributions: Employees may contribute between 1% and 50% of their eligible pay each pay period, with specific limits for highly compensated employees. Contributions can be made on a before-tax, after-tax, or Roth 401(k) basis, or a combination of these(SPD Management (Verizon)).

● Company Matching Contributions: Verizon matches $1 for every $1 contributed by the employee, up to 6% of eligible pay each pay period. Non-management participants may receive a different matching contribution formula(SPD Management (Verizon)).

● Profit Sharing: Depending on annual company performance, Verizon may also make a discretionary profit-sharing contribution of 0-3% of eligible pay(SPD Management (Verizon)).

Vesting:

● Employee Contributions: Employees are always 100% vested in their own contributions.

● Company Contributions: Vesting in company matching contributions and new profit-sharing awards occurs after three years of service. Certain conditions, such as qualifying for a company-sponsored severance plan or reaching normal retirement age, may result in automatic 100% vesting(SPD Management (Verizon)).

Investment Options:

● Investment Choices: Employees can invest their contributions and company matching contributions in various investment options offered under the plan. Investment elections can be changed at any time(SPD Management (Verizon)).

Loans and Withdrawals:

● Loans: Employees can borrow from their vested account balance, with loan amounts ranging from $1,000 to $50,000, limited to 50% of the vested account balance. Repayment occurs through payroll deductions(SPD Management (Verizon)).

● In-Service Withdrawals: Employees may take in-service withdrawals from after-tax contributions, vested company contributions, and rollover contributions, among others. Hardship withdrawals are allowed under specific IRS-defined circumstances(SPD Management (Verizon)).

Additional Features:

● Catch-Up Contributions: Employees aged 50 or older can make additional catch-up contributions beyond the standard contribution limits(SPD Management (Verizon)).

● Automatic Enrollment: New employees are automatically enrolled in the plan with a default contribution rate of 3% of eligible pay unless they choose otherwise(SPD Management (Verizon)).

Verizon 401(k) Savings Plan: Matching Contributions and Vesting

The Verizon 401(k) Savings Plan for Management Employees is designed to encourage employee savings by offering company matching contributions and a vesting schedule that rewards continued service.

Matching Contributions:

Verizon offers a competitive matching contribution to incentivize employee participation in the 401(k) plan. For every $1 that an eligible employee contributes to the plan, Verizon matches $1, up to 6% of the employee's eligible pay. This means that if an employee contributes 6% of their salary to the 401(k), Verizon will contribute an additional 6%, effectively doubling the employee's contribution for that portion of their salary.

Example Calculation:

● Employee Salary: $100,000 per year

● Employee Contribution: 6% of $100,000 = $6,000

● Verizon Matching Contribution: 6% of $100,000 = $6,000

In this example, the employee contributes $6,000, and Verizon matches this with an additional $6,000, resulting in a total annual contribution of $12,000 to the employee's 401(k) account.

Vesting Schedule:

Vesting refers to the process by which an employee earns the right to the full value of the company’s contributions to their 401(k) account. While employees are always 100% vested in their own contributions, vesting in Verizon's matching contributions occurs after a specific period of service.

For Verizon employees, vesting in the company's matching contributions and profit-sharing awards occurs after three years of service. This means that if an employee leaves the company before completing three years of service, they forfeit the matching contributions and any associated earnings.

Example of Vesting: Assume an employee has been with Verizon for two years and has received $12,000 in matching contributions over that period. If the employee leaves the company after two years, they would not be vested in the matching contributions and would forfeit the $12,000. However, if the employee completes three years of service, they would be fully vested and retain the full $12,000 plus any earnings on those contributions.

Over half of plan participants admit they don’t have the time, interest or knowledge needed to manage their 401(k) portfolio. But the benefits of getting help goes beyond convenience. Studies like this one, from Charles Schwab, show those plan participants who get help with their investments tend to have portfolios that perform better: The annual performance gap between those who get help and those who do not is 3.32% net of fees. This means a 45-year-old participant could see a 79% boost in wealth by age 65 simply by contacting an advisor. That’s a pretty big difference.

Getting help can be the key to better results across the 401(k) board.

A Charles Schwab study found several positive outcomes common to those using independent professional advice. They include:

- Improved savings rates – 70% of participants who used 401(k) advice increased their contributions.

- Increased diversification – Participants who managed their own portfolios invested in an average of just under four asset classes, while participants in advice-based portfolios invested in a minimum of eight asset classes.

- Increased likelihood of staying the course – Getting advice increased the chances of participants staying true to their investment objectives, making them less reactive during volatile market conditions and more likely to remain in their original 401(k) investments during a downturn. Don’t try to do it alone. Get help with your company's 401(k) plan investments. Your nest egg will thank you.

It’s important to know that certain withdrawals are subject to regular federal income tax and, if you’re under age 59½, you may also be subject to an additional 10% penalty tax. You can determine if you’re eligible for a withdrawal, and request one, online or by calling your company's Benefits Center.

Rolling Over Your 401(k)

Because a withdrawal permanently reduces your retirement savings and is subject to tax, you should always consider taking a loan from the plan instead of a withdrawal to meet your financial needs. Unlike withdrawals, loans must be repaid, and are not taxable (unless you fail to repay them). In some cases, as with hardship withdrawals, you are not allowed to make a withdrawal unless you have also taken out the maximum loan available within the company plan.

You should also know that your company's plan administrator reserves the right to modify the rules regarding withdrawals at any time, and may further restrict or limit the availability of withdrawals for administrative or other reasons. All plan participants will be advised of any such restrictions, and they apply equally to all corporate employees.

Borrowing from your 401(k)

Should you? Maybe you lose your job with your company, have a serious health emergency, or face some other reason that you need a lot of cash. Banks make you jump through too many hoops for a personal loan, credit cards charge too much interest, and … suddenly, you start looking at your 401(k) account and doing some quick calculations about pushing your retirement from your company off a few years to make up for taking some money out.

We understand how you feel: It’s your money, and you need it now. But, take a second to see how this could adversely affect your retirement plans after leaving your company.

Consider these facts when deciding if you should borrow from your 401(k). You could:

- Lose growth potential on the money you borrowed.

- Deal with repayment and tax issues if you leave your company.

- Repayment and tax issues, if you leave your company.

Net Unrealized Appreciation (NUA)

When you qualify for a distribution, you have three options:

- Roll-over your qualified plan to an IRA and continue deferring taxes.

- Take a distribution and pay ordinary income tax on the full amount.

- Take advantage of NUA and reap the benefits of a more favorable tax structure on gains.

How does Net Unrealized Appreciation work?

First an employee must be eligible for a distribution from their qualified company-sponsored plan. Generally, at retirement or age 59 1⁄2, the employee takes a 'lump-sum' distribution from the plan, distributing all assets from the plan during a 1-year period. The portion of the plan that is made up of mutual funds and other investments can be rolled into an IRA for further tax deferral. The highly appreciated company stock is then transferred to a non-retirement account.

The tax benefit comes when you transfer the company stock from a tax-deferred account to a taxable account. At this time, you apply NUA and you incur an ordinary income tax liability on only the cost basis of your stock. The appreciated value of the stock above its basis is not taxed at the higher ordinary income tax but at the lower long-term capital gains rate, currently 15%. This could mean a potential savings of over 30%.

You may be interested in learning more about NUA with a complimentary one-on-one session with a financial advisor from The Retirement Group.

IRA Withdrawal

When you qualify for a distribution, you have three options:

Your retirement assets may consist of several retirement accounts: IRAs, 401(k)s, taxable accounts, and others.

So, what is the most efficient way to take your retirement income after leaving your company?

You may want to consider meeting your income needs in retirement by first drawing down taxable accounts rather than tax-deferred accounts.

This may help your retirement assets with your company last longer as they continue to potentially grow tax deferred.

You will also need to plan to take the required minimum distributions (RMDs) from any company-sponsored retirement plans and traditional or rollover IRA accounts.

That is due to IRS requirements for 2024 to begin taking distributions from these types of accounts when you reach age 73. Beginning in 2024, the excise tax for every dollar of your RMD under-distributed is reduced from 50% to 25%.

There is new legislation that allows account owners to delay taking their first RMD until April 1 following the later of the calendar year they reach age 73 or, in a workplace retirement plan, retire.

Two flexible distribution options for your IRA

When you need to draw on your IRA for income or take your RMDs, you have a few choices. Regardless of what you choose, IRA distributions are subject to income taxes and may be subject to penalties and other conditions if you’re under 59½.

Partial withdrawals: Withdraw any amount from your IRA at any time. If you’re 73 or over, you’ll have to take at least enough from one or more IRAs to meet your annual RMD.

Systematic withdrawal plans: Structure regular, automatic withdrawals from your IRA by choosing the amount and frequency to meet your income needs after retiring from your company. If you’re under 59½, you may be subject to a 10% early withdrawal penalty (unless your withdrawal plan meets Code Section 72(t) rules).

Your tax advisor can help you understand distribution options, determine RMD requirements, calculate RMDs, and set up a systematic withdrawal plan.

Your Benefits

HSA's

Health Savings Accounts (HSAs) are often celebrated for their utility in managing healthcare expenses, particularly for those with high-deductible health plans. However, their benefits extend beyond medical cost management, positioning HSAs as a potentially superior retirement savings vehicle compared to traditional retirement plans like 401(k)s, especially after employer matching contributions are maxed out.

Understanding HSAs

HSAs are tax-advantaged accounts designed for individuals with high-deductible health insurance plans. For 2024, the IRS defines high-deductible plans as those with a minimum deductible of $1,600 for individuals and $3,200 for families. HSAs allow pre-tax contributions, tax-free growth of investments, and tax-free withdrawals for qualified medical expenses—making them a triple-tax-advantaged account.

The annual contribution limits for HSAs in 2024 are $4,150 for individuals and $8,300 for families, with an additional $1,000 allowed for those aged 55 and older. Unlike Flexible Spending Accounts (FSAs), HSA funds do not expire at the end of the year; they accumulate and can be carried over indefinitely.

Comparing HSAs to 401(k)s Post-Matching

Once an employer's maximum match in a 401(k) is reached, further contributions yield diminished immediate financial benefits. This is where HSAs can become a strategic complement. While 401(k)s offer tax-deferred growth and tax-deductible contributions, their withdrawals are taxable. HSAs, in contrast, provide tax-free withdrawals for medical expenses, which are a significant portion of retirement costs.

HSA as a Retirement Tool

Post age 65, the HSA flexes its muscles as a robust retirement tool. Funds can be withdrawn for any purpose, subject only to regular income tax if used for non-medical expenses. This flexibility is akin to that of traditional retirement accounts, but with the added advantage of tax-free withdrawals for medical costs—a significant benefit given the rising healthcare expenses in retirement.

Furthermore, HSAs do not have Required Minimum Distributions (RMDs), unlike 401(k)s and Traditional IRAs, offering more control over tax planning in retirement. This makes HSAs particularly advantageous for those who might not need to tap into their savings immediately at retirement or who want to minimize their taxable income.

Investment Strategy for HSAs

Initially, it's prudent to invest conservatively within an HSA, focusing on ensuring that there are sufficient liquid funds to cover near-term deductible and other out-of-pocket medical expenses. However, once a financial cushion is established, treating the HSA like a retirement account by investing in a diversified mix of stocks and bonds can significantly enhance the account's growth potential over the long term.

Utilizing HSAs in Retirement

In retirement, HSAs can cover a range of expenses:

- Healthcare Costs-Pre Medicare: HSA's Can pay for healthcare costs to bridge you to Medicare

- Healthcare Costs-Post Medicare: HSAs can pay for Medicare premiums and out-of-pocket medical costs, including dental and vision, which are often not covered by Medicare.

- Long-term Care: Funds can be used for qualified long-term care services and insurance premiums.

- Non-medical Expenses: After age 65, HSA funds can be used for non-medical expenses without incurring penalties, although these withdrawals are subject to income tax.

Conclusion

In summary, HSAs offer unique advantages that can make them a superior option for retirement savings, particularly after the benefits of 401(k) matching are maximized. Their flexibility in fund usage, coupled with tax advantages, makes HSAs an essential component of a comprehensive retirement strategy. By strategically managing contributions and withdrawals, individuals can maximize their financial health in retirement, keeping both their medical and financial well-being secure.

Your life insurance coverage and any optional coverage you purchase for your spouse/domestic partner and/or children ends on the date your employment with your company ends, unless your employment ends due to disability. If you die within 31 days of your termination date from your company, benefits are paid to your beneficiary for your basic life insurance, as well as any additional life insurance coverage you elected.

Note:

-

You may have the option to convert your life insurance to an individual policy or elect portability on any optional coverage.

-

If you stop paying supplementary contributions, your coverage will end.

-

If you are at least 65 and you pay for supplemental life insurance, you should receive information in the mail from the insurance company that explains your options.

-

Make sure to update your beneficiaries. See your company's SPD for more details.

Next Step:

- When you retire, make sure that you update your beneficiaries, and update the Beneficiary Designation form for life events such as death, marriage, divorce, childbirth, adoptions, etc.

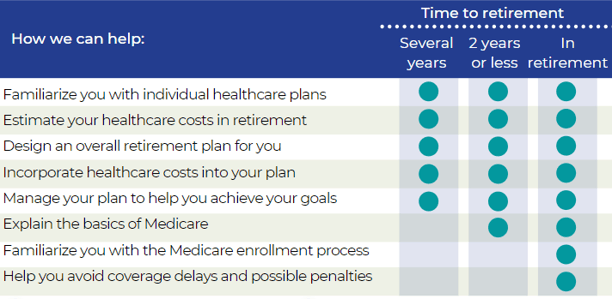

Social Security & Medicare

Knowing the foundation of Social Security, and using this knowledge to your advantage, can help you claim your maximum benefit.

It’s your responsibility to enroll in Medicare parts A and B when you first become eligible — and you must stay enrolled to have coverage for Medicare-eligible expenses. This applies to your Medicare eligible dependents as well.

You should know how your retiree medical plan choices or Medicare eligibility impacts your plan options. Before you retire from your company, contact the U.S. Social Security Administration directly at 800-772-1213, call your local Social Security Office or visit ssa.gov.

You and your Medicare-eligible dependents must enroll in Medicare Parts A and B when you first become eligible. Medical and MH/SA benefits payable under the company's-sponsored plan will be reduced by the amounts Medicare Parts A and B would have paid whether you actually enroll in them or not.

Divorce

If you’re divorced or in the process of divorcing, your former spouse(s) may have an interest in a portion of your retirement benefits from your company. Before you can start your pension — and for each former spouse who may have an interest — you’ll need to provide your company with the following documentation:

- A copy of the court-filed Judgment of Dissolution or Judgment of Divorce along with any Marital Settlement Agreement (MSA)

- A copy of the court-filed Qualified Domestic Relations Order (QDRO)

You were married for at least 10 years prior to the divorce.

You are currently unmarried.

Your ex-spouse is entitled to Social Security benefits.

Unlike with a married couple, your ex-spouse doesn’t have to have filed for Social Security before you can apply for your divorced spouse’s benefit.

Divorce doesn’t disqualify you from survivor benefits. You can claim a divorced spouse’s survivor benefit if the following are true:

- Your ex-spouse is deceased.

- You are at least 60 years of age.

- You were married for at least 10 years prior to the divorce.

- You are single (or you remarried after age 60).

In the process of divorcing?

If your divorce isn’t final before your retirement date from your company, you’re still considered married. You have two options:

- Retire from your company before your divorce is final and elect a joint pension of at least 50% with your spouse — or get your spouse’s signed, notarized consent to a different election or lump sum.

- Delay your retirement from your company until after your divorce is final and you can provide the required divorce documentation.*

Source: The Retirement Group, “Retirement Plans - Benefits and Savings,” U.S. Department of Labor, 2019; “Generating Income That Will Last Throughout Retirement,” Fidelity, 2019

Survivor Checklist

In the unfortunate event that you aren’t able to collect your benefits from your company, your survivor will be responsible for taking action.

What your survivor needs to do:

- Report your death. Your spouse, a family member or even a friend should call your company’s benefits service center as soon as possible to report your death.

- Collect life insurance benefits. Your spouse, or other named beneficiary, will need to call your company's benefits service center to collect life insurance benefits.

If you have a joint pension:

- Start the joint pension payments. The joint pension is not automatic. Your joint pensioner will need to complete and return the paperwork from your company's pension center to start receiving joint pension payments.

- Be prepared financially to cover living expenses. Your spouse will need to be prepared with enough savings to bridge at least one month between the end of your pension payments from your company and the beginning of his or her own pension payments.

If your survivor has medical coverage through your company:

- Decide whether to keep medical coverage.

- If your survivor is enrolled as a dependent in your company-sponsored retiree medical coverage when you die, he or she needs to decide whether to keep it. Survivors have to pay the full monthly premium.

Life After Your Career

Make up for decreased value of savings or investments. Low interest rates make it great for lump sums but harder for generating portfolio income. Some people continue to work to make up for poor performance of their savings and investments.

Maybe you took an offer from your company and left earlier than you wanted with less retirement savings than you needed. Instead of drawing down savings, you may decide to work a little longer to pay for extras you’ve always denied yourself in the past.

Meet financial requirements of day-to-day living. Expenses can increase during your retirement from your company and working can be a logical and effective solution. You might choose to continue working in order to keep your insurance or other benefits — many employers offer free to low cost health insurance for part-time workers.

You might find yourself with very tempting job opportunities at a time when you thought you’d be withdrawing from the workforce.

Staying active and involved. Retaining employment after your previous job, even if it’s just part-time, can be a great way to use the skills you’ve worked so hard to build over the years and keep up with friends and colleagues.

Enjoying yourself at work. Just because the government has set a retirement age with its Social Security program doesn’t mean you have to schedule your own life that way. Many people genuinely enjoy their employment and continue working because their jobs enrich their lives.

Sources

6.png)

- “National Compensation Survey: Employee Benefits in the United States, March 2019," Bureau of Labor Statistics, U.S. Department of Labor.

- “Generating Income That Will Last throughout Retirement.” Fidelity, 22 Jan. 2019, www.fidelity.com/viewpoints/retirement/income-that-can-last-lifetime.

- “Retirement Plans-Benefits & Savings.” U.S. Department of Labor, 2019, www.dol.gov/general/topic/retirement.

- AT&T Summary Plan Description, 2019

- Chevron Summary Plan Description, 2019

- Shell Summary Plan Description, 2019

- ExxonMobil Summary Plan Description, 2019

- https://seekingalpha.com/article/4268237-order-withdrawals-retirement-assets

- https://www.aon.com/empowerresults/ensuring-retirees-get-health-care-need/

- 8 Tenets when picking a Mutual Fund e-book

- Determining Cash Flow Need in Retirement e-book

- Early Retirement Offers e-book

- Lump Sum vs. Annuity e-book

- Social Security e-book

- Rising Interest Rates e-book

- Closing The Retirement Gap e-book

- Rollover Strategies for 401(k)s e-book

- How to Survive Financially After a Job Loss e-book

- Financial PTSD e-book

- RetireKit

- What has Worked in Investing e-book

- Retirement Income Planning for ages 50-65 e-book

- Strategies for Divorced Individuals e-book

- TRG Webinar for Corporate Employees

- Composite Corp Bond Rate history (10 years)http://www.irs.gov/retirement/article/0,,id=123229,00.html https://www.irs.gov/retirement-plans/composite-corporate-bond-rate-table

- IRS 72(t) code: https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-tax-on-early-distributions

- Missing out: How much employer 401(k) matching contributions do employees leave on the table?

- Jester Financial Technologies, Worksheet Detail - Health Care Expense Schedule

- Social Security Administration. Benefits Planner: Income Taxes and Your Social Security Benefits. Social Security Administration. Retrieved October 11, 2016 from https://www.ssa.gov/planners/taxes.html

- http://hr.chevron.com/northamerica/us/payprograms/executiveplans/dcp/

- https://www.lawinsider.com/contracts/1tRmgtb07oJJieGzlZ0tjL/chevron-corp/incentive-plan/2018-02-02

-

https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2022

-

https://news.yahoo.com/taxes-2022-important-changes-to-know-164333287.html

-

https://www.nerdwallet.com/article/taxes/federal-income-tax-brackets

-

https://www.the-sun.com/money/4490094/key-tax-changes-for-2022/

-

https://www.bankrate.com/taxes/child-tax-credit-2022-what-to-know/